In 2024, as Ethereum Layer-2 networks continued to expand and compete on fees, another conversation quietly emerged in Web3 infrastructure circles: are transaction fees really the biggest cost, or is storage becoming the hidden bottleneck? This question matters because modern Web3 is no longer just about sending tokens. It is about storing data—NFT media, AI datasets, game assets, application state, and long-lived content. This is where Walrus Protocol ($WAL) enters the comparison, not as a traditional execution layer, but as a storage-focused protocol built on Sui with a very different cost model.

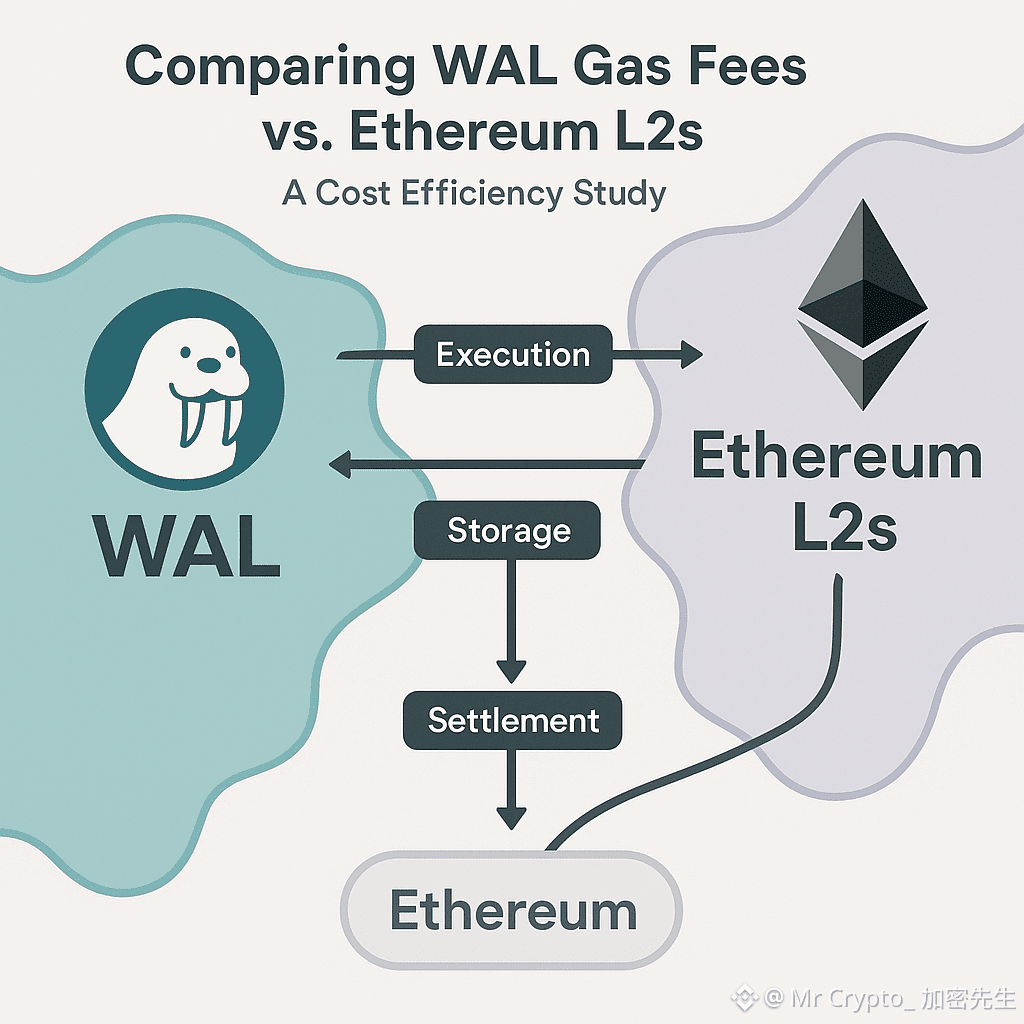

Ethereum L2s such as optimistic and zk-based rollups were designed to reduce execution costs. They batch transactions, compress calldata, and settle back to Ethereum for security. For simple transfers or swaps, this works well. By late 2024, average L2 transaction fees were often low enough to feel usable. However, when applications need to store or reference large amounts of data, L2s inherit a structural limitation: data still ultimately settles to Ethereum, and Ethereum data availability is expensive by design.

Walrus approaches the problem from a different angle. It does not try to compete with L2s on execution. Instead, it focuses on blob storage—large, unstructured data that blockchains are not meant to store directly. Rather than pushing data into calldata or compressed rollups, Walrus keeps heavy data off-chain across a decentralized storage network, while anchoring proofs and coordination on Sui. This distinction is crucial when comparing costs.

On Ethereum L2s, storing data typically means one of three things: putting it directly on L1 (very expensive), embedding it in calldata through the rollup (cheaper but still tied to Ethereum gas dynamics), or relying on external storage like centralized clouds or IPFS gateways. Each option has trade-offs. The key issue is that fees scale poorly with data size. As files grow larger, costs rise quickly, regardless of how optimized the rollup is.

Walrus, by contrast, prices storage through an economic model, not a gas model. Storage costs are determined by network supply, demand, and WAL-denominated incentives rather than per-byte gas fees. This means that once data is stored, it is not repeatedly paid for every time it is referenced. The cost is associated with availability over time, not constant re-execution. For applications that need long-term persistence, this difference is significant.

Another important factor is predictability. Ethereum L2 fees may be low on average, but they are still affected by Ethereum L1 congestion. During periods of market stress—something seen repeatedly through 2024 and early 2025—fees can spike unexpectedly. Walrus is insulated from this volatility because storage availability is handled by its own decentralized network of nodes, backed by staking and incentives, not by competition for block space on Ethereum.

From a developer perspective, this creates a different cost profile. On L2s, developers often optimize aggressively to reduce calldata usage, compress data, or offload storage elsewhere. On Walrus, developers can treat storage as a first-class primitive. Large files are stored once, referenced many times, and protected by redundancy and erasure coding. The economics encourage durability rather than constant minimization.

It is also important to compare who pays. On Ethereum L2s, users often bear the cost of gas directly. On Walrus, storage costs can be abstracted at the application level. Developers or protocols can manage WAL staking and storage payments in the background, creating smoother user experiences. This matters for consumer-facing apps like games, social platforms, and AI tools where users should not think about gas every time data is accessed.

Security trade-offs are often raised in these comparisons. Ethereum L2s inherit Ethereum’s security guarantees for execution and data availability. Walrus does not replace Ethereum’s security model; it complements it. Walrus secures data through economic guarantees—delegated staking, redundancy, and eventually slashing—rather than through Ethereum calldata. This is a different trust model, but one designed specifically for storage, not computation.

By early 2025, this separation of concerns began to look intentional rather than accidental. Ethereum L2s are excellent for high-frequency execution. Walrus is optimized for long-lived data. Comparing WAL storage costs directly to L2 gas fees misses the point slightly; they solve different problems. The real efficiency comes from using each layer for what it does best.

In simple words, Ethereum L2s reduce the cost of doing things. Walrus reduces the cost of keeping things. As Web3 applications grow more complex, both are needed. Trying to force storage into execution layers creates hidden costs that surface later.

The deeper lesson from comparing WAL and Ethereum L2 fees is that scalability is not only about transactions per second. It is about sustainable economics. Walrus is not cheaper because it cuts corners. It is cheaper because it is purpose-built.

As Web3 continues through 2025 and beyond, applications that rely on large, persistent datasets will increasingly separate execution from storage. In that architecture, Ethereum L2s and Walrus Protocol ($WAL) are not competitors. They are complementary layers. And when viewed through that lens, Walrus’ cost efficiency is not just attractive—it is necessary for Web3 to scale without breaking its own foundations. @Walrus 🦭/acc #walrus