Introduction: Why Strategy Beats Emotion Every Time 🧠

If there's one lesson I've learned after years of navigating the crypto markets, it's this: the difference between those who build wealth and those who get rekt isn't intelligence—it's discipline.

Too many traders obsess over finding the "perfect entry point," checking charts every hour, letting FOMO drive their buys at peaks and panic drive their sells at bottoms. I used to be one of them. But after painful lessons and hard-earned experience, I've developed a systematic Bitcoin purchase strategy that removes emotion from the equation and positions me for long-term success.

Let me share the exact framework I'm using in 2025 to steadily accumulate BTC. 📈

---

## The Foundation: Dollar-Cost Averaging (DCA) 💰

What It Is:

Dollar-Cost Averaging means investing a fixed amount of money into Bitcoin at regular intervals, regardless of the price. Simple, but incredibly powerful.

My Implementation:

Every two weeks, on payday, I automatically purchase Bitcoin with a predetermined percentage of my income—typically 10-15% depending on my financial situation. Whether BTC is at $40K, $60K, or $100K, that purchase happens like clockwork. ⏰

Why It Works:

- Eliminates timing anxiety: I'm not trying to predict if tomorrow will be higher or lower

- Smooths out volatility: Sometimes I buy high, sometimes low, but over time it averages to a solid entry

- Creates discipline: It's a habit, not a decision I reevaluate every time

- Reduces regret: No "I should have waited" or "I missed the dip" because I'm always in the market

Real Example:

Over the past 12 months, my DCA purchases ranged from $38,000 to $71,000 per BTC. My average cost? Somewhere in the middle, and I didn't stress about a single purchase. 😌

---

## Enhancement #1: Fear-Based Accumulation 😱📉

While my base DCA never stops, I've added a tactical layer that takes advantage of market psychology.

The Strategy:

I monitor the Crypto Fear & Greed Index regularly. When it drops into "Extreme Fear" territory (below 25), I increase my bi-weekly purchase by 50-100%. When everyone's panicking and headlines scream "Bitcoin is dead," that's when I'm most aggressive.

Why This Works:

The best buying opportunities in Bitcoin's history have come during peak fear:

- March 2020: COVID crash to $3,800 🩸

- May 2021: China mining ban panic ⚠️

- November 2022: FTX collapse to $15,500 💥

- August 2024: Market correction amid macro uncertainty 📉

While others are panic-selling, I'm accumulating at discounted prices. Warren Buffett said it best: "Be fearful when others are greedy, and greedy when others are fearful." 🎯

My Rule:

When Fear & Greed Index < 25 for 3+ consecutive days = Double my DCA amount until it rises above 35.

---

## Enhancement #2: The 30-50-20 Deployment Framework 🎯

Not all my allocated capital goes into immediate purchases. I split it strategically:

### 30% - Immediate Execution 🔥

This portion buys BTC right away through my regular DCA. It ensures I'm always participating in the market and capturing today's price.

### 50% - Gradual Deployment ⏳

This is my "smoothing" bucket. I divide it into 4-8 smaller purchases spread over the next 1-2 months. If I have $1,000 allocated, I might split the $500 into 5 purchases of $100 each week.

The benefit? If Bitcoin dips 5-10% in the coming weeks, I'm still buying at those levels. If it rallies, I'm still getting exposure with my 30% immediate purchase.

### 20% - Dry Powder Reserve 💧

This stays in stablecoins (USDT/USDC) waiting for significant corrections of 10% or more. These are my "opportunity buys."

When Bitcoin drops 10-15% in a short period, I deploy 25-50% of this reserve. If it drops 20%+, I deploy the full amount. This capital is specifically for those moments when the market hands you a gift. 🎁

Example in Action:

- Monthly allocation: $1,000

- $300 buys BTC immediately

- $500 split into $125 weekly purchases

- $200 stays in USDC for dips

- If BTC drops 12%, that $200 gets deployed

---

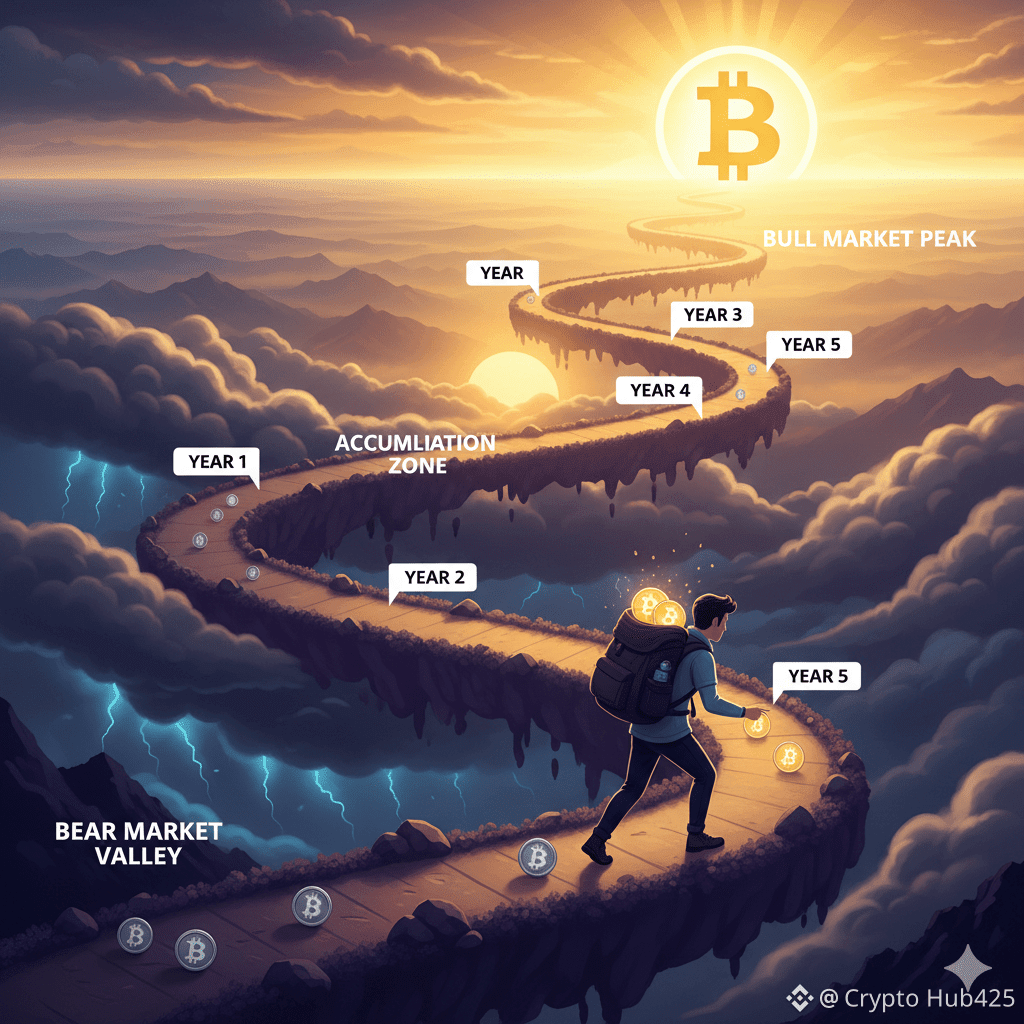

## The Long-Term Mindset: Playing the Infinite Game ♾️

Here's the reality: I'm not here to make a quick 2x and cash out. My Bitcoin strategy is part of a 5-10 year wealth-building plan. Every satoshi I accumulate today is a small piece of my financial future.

Why This Timeframe? 🕰️

1. Bitcoin's cycles are multi-year: Halving events occur every 4 years, and historically, major bull runs follow 12-18 months later

2. Compounding takes time: The real magic happens when you hold through multiple cycles

3. Tax efficiency: Long-term capital gains treatment in many jurisdictions

4. Stress reduction: I don't care about daily or even monthly price action

What I Ignore:

- ❌ "Bitcoin to $10K!" FUD articles

- ❌ "This altcoin will flip BTC!" hype

- ❌ Trading guru predictions

- ❌ Short-term price swings

- ❌ Social media panic

What I Focus On:

- ✅ Bitcoin's fixed supply of 21 million

- ✅ Growing institutional adoption

- ✅ Network security and decentralization

- ✅ Global monetary trends

- ✅ My accumulation target in BTC, not USD value

---

## Risk Management: Protecting the Downside 🛡️

No strategy is complete without risk management. Here's how I protect myself:

1. Never Invest More Than I Can Afford to Lose

My Bitcoin purchases come from discretionary income, never from emergency funds or money needed for bills. 💸

2. Secure Storage

The majority of my BTC moves to cold storage (hardware wallet) once I hit certain thresholds. Not your keys, not your coins. 🔐

3. Diversification Beyond Crypto

Bitcoin is a significant part of my portfolio, but not the entirety. I maintain traditional investments, emergency funds, and other assets. 📊

4. Regular Portfolio Review

Every quarter, I assess whether my Bitcoin allocation is still appropriate given my overall financial situation and goals. 📋

---

## Tools and Resources I Use 🛠️

- Binance: Primary exchange for purchases and some strategic holdings

- Hardware Wallet: Ledger/Trezor for long-term cold storage

- Alternative.me: For the Fear & Greed Index

- TradingView: For basic chart analysis and trend monitoring

- Spreadsheet: Tracking all purchases, average cost, and total BTC held

- Calendar Reminders: Automated reminders for DCA days

---

## Common Mistakes I've Made (So You Don't Have To) ⚠️

Mistake #1: Trying to Time the Bottom

Early on, I'd wait for the "perfect" dip, missing accumulation opportunities. DCA fixed this. ✅

Mistake #2: Going All-In During FOMO

I once deployed too much capital during a euphoric rally. Keeping the 30-50-20 split prevents this. ✅

Mistake #3: Not Taking Security Seriously

Lost access to a small amount early on. Now I'm paranoid about backups and cold storage. ✅

Mistake #4: Checking Price Too Often

It drove me crazy and almost made me sell during dips. Now I check weekly at most. ✅

Mistake #5: Listening to "Experts"

Everyone has an opinion. I learned to trust my strategy over Twitter predictions. ✅

---

## The Psychological Edge: Why Most Fail 🧠💪

The hardest part of any Bitcoin strategy isn't the math—it's the psychology. Markets are designed to shake out weak hands:

- Bull markets make you feel like a genius and tempt you to over-leverage 📈

- Bear markets make you feel stupid and tempt you to capitulate 📉

My strategy protects me from both extremes. When everyone's euphoric, I'm systematically taking profits into stablecoins (my 20% reserve). When everyone's despairing, I'm systematically buying more (fear-based accumulation).

The secret? Having a plan you trust completely, and executing it regardless of market conditions or emotions. 🎯

---

## My 2025 Targets and Milestones 🏆

While I don't fixate on price predictions, I do have accumulation goals:

- Q1 2025: Increase BTC stack by 15%

- Q2 2025: Maintain DCA regardless of price action

- Full Year: Add X BTC to holdings (personal target)

- 5-Year Goal: Accumulate enough BTC to represent 20-30% of net worth

These are measured in BTC, not dollars. That's a critical mindset shift. 🔄

---

## Adapting the Strategy to Your Situation 🎨

Your situation isn't mine, so customize accordingly:

If you're just starting:

- Begin with smaller DCA amounts to get comfortable

- Focus on learning security basics first

- Consider starting with just the 30% immediate purchase until you understand the rhythm

If you have more capital:

- Consider increasing the 20% reserve for larger dip-buying opportunities

- Might add a 4th bucket for ultra-deep dips (20%+ corrections)

- Explore advanced strategies like yield generation on a small portion

If you're risk-averse:

- Reduce the percentage of income allocated to BTC

- Increase the proportion going to gradual deployment (maybe 60-70%)

- Set stricter rules for deploying reserves

---

## Final Thoughts: Patience is the Ultimate Edge ⏰💎

In a market obsessed with overnight riches and 100x gains, my Bitcoin strategy is almost boring. And that's exactly the point.

The crypto markets reward patience and punish impulsivity. By removing emotion, maintaining discipline, and thinking in years rather than days, I'm positioning myself to benefit from Bitcoin's long-term trajectory regardless of short-term volatility.

Every two weeks, whether Bitcoin is making new all-time highs or "crashing" according to headlines, I execute my plan. I'm not smarter than the market—I'm just more consistent. 🔁

The journey to meaningful Bitcoin accumulation isn't exciting. It's methodical. It's repetitive. And it works. 💪

---

## Your Turn: What's Your Strategy? 🤔💬

I've shared my complete framework—the good, the bad, and the lessons learned. Now I want to hear from you:

- What's your Bitcoin purchase strategy?

- Do you DCA, lump sum, or something else?

- How do you handle extreme market volatility?

- What mistakes have you learned from?

Drop your thoughts in the comments below! Let's learn from each other and build our Bitcoin positions together. 🚀

Remember: The best time to start was yesterday. The second-best time is today.

Stack sats, stay humble, and think long-term. 🧡

---

#StrategyBTCPurchase #Bitcoin #CryptoStrategy #DCA #HODL #BTC #CryptoInvesting #BitcoinAccumulation #LongTermInvestin #Binance