Analysis of Dusk Foundation's Ecosystem Development Fund: How 15 Million DUSK Tokens Are Driving Innovation in the Compliant RWA Market

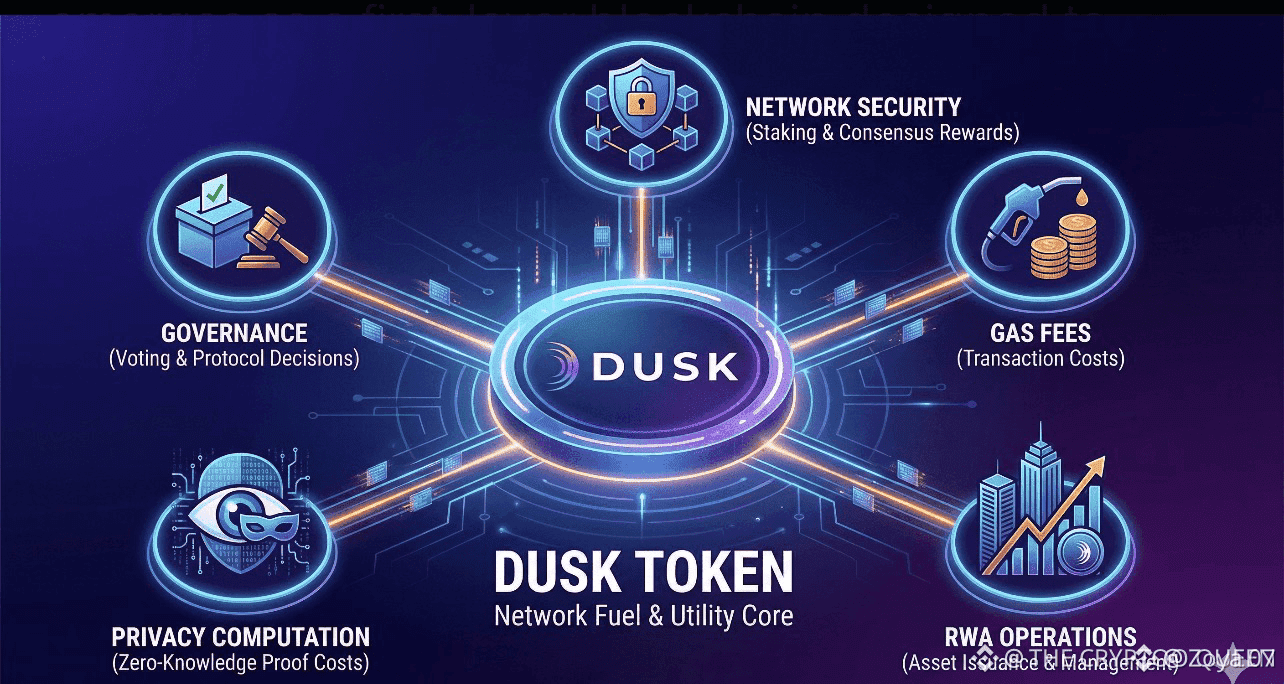

With the full implementation of the EU's (Distributed Ledger Technology Pilot Regime) in 2025, Dusk Foundation, a public blockchain protocol focused on regulatory compliance, is strategically deploying its ecosystem fund to seize early opportunities in the RWA (Real World Assets) sector. The 15 million DUSK ecosystem fund (worth approximately $9.88 million), established at the beginning of this year, has entered its phased disbursement phase, with primary funding directed toward archival and validator infrastructure, bidirectional cross-chain bridges, and decentralized exchanges three core areas. This strategy directly addresses current pain points in compliant asset tokenization: traditional financial institutions require blockchain infrastructure that meets regulatory standards such as MiFID II while also ensuring privacy protection. Dusk’s 'programmable compliance' feature, enabled by zero-knowledge proof technology, precisely fills this market gap.

From a technical architecture perspective, Dusk's Byzantine consensus mechanism (SBA) innovatively combines privacy and compliance. The confidential secure contract (XSC) standard allows developers to perform compliance checks on-chain without exposing sensitive data. For example, institutional users can use the Phoenix trading model to achieve transaction information confidentiality while meeting the audit requirements of the EU Markets in Financial Instruments Directive II (MiFID II). This technological advantage has already attracted real-world financial applications, such as the collaboration with the Dutch multilateral trading facility NPEX, where Dusk is assisting in tokenizing securities and establishing a secondary market, with an expected initial on-chain asset volume of 30 million.

The initial funding projects of the ecological fund highlight strategic targeting. The improvement of archival node infrastructure will enhance the efficiency of querying on-chain historical data, which is crucial for traditional financial institutions requiring continuous compliance reporting; while the development of bidirectional cross-chain bridges with Ethereum and BNB Chain can打@Dusk $DUSK s ecosystem and liquidity channels with mainstream DeFi projects. Notably, the launch of the Dusk Vault custody solution provides institutional investors with an asset storage solution compliant with MiCA regulations, significantly lowering the barrier for traditional finance users entering Web3.

The token economy model shows that the current circulating supply of DUSK is approximately 450 million tokens, with the ecological fund holding 3DUSK. The tokens will be locked in smart contracts until milestones are achieved, controlling the circulating supply while ensuring long-term developer commitment. According to on-chain data, 27 projects have already submitted funding applications, covering scenarios such as digital bonds, carbon credit trading, and tokenization of fund shares. If these applications are successfully implemented, they will create real on-chain demand for $DUSK.

Compared to other privacy-focused blockchains, Dusk's differentiating advantage lies in the completeness of its compliance framework. The EURQ stablecoin, launched in collaboration with Quantoz, is the first electronic money token fully compliant with MiCA. This combination of 'compliant assets private settlement' gives Dusk a first-mover advantage in the EU blockchain pilot program. As more financial institutions test on-chain securities settlement in 2025, $DUSK may see a revaluation of its practical value.