For a long time, BNB was seen simply as “the Binance token.” Useful, popular, but closely tied to one exchange. As we move through 2026, that perception no longer holds. BNB Chain has quietly evolved into one of the most practical and widely used blockchain ecosystems in the crypto space, powering real applications that people use daily.

What’s happening with BNB today isn’t about hype cycles or short-term narratives. It’s about infrastructure, usability, and scale.

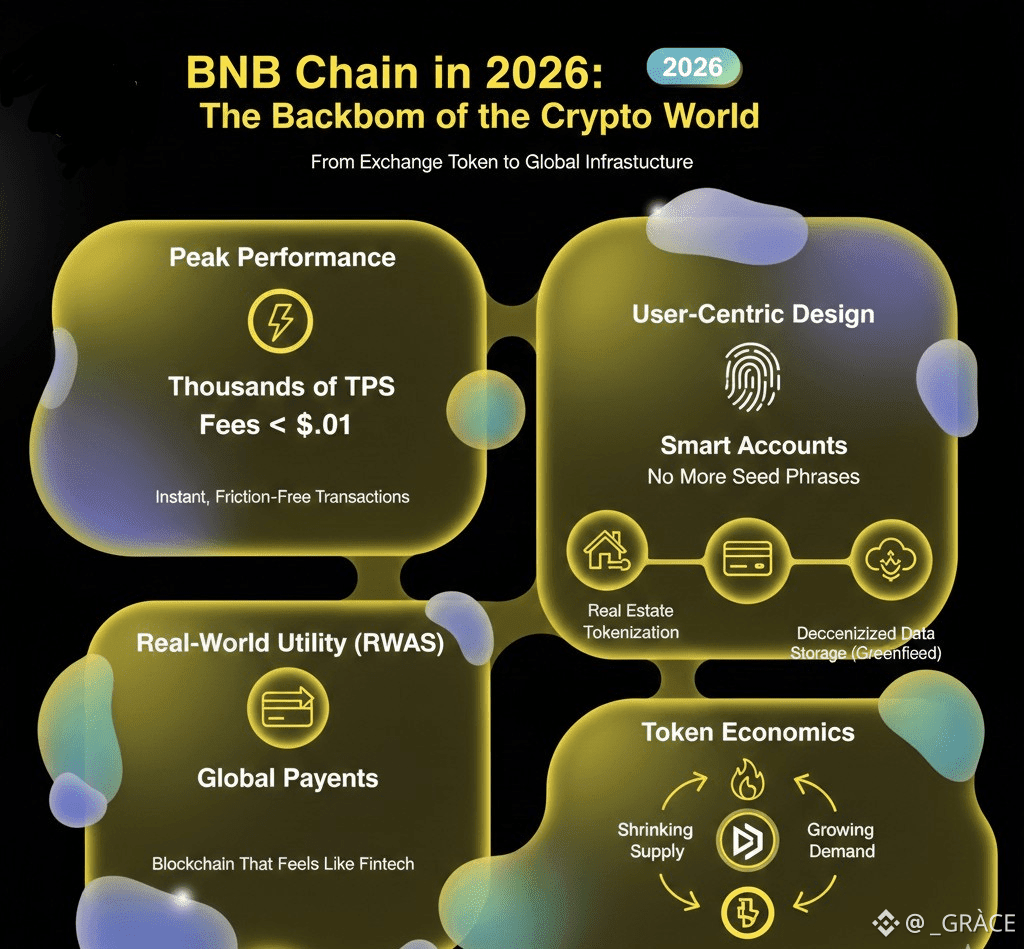

Speed and Fees That Actually Make Sense

One of the biggest problems blockchain has always faced is friction. Transactions that take too long. Fees that spike unpredictably. Experiences that feel clunky compared to traditional apps.

BNB Chain has largely solved this. The network now processes thousands of transactions per second while keeping fees extremely low. For everyday users, this means sending funds, interacting with apps, or buying NFTs feels instant and costs less than a cent. There’s no need to “wait for confirmations” or overthink gas fees. The system just works.

This level of performance is one of the main reasons developers continue to build on BNB Chain, especially for applications that need speed and scale.

Opening the Door to Non-Crypto Users

In 2026, BNB Chain is no longer designed only for crypto-native users. One of the biggest shifts has been the introduction of Smart Accounts. These accounts remove much of the complexity that used to scare people away from blockchain.

Users can now log into apps using familiar tools like FaceID or fingerprint authentication. There’s no need to manage long recovery phrases or worry about losing access forever because of a forgotten password. This change alone dramatically lowers the barrier to entry and makes BNB-based apps feel closer to modern fintech products than experimental crypto tools.

As a result, the ecosystem is seeing more users who don’t even think of themselves as “crypto people.”

Connecting Blockchain to the Real World

BNB Chain’s growth isn’t limited to digital-native use cases. It’s increasingly being used to connect blockchain technology with real-world activity.

Real estate tokenization is one clear example. Users can now own fractional shares of property through blockchain-based tokens, opening access to markets that were once limited to large investors.

Payments are another area of expansion. More online merchants are choosing BNB Chain for payments because transactions are faster and cheaper than traditional card networks, especially for global commerce.

Data storage is also becoming a key pillar through BNB Greenfield. This allows users and applications to store data in a decentralized way, reducing reliance on large centralized tech companies while maintaining security and accessibility.

These are not experimental ideas anymore. They are working products being used today.

A Deflationary Asset by Design

BNB’s token economics continue to play an important role in the ecosystem. The network regularly burns a portion of the supply, permanently removing tokens from circulation. Over time, this creates a shrinking supply.

As BNB Chain adoption grows and more applications rely on the network, demand increases while supply steadily decreases. This dynamic keeps long-term value firmly in focus for the community and reinforces BNB’s role as more than just a utility token.

The Bigger Picture

In 2026, BNB Chain is focused on one core goal: simplicity. It aims to make blockchain feel invisible, not intimidating. Users shouldn’t need to understand wallets, gas mechanics, or cryptographic keys just to participate in the digital economy.

BNB Chain is no longer just about trading tokens. It’s becoming a foundational layer for games, finance, data storage, and global payments. Quietly, consistently, it’s positioning itself as one of the most important pieces of crypto infrastructure in the world.

And that’s exactly why many now see it as the backbone of the next phase of crypto adoption.