Bitcoin has climbed above the $95,000 mark for the first time since mid-November, extending its January recovery as spot market demand shows renewed strength.

At the time of writing, Bitcoin was trading around $97,200, according to TradingView data. This marks a decisive break above the upper boundary of a multi-week consolidation range that had capped price action since late 2025.

Bitcoin breakout ends prolonged consolidation phase

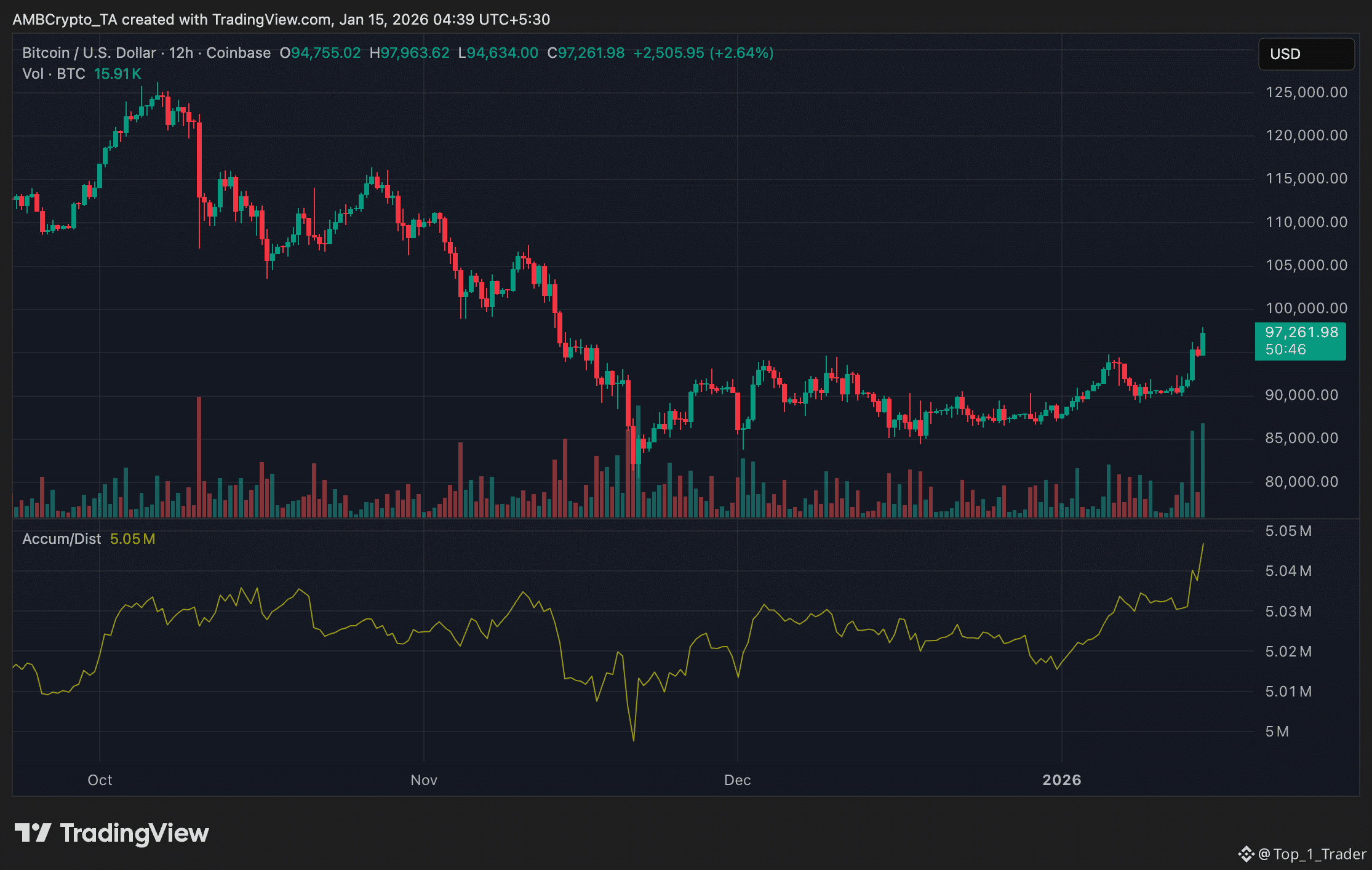

Bitcoin spent much of December and early January trading sideways between roughly $88,000 and $94,000, following a sharp correction from November highs.

Bitcoin 12-hour price trend chart

Source: TradingView

The latest move higher represents a technical shift, with price now establishing a higher high on the 12-hour chart.

Trading volume expanded alongside the breakout, suggesting the move was supported by participation rather than thin liquidity.

This reduces the likelihood of a short-lived price spike and points instead to renewed market engagement at higher levels.

Spot taker data signals renewed buy-side pressure

According to CryptoQuant, Bitcoin’s 90-day Spot Taker Cumulative Volume Delta [CVD] has turned positive again in January, signalling a return to taker buy dominance.

Taker CVD measures whether aggressive market participants are buying or selling at the market price.

A sustained positive reading indicates that buyers are willing to pay higher prices to secure exposure. This is a dynamic typically associated with momentum-driven advances rather than passive accumulation.

It marks a shift from the September–November period, when taker sell dominance coincided with Bitcoin’s corrective phase.

Bitcoin accumulation metrics confirm follow-through

Further confirmation comes from the Accumulation/Distribution [A/D] indicator, which has continued trending higher during the breakout.

The metric recently reached a local high of 5.05 million. The rise suggests that inflows have persisted even as price moved above resistance.

Historically, rising accumulation alongside a breakout increases the probability that price strength is being supported by broader market participation, rather than short-term positioning alone.

Key levels now in focus

With $95,000 reclaimed, the zone between $94,000 and $95,000 may now act as near-term support.

On the upside, Bitcoin is approaching the psychological $100,000 level. However, price action around that area will likely determine whether momentum can extend further.

Final Thoughts

Bitcoin’s move above $95,000 is supported by a shift in spot taker behavior, with buyers regaining control after weeks of neutral-to-sell-dominated flow.

While the rally has yet to challenge prior highs, improving accumulation trends suggest the breakout is underpinned by sustained demand rather than short-term speculation.

#MarketRebound #BTC100kNext? #StrategyBTCPurchase #USNonFarmPayrollReport