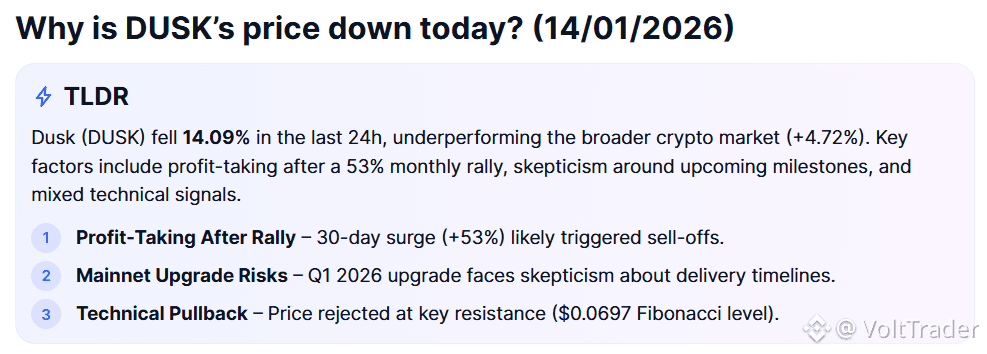

1. Taking Profits Following a Rally (Bearish Impact)

Short-term traders were drawn to $DUSK the ~53% increase over the past 30 days, and they probably booked profits as the momentum for altcoins as a whole waned. The pullback was exacerbated by decreased liquidity, and DUSK has a history of sharp corrections following strong rallies, so this move is both technically and behaviorally consistent.

2. Upgrade to the Mainnet Skepticism (Diverse Effects)

Regarding the anticipated Q1 2026 mainnet upgrade, market sentiment is still cautious. Although institutional adoption may be aided by improvements to cross-chain bridges and DEX stability, bullish sentiment has been temporarily tempered by uncertainty surrounding execution and timelines.

3. Technical Rejection (Bearish Impact)

Price rejection near key Fibonacci resistance and failure to hold short-term moving averages signal cooling momentum. The RSI has eased from overbought levels, suggesting volatility ahead, with buyers closely watching the $0.063-$0.068 support zone for trend confirmation.