In January 2026, while much of the crypto market remains focused on short-term narratives and retail-driven momentum, a different story is unfolding beneath the surface. Institutional investors are not chasing hype. They are positioning for infrastructure that can survive regulation, compliance, and scale. This is why Dusk Network ($DUSK) has been quietly moving onto institutional radar screens in 2026, not through loud announcements, but through design choices that align closely with how real financial markets actually work.

To understand why institutions care about Dusk, it helps to start with what most blockchains still get wrong. Public blockchains are transparent by default. That transparency works well for open experimentation, but it breaks down the moment regulated finance enters the picture. Institutions cannot operate in environments where trade sizes, identities, and strategies are exposed in real time. Privacy is not a preference for them. It is a requirement. Dusk was built around this reality from the beginning.

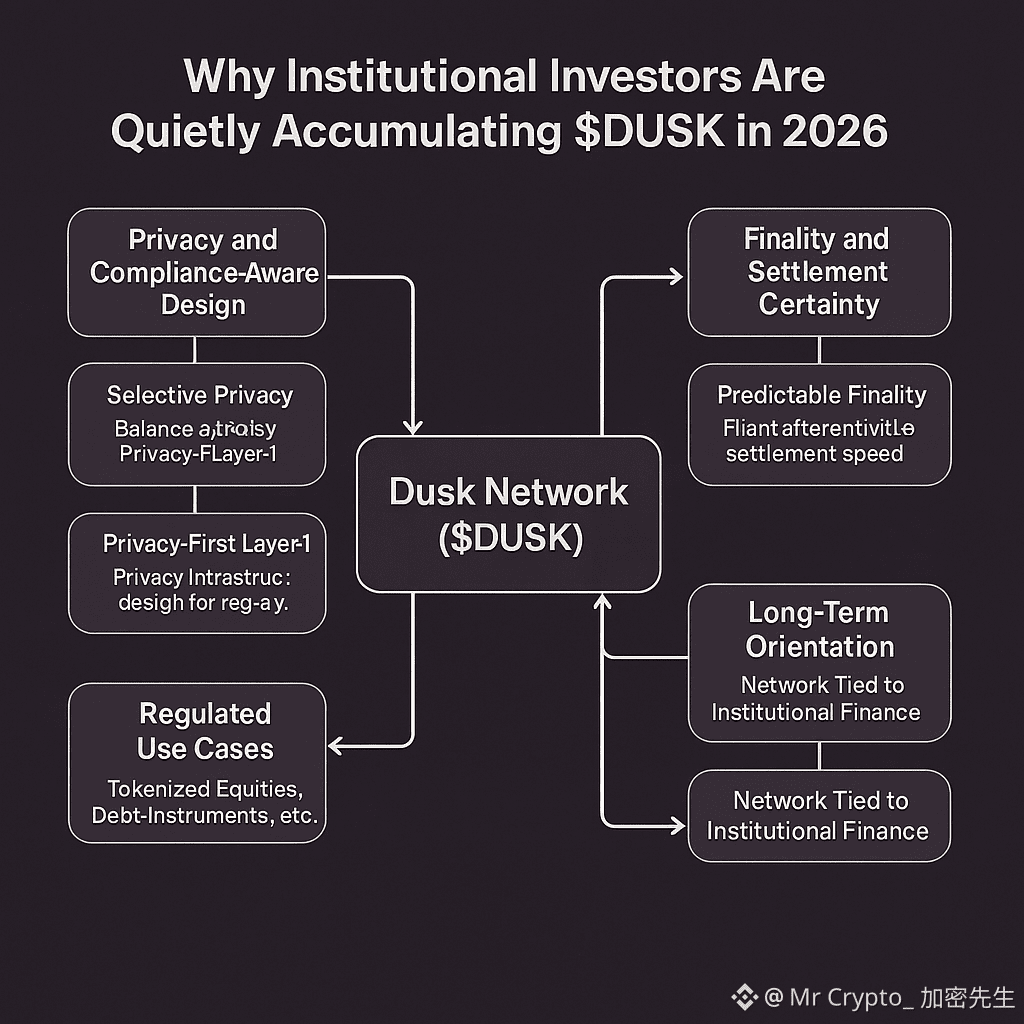

Dusk Network is a privacy-first, compliance-aware Layer-1, designed specifically for regulated financial activity. Instead of trying to retrofit privacy later, Dusk treats it as foundational infrastructure. By late 2024, when regulators became more explicit about on-chain compliance expectations, this design choice started to look less ideological and more practical.

One of the core reasons institutions are accumulating $DUSK in 2026 is selective privacy. Dusk does not promote absolute anonymity. It enables confidential transactions while still allowing proofs and disclosures when required. This balance is critical for securities, funds, and real-world assets moving on-chain. Institutions need privacy from competitors, but accountability toward regulators. Dusk’s architecture is built for that exact tension.

Another key factor is finality and settlement certainty. Financial institutions care deeply about settlement risk. Dusk’s consensus design prioritizes predictable finality rather than headline transaction speed. In real markets, knowing when a transaction is final matters more than shaving off milliseconds. By 2025, as tokenized securities pilots expanded globally, this focus on settlement quality became increasingly valuable.

Dusk is also not trying to be a general-purpose DeFi playground. Its ecosystem is structured around regulated use cases: tokenized equities, debt instruments, compliant funds, and permissioned financial workflows. This clarity of purpose is attractive to institutions. They are not looking for chains that do everything. They are looking for chains that do one thing correctly.

The $DUSK token plays a supporting role in this design. It is not positioned as a speculative utility token detached from network purpose. It aligns incentives around network security, participation, and long-term operation. For institutions, this matters. They assess whether a token’s value is tied to real usage or purely to market sentiment. In Dusk’s case, the token is tied to a network explicitly designed for institutional finance.

By mid-2025, another trend became clear: privacy itself was being reframed by regulators. Rather than rejecting privacy outright, regulatory frameworks began distinguishing between privacy that hides wrongdoing and privacy that protects legitimate business confidentiality. Dusk fits neatly into the second category. This shift reduced perceived regulatory risk and made exposure to privacy-aware infrastructure more acceptable.

There is also a strategic reason institutions accumulate quietly. Liquidity in infrastructure tokens is often thinner than in large-cap assets. Accumulating slowly avoids market impact and attention. Institutions learned this lesson repeatedly across crypto cycles. By the time a narrative becomes obvious on social media, positioning is already complete. Dusk’s accumulation pattern in early 2026 reflects this behavior.

Another overlooked aspect is operational risk. Many blockchains optimize for developer experimentation, not operational reliability. Institutions care about uptime, governance clarity, and long-term maintenance. Dusk’s development approach emphasizes correctness and auditability over rapid iteration. This conservative engineering culture resonates strongly with institutional risk teams.

In simple words, Dusk is not exciting in the way meme coins or consumer apps are exciting. It is exciting in the way financial plumbing is exciting—only to people who understand how markets actually break. Institutions do not invest based on narratives alone. They invest based on whether infrastructure reduces risk over a ten-year horizon.

By 2026, the crypto industry is no longer asking whether institutions will come on-chain. That question has been answered. The real question is where they will settle. Dusk offers something few networks do: a place where privacy, compliance, and decentralization coexist without contradiction.

That is why institutional investors are accumulating $DUSK quietly. Not because they expect overnight price action, but because they see a network built for the rules of the real world. And in finance, infrastructure that respects those rules tends to last longer than anything built to ignore them.