🇺🇸 BREAKING | A DEFINING WEEK FOR CRYPTO IN THE UNITED STATES

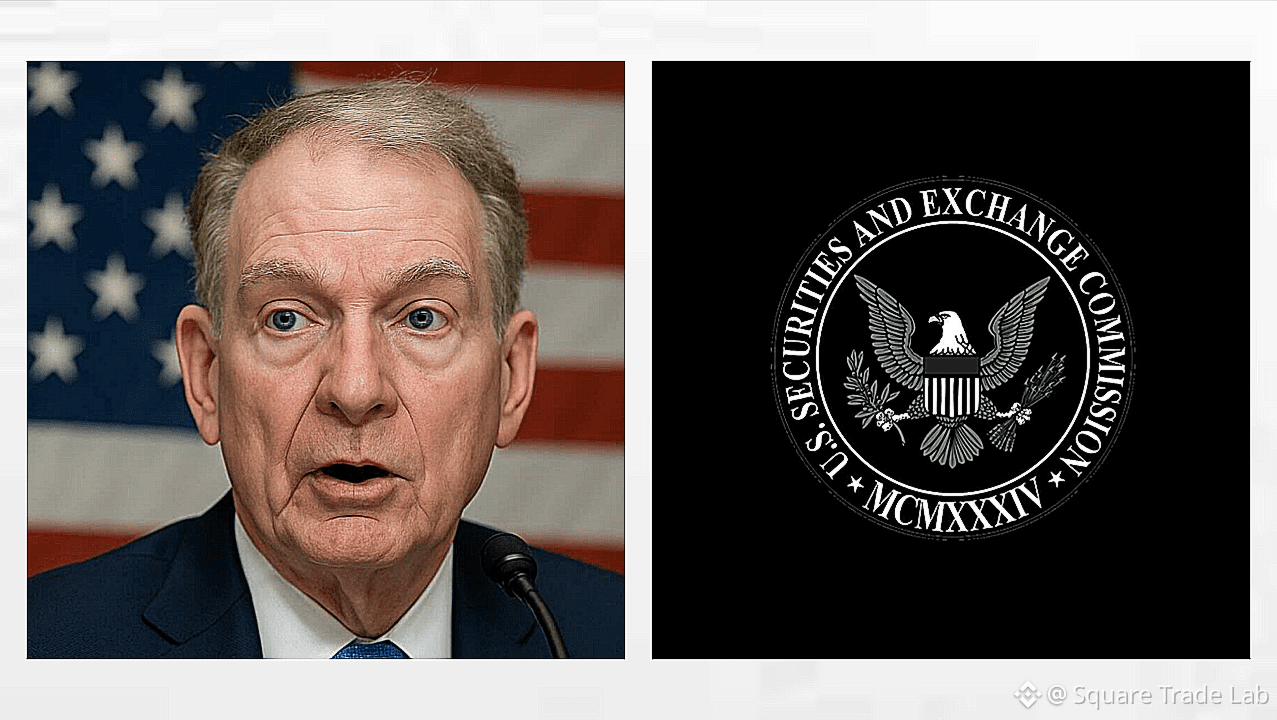

SEC Chair Paul Atkins just dropped one of the most important statements crypto markets have heard in years:

“This is a big week for crypto.”

“Passing bipartisan market structure legislation will help us future-proof against rogue regulators.”

This is not a casual remark.

This is a signal.

For the first time in modern U.S. financial history, the head of the SEC is openly backing Congress-led crypto clarity — not enforcement-first regulation, not lawsuits, not regulatory ambiguity.

🔍 WHAT THIS ACTUALLY MEANS

For years, crypto in the U.S. has existed in a gray zone:

No clear definitions of what is a security vs commodity

Enforcement actions used instead of rulemaking

Companies forced offshore due to legal uncertainty

Now, that framework is changing.

Market structure legislation aims to:

Clearly define regulatory jurisdiction between the SEC and CFTC

Establish transparent rules for exchanges, custodians, and issuers

End “regulation by enforcement”

Protect innovators while safeguarding consumers

Atkins calling out “rogue regulators” is key.

It signals a shift away from unchecked agency power and toward law-based governance.

🏛 WHY THIS WEEK MATTERS

This is not theoretical anymore.

Bipartisan support is already in place

Senate and House momentum is aligning

Institutional players are watching closely

Markets are beginning to price in regulatory clarity

When regulation becomes predictable, capital moves in — fast.

That’s how ETFs get approved

That’s how banks deploy serious balance sheets

That’s how pensions and sovereign funds participate

📈 MARKET IMPLICATIONS

Historically, crypto performs best when:

Regulatory risk is reduced

Legal clarity improves capital allocation

Institutions feel protected entering the market

This is why:

Bitcoin strengthens during policy certainty

Ethereum benefits from institutional adoption

Layer-1s and infrastructure tokens reprice

On-chain activity accelerates

This is not hype-driven momentum.

This is structural.

🌍 BIGGER PICTURE

The U.S. has been losing crypto talent and capital to:

Dubai

Singapore

Hong Kong

Clear legislation changes that narrative.

If passed, the U.S. doesn’t just participate in crypto —

it competes to lead it.

And when the largest capital market in the world commits to clarity, the global market adjusts.

🔥 FINAL TAKE

When the SEC Chair publicly endorses market structure reform, it means the era of uncertainty is ending.

This week could mark:

The end of regulatory whiplash

The return of crypto builders to the U.S.

The beginning of a new institutional cycle

Markets are watching.

Institutions are positioning.

And crypto is stepping into its next phase.