In the rapidly evolving world of blockchain and decentralized finance, @dusk_foundation stands out as a true innovator. Founded in 2018, Dusk is a Layer 1 blockchain protocol specifically designed for regulated financial markets. It combines cutting-edge privacy features with built-in regulatory compliance, making it an ideal platform for institutional-grade applications, tokenized real-world assets (RWAs), andcompliant DeFi. Unlike many other blockchains that handle compliance at the application level, Dusk embeds it directly into the protocol, ensuring privacy, auditability, and legal interoperability across the entire network.

The Core Pillars: Privacy, Compliance, and Permissionless Access

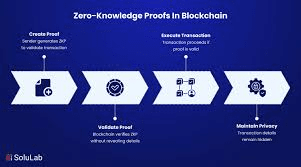

At its heart, Dusk Network is built around four key pillars: privacy, permissionless participation, public access, and compliance. It leverages zero-knowledge cryptography (ZK proofs) to enable confidential transactions while allowing authorized parties to verify compliance through provable encryption. This means users enjoy complete privacy in theirfinancial activities, but regulators or auditors can still confirm that rules are followed without exposing sensitive data.

Dusk achieves this through innovative technologies like its custom Segregated Byzantine Agreement (SBA) consensus mechanism, combined with Private Proof of Stake. These ensure high security,decentralization, and resistance to attacks. The network also supports native confidential smart contracts via the Confidential Security Contract (XSC) standard and the Rusk virtual machine, allowing developers to build programmable, privacy-focused dApps with built-in compliance parameters.

This unique blend addresses a major challenge in traditional finance: high costs, lack of privacy, and complex regulations that limit efficiency in trading securities and other assets.

Dusk's Regulatory Edge: The Game-Changing Partnership with NPEX

One of the most exciting recent developments is Dusk's strategic partnership with NPEX, a regulated Dutch stock exchange. This collaboration grants $DUSK access to a powerful suite of financial licenses integrated directly into the protocol:

MTF (Multilateral Trading Facility) license for operating regulated secondary markets.

Broker license for sourcing and executing trades in assets like money market funds and bonds.

ECSP (European Crowdfunding Service Provider) license for offering retail investment instruments across the EU.

Upcoming DLT-TSS (Distributed Ledger Technology - Trusted Setup Service) license for native on-chain tokenization.

These licenses enable the full lifecycle of compliant financial activities—issuance, investment, trading, and settlement—to happen entirely on-chain. The upcoming NPEX dApp, co-developed by the Dusk team and experts, serves as a fully licensed front-end and back-end for tokenized securities. Built on DuskEVM (Dusk's EVM-compatible layer), it integrates seamlessly with standard tools and initially features tokenized assets from NPEX, 21X, and institutional partners.

This positions Dusk as the first blockchain to offer network-native regulated DeFi, where compliance is protocol-level rather than siloed in individual apps. It unlocks single KYC onboarding, composability between licensed assets and dApps, and instant settlement—all while maintaining privacy.

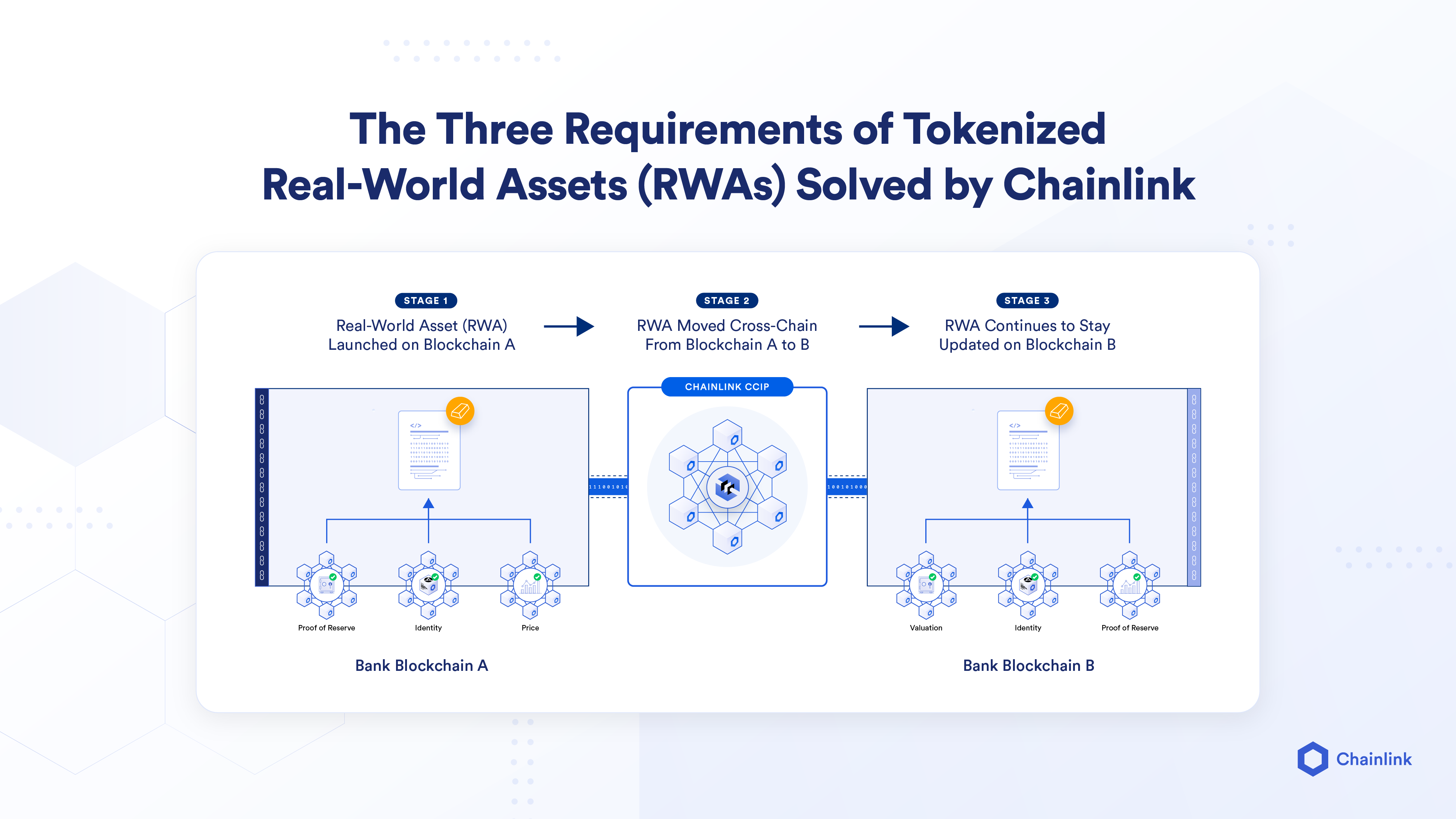

Why Dusk is Perfect for Tokenizing Real-World Assets (RWAs)

Traditional tokenization often creates mere "receipts" on-chain, but Dusk goes further by enabling native issuance of regulated assets like equities, treasuries, and money market funds. This brings massive advantages:

Instant clearance and settlement to reduce risks and delays.

Automated compliance to cut costs and eliminate middlemen.

Reduced liquidity fragmentation through composable infrastructure.

Privacy by design with options for confidential or transparent transactions (via Phoenix and Moonlight models).

Dusk's focus on EU regulations like MiCA, MiFID II, DLT Pilot Regime, and GDPR-style rules makes it highly future-proof. It's not just about tokenizing assets—it's about creating a decentralized, open network where real-world finance integrates seamlessly with blockchain.

Use Cases and Vision for the FutureDusk's mission is to unlock economic inclusion by bringing institution-level assets directly to anyone's wallet. Key use cases include:

Issuance and trading of security tokens (STOs) with automatic compliance.

Privacy-preserving DeFi applications for institutional players.

Secure, auditable transactions for businesses and users.

The network supports self-custody, fast finality, and developer-friendly tools, paving the way for a global ecosystem of ZK-powered dApps. With ongoingadvancements in digital identity (like EUDI integration) and partnerships expanding tokenized assets, Dusk is building the foundation for scalable, regulated DeFi.

Conclusion: The Future of Compliant Privacy in Blockchain

In a world where privacy concerns clash with regulatory demands, @dusk_foundation offers a balanced, forward-thinking solution. By embedding licenses, ZK privacy, and compliance at theprotocol level, Dusk is redefining how real-world assets enter the blockchain era. As adoption grows, $DUSK could become central to the next wave of institutional finance on-chain.Whether you're a developer, investor, or enthusiast, keep an eye on this project—it's leading the charge toward a more inclusive, secure, and efficient financial system.