Most traders only notice storage when it fails.

A chart won’t load during a volatile session. A project’s dashboard suddenly shows blank history. A dataset powering a strategy disappears because a hosting bill wasn’t paid or a backend changed. It doesn’t feel like a blockchain problem at first—but it is. Markets run on information, and information needs a place it can reliably live.

This is the gap Walrus is closing on the Sui blockchain. Not as a side utility, but as a system that treats data as a first-class asset: programmable, verifiable, retrievable, and economically secured.

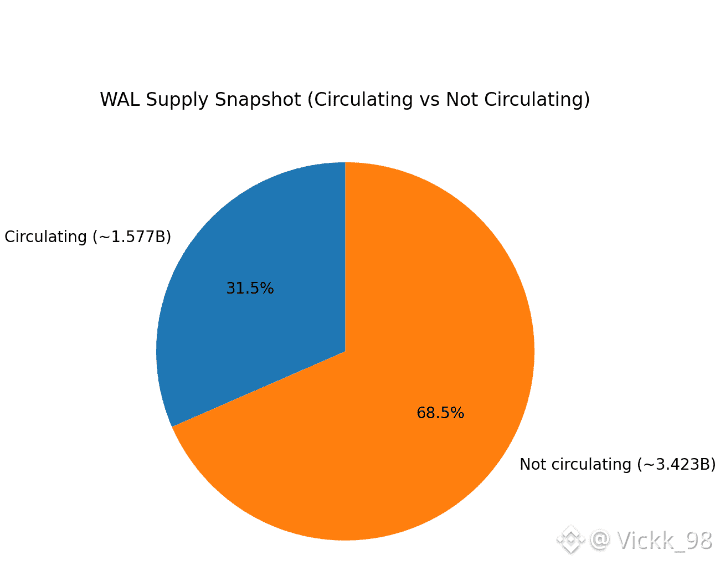

Today WAL trades around $0.15, with roughly $26 million in 24-hour volume and a market cap near $233 million. Circulating supply sits at approximately 1.577 billion with a max of 5 billion. This shows meaningful liquidity for investors while leaving plenty of room for growth as the ecosystem matures.

But price is not the main story. Storage is.

Most blockchains are designed to store state, not files. They can record who owns what and what happened when—but trying to store large files on-chain is costly and slow. The typical workaround is to store metadata on-chain and the actual content elsewhere, trusting it will remain accessible. That works… until it doesn’t.

Walrus takes a different approach. It is a decentralized storage protocol built for Sui, designed to handle large unstructured data blobs with reliability and fault tolerance. The system is content-addressable, meaning each piece of data is retrieved using an identifier derived from its content rather than a server path. For traders and developers, this has a simple implication: data becomes harder to fake, harder to censor, and easier to verify. Any change to the data changes its identity—exactly what you want when strategy depends on data integrity.

Consider a practical example. A trading group subscribes to a “whale watch” dataset and a custom heatmap flagging unusual exchange flows. For months it works perfectly. Then, during high volatility, the dataset fails to refresh. Investigation shows the provider relied on a centralized backend that was quietly restructured. The data isn’t wrong—it’s missing—and a session of strategy execution collapses. This is a storage failure, not a market failure.

Walrus solves that by decentralizing critical content. If dApps store trading signals, backtests, or AI outputs through Walrus, these applications become resilient under stress. Execution failures in crypto rarely come from being wrong—they come from missing information, broken tooling, or inaccessible data at crucial moments.

Programmable storage also opens new possibilities. Data is not just something to hold—it’s something to govern and monetize. Walrus enables “data markets” where access, usage rights, and lifecycle rules are enforced cryptographically. This goes beyond simple storage. It allows applications to treat data as a reliable, economically meaningful asset.

For investors, the long-term question is clear: as Sui attracts games, AI tools, social platforms, and financial dApps, where will all that content live? Who earns fees or yield for keeping it available?

WAL is the mechanism aligning all stakeholders. Launched on mainnet in 2025, Walrus positions the token to coordinate storage providers, users, and applications. Economic incentives ensure reliability without turning storage into a charitable activity.

From a market perspective, WAL’s trajectory depends on three factors:

Ecosystem adoption: Real usage by Sui applications, not just announcements. Metrics include storage consumption, retrieval frequency, and integration in developer tools.

Reliability reputation: Storage is unforgiving. Credibility is earned through consistent performance and node decentralization.

Industry trends: AI and crypto data pipelines are converging. If this trend accelerates, decentralized storage shifts from niche to core infrastructure.

Viewed through a trader-investor lens, Walrus is less about chart patterns and more about testing whether Web3 can finally treat storage as essential. The blockchains that endure won’t be the ones with the fastest transactions—they’ll be the ones where execution, data, tooling, and access hold up when stress hits.

For Sui to host applications people rely on, Walrus isn’t optional. It’s the missing layer of durable, long-term infrastructure. And in crypto, it’s often these quiet, unglamorous layers where the most lasting value accumulates—slowly, steadily, and only obvious in hindsight.