Bitcoin Outlook: Why the Market Structure Still Favors Further Upside

Despite growing short-term skepticism, current market structure suggests that Bitcoin remains positioned for further upside rather than a deep retracement.

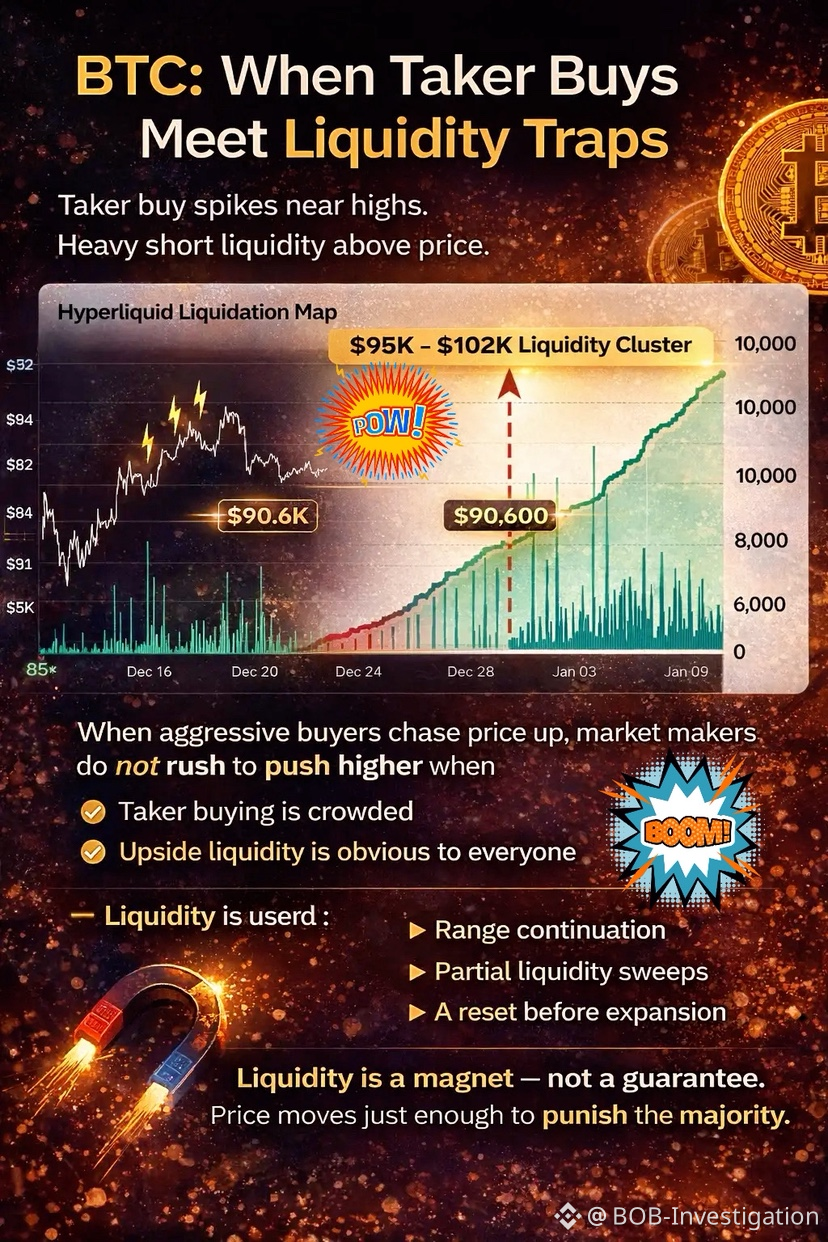

1. Liquidity Distribution Favors Higher Prices

Recent liquidation data shows a clear imbalance in liquidity placement. Downside liquidity below current price has thinned considerably, particularly around previously attractive levels near the high-80k range. This indicates that weak longs have largely been flushed, reducing the incentive for market makers to push price significantly lower.

In contrast, short-side liquidity is stacking aggressively above current levels. Large clusters of short liquidation are visible from the mid-90k range extending above 100k, creating a strong liquidity magnet to the upside.

In markets driven by leverage, price typically seeks the path of maximum liquidity extraction — and that path currently points higher.

2. Absence of Panic Selling Confirms Structural Strength

Despite macro uncertainty and heightened news sensitivity, Bitcoin has not experienced panic-driven sell pressure. Volatility remains controlled, and price behavior suggests absorption rather than distribution

This type of price action is characteristic of accumulation phases, where stronger hands quietly absorb supply while leverage is repositioned on the wrong side of the market.

3. Failed Bearish Follow-Through

Repeated attempts to push Bitcoin lower have resulted in shallow pullbacks rather than sustained breakdowns. Each downside move has been met with immediate buying interest, signaling that sellers lack conviction and that downside momentum is weakening.

When bearish narratives fail to translate into lower prices, it often precedes continuation to the upside.

4. Market Maker Incentives Align with a Higher Expansion

From a market microstructure perspective, the current environment favors an upside expansion:

Downside liquidity is limited

Upside liquidation rewards are significantly larger

A short squeeze scenario offers higher efficiency for capital deployment

This makes higher prices a more rational outcome in the near term.

Conclusion

Bitcoin does not currently exhibit the conditions required for a sustained correction. With downside liquidity largely exhausted and short positioning building above price, the market remains structurally biased toward further upside.

Any short-term pullbacks should be viewed as tactical liquidity resets rather than trend reversals.

In leveraged markets, price does not move to where traders expect — it moves to where liquidity is. And for now, liquidity is above.$BTC