📊 Consensus Forecasts (2026–2030)

Conservative / Algorithmic Models

These use trend analysis and price history:

Year

Lower Estimate

Avg/Mid

Upper Estimate

2026

~$95K

~$100K

~$140K

2027

~$98K

~$100K

~$420K

2028

~$104K

~$115K

~$540K

2029

~$110K

~$115K

~$640K

2030

~$117K

~$125K

~$650K

Source: DigitalCoinPrice projections/algorithms �

DigitalCoinPrice

(This range is more “technical trend-based” and tends to be conservative.)

🚀 Bullish Analyst & Market Forecasts

Some forecasts assume strong institutional adoption, halving cycles, and wider crypto integration:

Year

Moderate Target

Bullish Target

2026

~$150K–$230K

~$200K+

2027

~$170K–$330K

~$400K+

2028

~$200K–$450K

~$500K+

2029

~$275K–$640K

~$700K+

2030

~$380K–$900K

~$1M+

Source: Crypto market prediction models (Coinpedia & FutureFinanceView) �

Coinpedia Fintech News +1

📌 Some analysts even forecast BTC reaching

➡️ $350K–$500K by 2030,

➡️ $1M+ by 2030 in very bullish scenarios. �

Techopedia +1

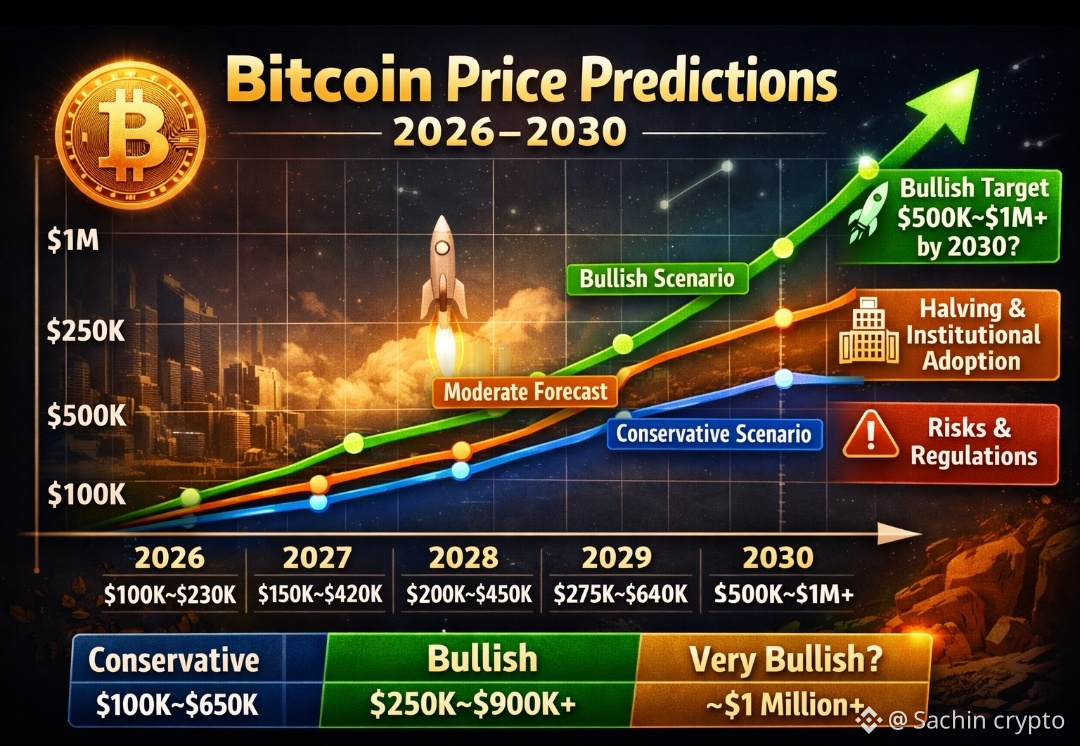

📉 Bullish vs Conservative Visual Comparison

Bullish Scenario (higher forecast)

�

Shows a potential strong uptrend to $500K–$900K by 2030.

Conservative/Algorithmic Scenario

�

Shows steady growth into six-figure territory.

(These are illustrative examples — actual price lines vary by model used.)

🔍 Key Factors That Could Influence BTC Prices

🚀 Bullish Drivers

Bitcoin Halving (2028) → historically boosts price over time. �

Coinpedia Fintech News

Institutional adoption & ETFs inflows → perceived increasing demand. �

Axi

Macro trends (inflation/hedge demand) – bullish for scarce assets.

⚠️ Bearish/Neutral Risks

Market volatility & macro shocks.

Regulatory changes and reduced speculative inflows.

Recent analyst revisions show more modest near-term targets (e.g., ~$150K – Reuters notes some forecasts lowered). �

MarketWatch

🧠 Summary of Predictions to Keep in Mind

Scenario

2026

2027

2028

2029

2030

Algorithmic/Conservative

~$95–140K

~$100–420K

~$115–540K

~$115–640K

~$125–650K

Bullish Market Forecasts

~$150–230K

~$170–330K+

~$200–450K

~$275–640K

~$380–900K+

Very Bullish Analyst Targets

—

—

—

—

~$500K–$1M+

📌 Important: All these are predictions and estimates, not guarantees. Bitcoin’s price is influenced by investor sentiment, macroeconomic conditions, regulatory news, and technology adoption — all of which can change rapidly.$BTC

#USNonFarmPayrollReport #BinanceHODLerBREV #BTC