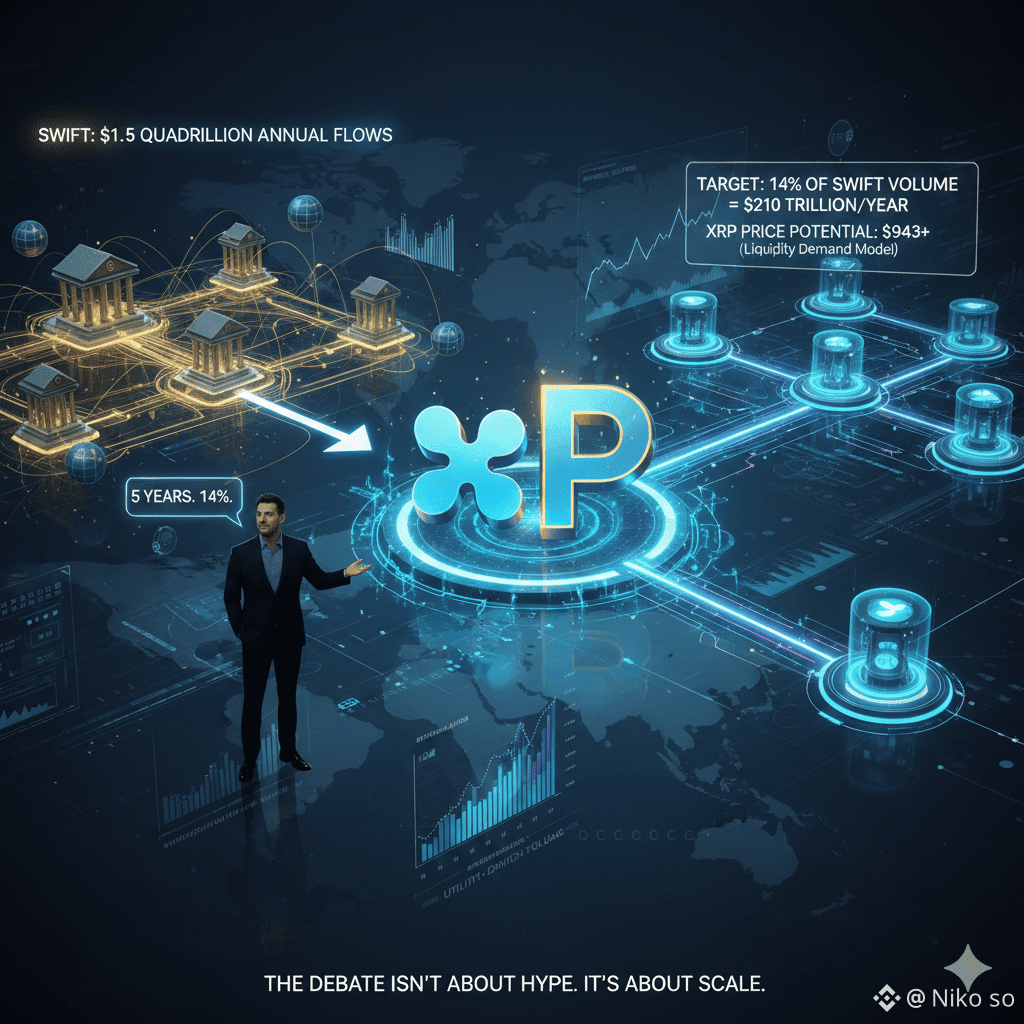

The crypto world is buzzing after a bold statement linked to Ripple CEO Brad Garlinghouse—one that has ignited serious debate around XRP’s long-term valuation. The claim? XRP could capture up to 14% of SWIFT’s global transaction flows within the next five years. If that happens, the numbers behind XRP’s potential price move into completely uncharted territory.

Understanding the Scale: SWIFT vs XRP

SWIFT is not a blockchain. It’s a messaging network that facilitates international money transfers between banks. Every year, SWIFT supports approximately $1.5 quadrillion in transaction value. Yes—quadrillion.

If XRP-powered systems were to handle just 14% of that volume, it would represent roughly $210 trillion in annual flows. For comparison, the entire U.S. GDP is around $27 trillion. That contrast alone shows why this discussion is gaining traction.

Why XRP Is Even in This Conversation

Ripple’s core value proposition is speed, cost efficiency, and liquidity optimization for cross-border payments. XRP is designed to act as a bridge asset, reducing the need for banks to pre-fund accounts (nostro/vostro). As global payments evolve, even a small percentage of adoption could create massive demand for XRP liquidity.

Garlinghouse’s “5 years. 14%” comment is being interpreted by many as a signal of confidence in Ripple’s adoption roadmap, not just marketing hype.

The Math Behind the $943 XRP Theory

Let’s break down the numbers often cited in bullish scenarios:

0.1% of global flows → approximately $9–10 per XRP

1% of global flows → approximately $90–100 per XRP

High-liquidity scenario with constrained effective supply

(estimated ~5.6 billion XRP actively circulating) → up to $943 per XRP

This is not based on speculation alone but on liquidity demand models, where price rises sharply when large volumes must pass through a relatively limited supply.

Why This Would Be Unlike Any Past Cycle

Traditional crypto cycles are driven by retail speculation. This scenario is different. It assumes:

Institutional usage, not hype

Real transaction volume, not just trading

Utility-driven demand, not memes or narratives

If even a fraction of SWIFT-level flows begin settling through XRP rails, price discovery would no longer resemble previous bull runs.

Reality Check: Is It Guaranteed?

No. This scenario depends on:

Regulatory clarity

Bank and institutional adoption

Competition from other payment rails

Real-world execution by Ripple

However, the key takeaway isn’t that XRP will hit $943—it’s that XRP doesn’t need full global domination to reach life-changing valuations.

Final Thoughts

Forget $3. Forget $10.

When you start thinking in terms of global financial infrastructure, the numbers naturally get wild.

Brad Garlinghouse’s words suggest Ripple is aiming far beyond survival—it’s aiming for relevance at the core of global finance. Whether XRP captures 0.1%, 1%, or something larger, even the smallest slice of that market could redefine what investors consider possible.

🚀 The debate isn’t about hype anymore—it’s about scale.#WriteToEarnUpgrade #Binance #Xrp🔥🔥