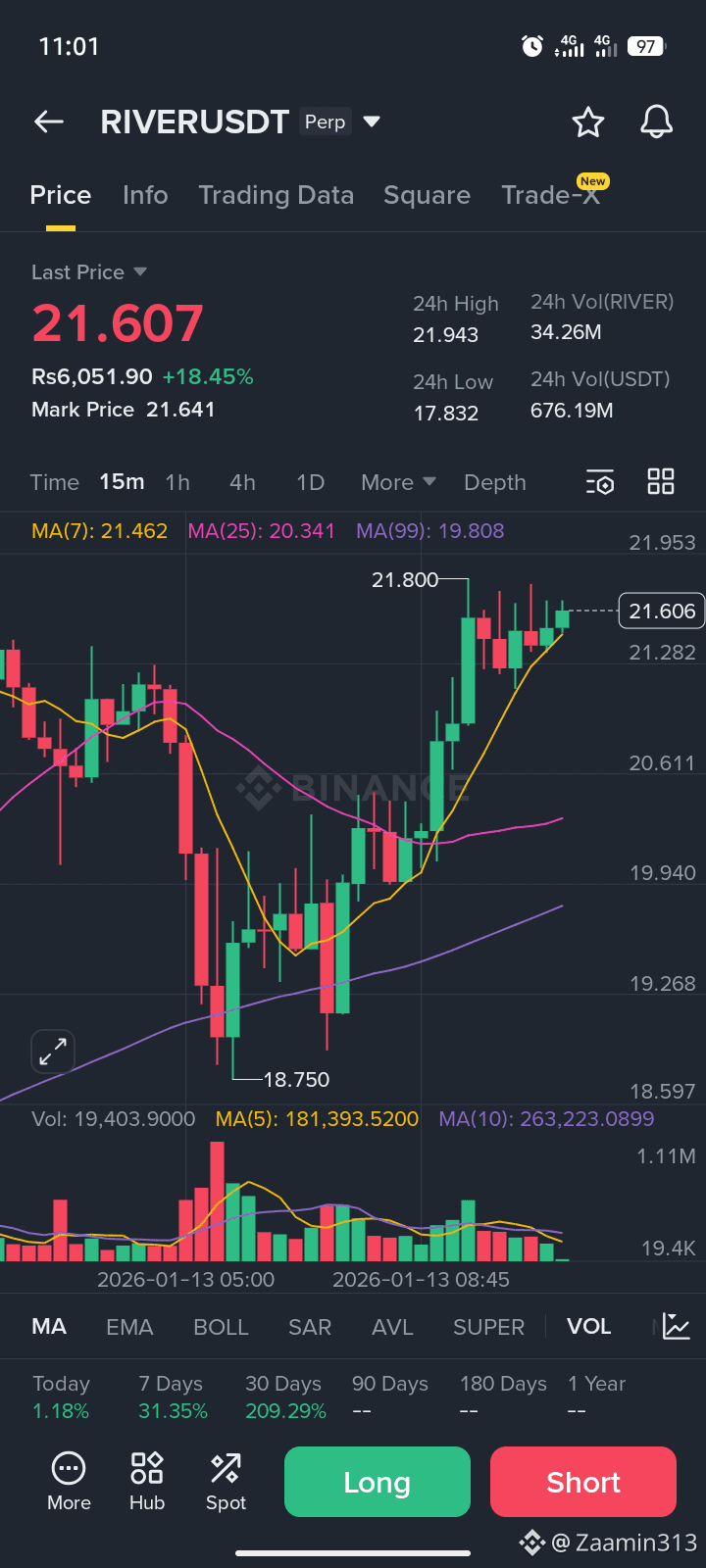

#RİVER Short-Term Technical Indicators (Next 24 Hours)

📈 Overall Bias: Mild Bullish / Neutral

Real-time technical ratings from trading indicators (moving averages + oscillators) show predominantly Buy/Neutral signals on short and daily timeframes. Moving averages like EMA and SMA are mostly trending upward.

Binance

Oscillators like MACD and Stochastic RSI are leaning bullish or neutral, suggesting no strong downward pressure right now.

Binance

What this means: On a very short timeframe (next 24 h), the chart leans slightly bullish or indecisive – not clearly bearish.

📊 Key Levels to Watch (for 24-hour trading)

🛑 Resistance (Upside Targets)

$23.3 – $24 region — immediate resistance zone where sellers could pressure price.

Coin Arbitrage Bot

Pivot ~ $19.9 – $20 (near recent price) — last barrier before bigger resistance.

Coin Arbitrage Bot

➡ If price breaks above $20–$21 with volume, it could aim toward $23+.

🛡 Support (Downside Risk Zones)

$18.2 – $18.3 — first key support zone.

Coin Arbitrage Bot

$16.7 – $17 — stronger support below, psychologically important. �

Coin Arbitrage Bot

➡ If price falls below $18, risk increases for deeper pullbacks.

📉 Momentum Indicators (for Intraday)

⚡ RSI (Momentum Gauge)

RSI around neutral to slightly bullish range (~60ish), not yet overbought — suggests room for more upside but also no runaway momentum.

🔎 24-Hour Trading Scenarios

🟢 Bullish Intraday Scenario

Price holds above $18.2–$18.5 support

Break above $20–$21 with increased volume

→ Price could test resistance near $23–$24 in next 24 h.

🟡 Neutral / Sideways Scenario

Price stays between $18 and $20

Oscillators stay in neutral zone

→ Likely sideways consolidation before a clearer direction.

🔴 Bearish Short-Term Scenario

Price breaks under $18 support

Momentum weakens (RSI drops)

→ Could revisit lower support ($16.7–$17).

🧠 What Traders Typically Look For Next 24 h

📌 Breakout Confirmation:

If candles close above resistance levels with high volume → bullish continuation.

📌 Support Breakdown:

If volume increases on down moves and closes below support → short-term bearish.

📌 Watch Volume:

Low volume means price moves are less reliable.

📍 Summary (Short Term)

Next 24 hours TA suggests:

👉 Slight bullish bias with strong resistance ahead → break above $20–$21 is key.

👉 Support around $18–$17 levels could prevent deeper drops.

👉 Indicators are mostly neutral to bullish — no strong sell signal yet.