$BTC Here’s the latest Bitcoin (BTC) market analysis (as of today) — including price action, key technical levels, sentiment, and short-/medium-term outlook, along with visuals to help you interpret the trend. This is informational only and not financial advice. �

forbes.com +1

📊 Latest Price & Market Snapshot

BTC Price: around $95,000 in live markets with a recent uptick in buying volume. �

coinbase.com

Market Cap: approx $1.9 trillion — roughly ~58% dominance of total crypto market. �

CoinMarketCap

Recent Range: BTC has traded between ~$91K–$96K over the last 24 hours. �

CoinMarketCap

2025 High: ~$126K (Oct 2025), now still ~24% below that peak. �

coinbase.com

Interpretation: Price is above crucial psychological levels near $90K with buyers returning after a period of consolidation — a sign of short-term stabilization. �

coinbase.com

📈 Bullish Factors

✔️ Demand Drivers

Safe-haven flows: Softer U.S. inflation data + geopolitical uncertainty have increased BTC interest — especially from macro-sensitive investors. �

The Economic Times

Regulatory optimism: Progress on U.S. crypto legislative clarity has boosted sentiment around digital assets. �

barrons.com

✔️ Short-Term Technical Signals

Momentum indicators (like MACD) show some bullish momentum building after recent consolidation. �

CoinMarketCap

📉 Bearish/Neutral Signals

➖ Resistance Ahead

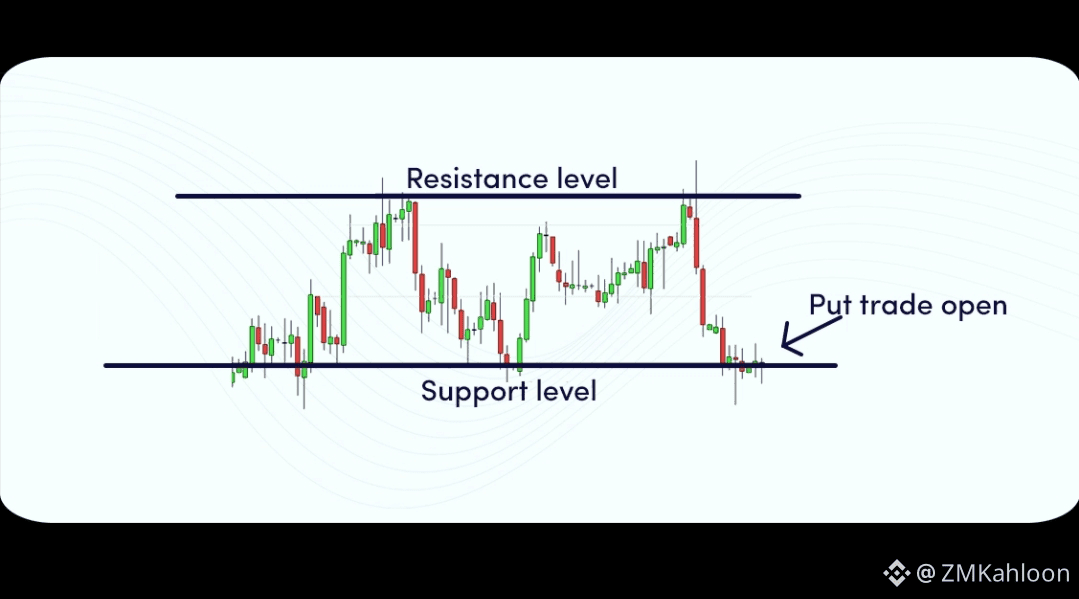

BTC is encountering near-term resistance around ~$92K–$95K, which it’s testing repeatedly. Failure to hold could lead to sideways or downward shifts. �

CoinMarketCap

➖ Macro Risk

Broader risk-off sentiment (equities volatility, interest-rate uncertainty) could pressure risk assets like BTC. �

business-standard.com

➖ Technical Vulnerabilities

Price remains below major long-term moving averages (e.g., 200-day SMA) — a structural bearish indicator until reclaimed. �

CoinMarketCap

Sustained close below ~$89K could open deeper retracements. �

CoinMarketCap

🧠 Key Levels to Watch

Level

Importance

Support ~$89,500–$90,000

Short-term floor; holds bullish bias

Support ~$86,000

Wider range support

Resistance ~$95,000–$98,000

Breakout zone for upside

Bullish Breakout Target above $100,000

Confirms bullish continuation

These are commonly monitored pivot points by technical analysts. �

CoinMarketCap

🕰️ Outlook Summary

📅 Short Term (Next Days–Weeks)

BTC may continue range-bound trading between $90K–$98K as bulls and bears battle for control.

A decisive break above $98K could lean into renewed upside momentum.

A drop under $89K may increase downside risk toward mid-$80K zones.

📆 Medium Term (1–3 Months)

Bullish Scenario: Macro support and inflows extend BTC’s recovery trend.

Bearish Scenario: Macro tightening and technical selling push BTC back into consolidation or deeper corrections.

🧠 What Analysts Are Saying (Latest Market News)

forex.com

FXStreet

Bitcoin Analysis: Is a New Bullish Bias Entering the Market?

Bitcoin price analysis: BTC/USD tests upper structure into mid-January

Yesterday

Today

Bullish momentum building? Bitcoin has posted multiple positive sessions recently, suggesting buyers are stepping in. �

forex.com

Testing upper structure: Price action suggests BTC is probing key chart levels. �

FXStreet

Regulatory optimism: U.S. legislative clarity may spark renewed confidence and inflows. �

barrons.com

Macro tension influence: Political and global central-bank narratives could continue moving BTC if risk markets shift. �

Cryptonews

If you want a custom chart analysis with support/resistance overlays and indicator readings (e.g., RSI/MACD), tell me your preferred timeframe (e.g., daily, 4-hr) and I’ll build that for you.$BTC