As of January 11, 2026, the cryptocurrency market is characterized by a "wait and see" sentiment. After a volatile end to 2025, the market has stabilized, with Bitcoin and major altcoins consolidating near key psychological levels.

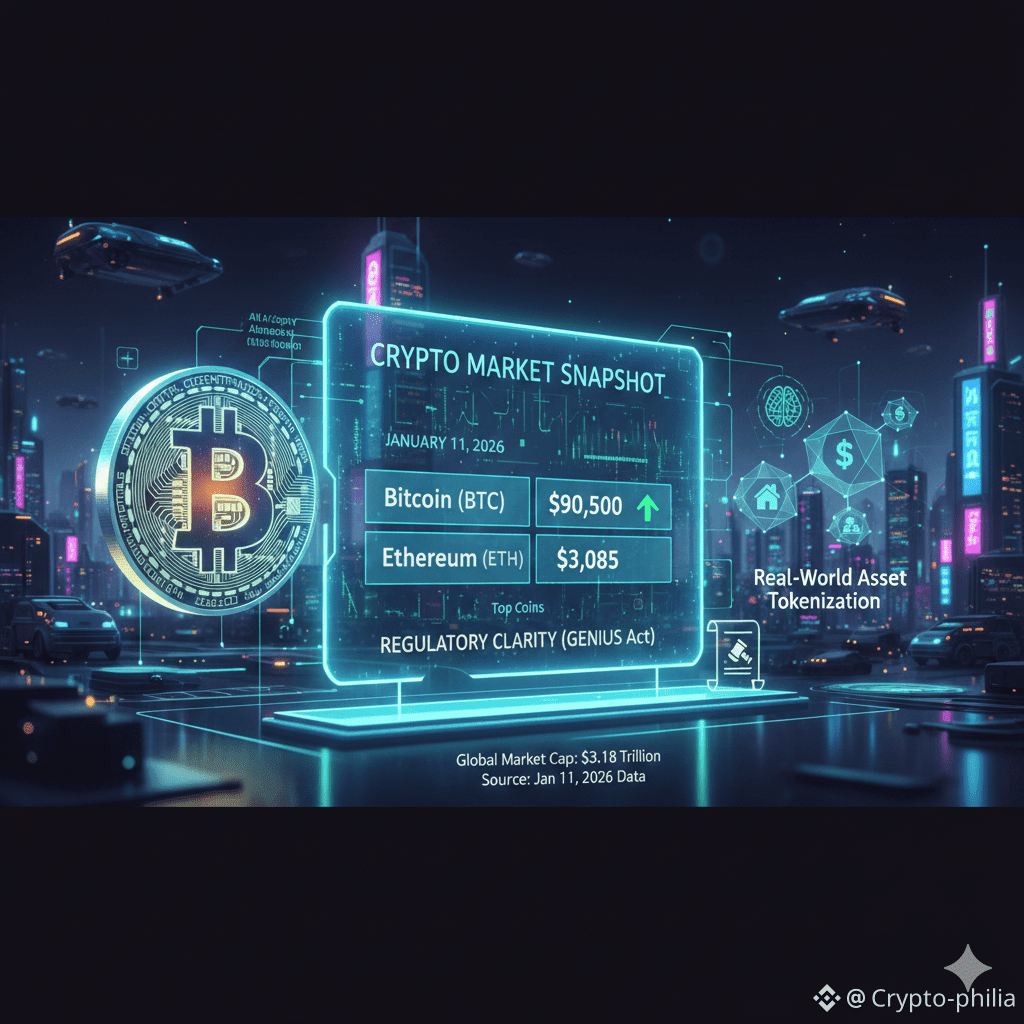

📊 Market Snapshot (Jan 11, 2026)

The global crypto market cap sits at approximately $3.18 Trillion.

| Rank | Cryptocurrency | Current Price | Market Cap |

|---|---|---|---|

| 1 | Bitcoin (BTC) | ~$90,500 | $1.81 Trillion |

| 2 | Ethereum (ETH) | ~$3,085 | $373 Billion |

| 3 | Tether (USDT) | $1.00 | $186 Billion |

| 4 | XRP (XRP) | ~$2.09 | $127 Billion |

| 5 | BNB (BNB) | ~$913 | $125 Billion |

🚀 Key Trends & Narratives for 2026

1. The "Institutional Era"

Unlike previous cycles driven by retail "hype," 2026 is seeing massive corporate treasury adoption. Over 170 publicly traded companies now hold Bitcoin as a reserve asset. This institutional floor has helped Bitcoin maintain support levels around $80k–$85k even during market pullbacks.

2. Real-World Asset (RWA) Tokenization

One of the fastest-growing sectors this year is the movement of "real" assets onto the blockchain. This includes:

* Tokenized T-Bills: Providing on-chain yield for stablecoin holders.

* Real Estate: High-value properties being fractionalized for easier trading.

3. Regulatory Clarity (The GENIUS Act)

The market is currently pricing in the impact of new U.S. bipartisan legislation aimed at market structure. This is expected to bring regulated trading of digital asset securities and clearer rules for stablecoin issuers, potentially reducing "black swan" risks.

4. AI & Crypto Integration

Artificial Intelligence is no longer just a buzzword in crypto. We are seeing the rise of Autonomous AI Agents that hold their own crypto wallets to pay for computing power and data on-chain, creating a new "machine-to-machine" economy.

⚠️ Current Outlook

* Resistance: Bitcoin is facing heavy resistance near the $95,000 mark. Many analysts believe a break above this could lead to a run toward $120,000 by mid-year.

* Macro Factors: Keep an eye on U.S. employment data and interest rate decisions, as Bitcoin is increasingly being traded as a "macro asset" sensitive to global liquidity.

> Note: Cryptocurrency remains a high-risk asset class. Prices can be extremely volatile.