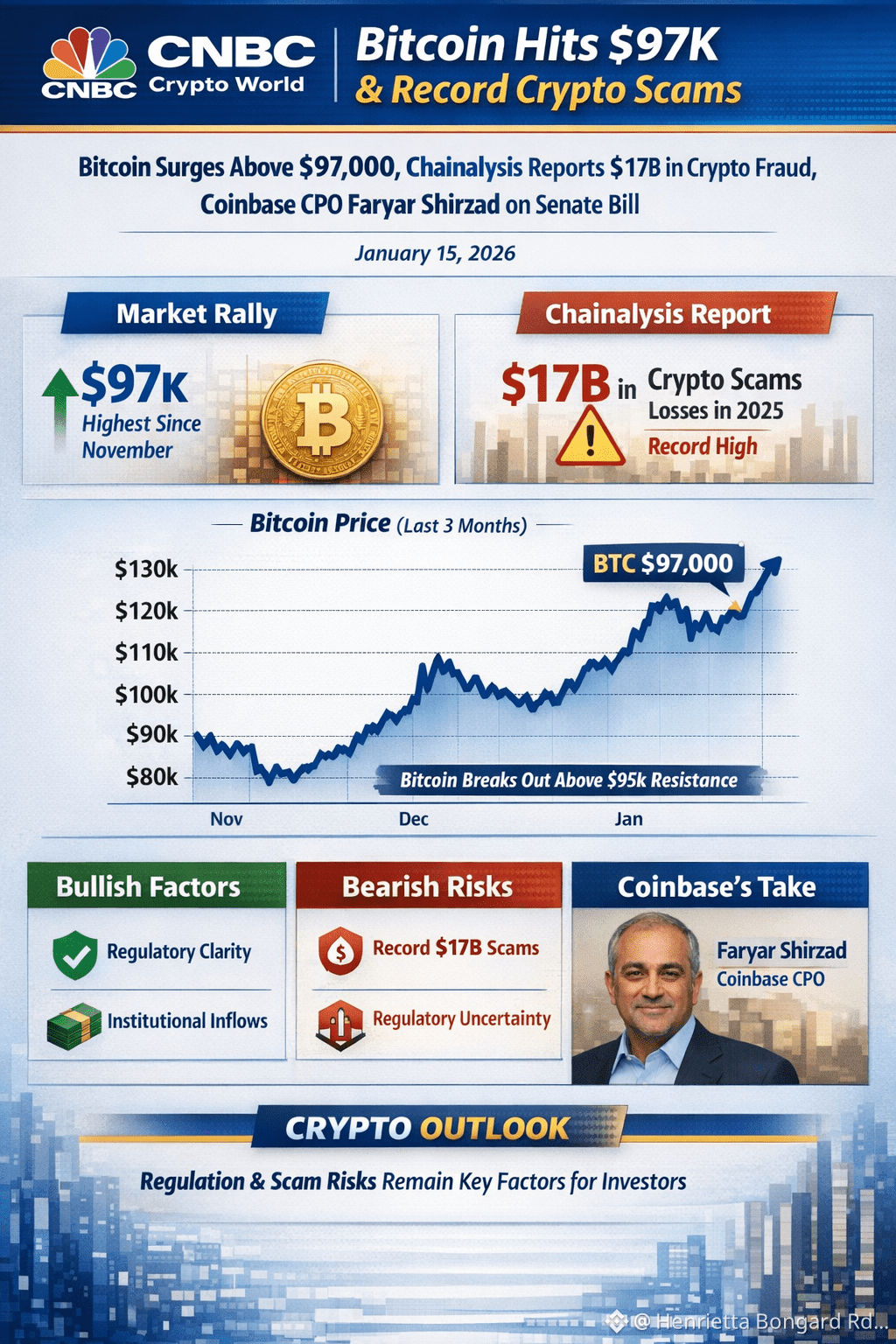

January 15, 2026 — Bitcoin surged past $97,000, marking its highest level since November, driven by renewed investor optimism around U.S. regulatory clarity and significant inflows into digital assets. This breakout comes amid key developments on Capitol Hill, including debate over a major crypto market structure bill and worrying new data on crypto scams.

Market Rally: What’s Driving Bitcoin

Bitcoin climbed above $97,000 on Wednesday, reversing recent volatility and signaling strengthening sentiment among traders and institutions. The rally coincided with progress toward advancing the Digital Asset Market Clarity Act — a bill designed to bring long-awaited regulatory clarity for digital assets by defining how federal agencies oversee cryptocurrencies and stabilizing the legal status of tokens.

Positive momentum has also been buoyed by broader crypto asset gains, with other major coins such as Ethereum and XRP posting increases alongside Bitcoin’s surge.

Record Scam Losses Cloud the Upside

While prices rise, the crypto crime landscape worsened dramatically in 2025. According to analytics firm Chainalysis, crypto scams and fraud schemes stole an estimated $17 billion over the past year — the highest amount ever recorded. This dramatic increase stems largely from highly sophisticated tactics, including impersonation scams and AI-assisted schemes that significantly boost the efficiency and scale of fraud.

Regulatory Crossroads: Coinbase Speaks Out

Amid these market moves, Coinbase’s chief policy officer, Faryar Shirzad, offered cautious commentary ahead of the Senate Banking Committee’s markup on the crypto market structure bill. Shirzad reiterated industry concerns about provisions tied to stablecoin incentives and regulatory reach. His perspective reflects broader tensions as lawmakers seek to balance innovation with investor protections.

Market Snapshot: Simple Graph of Bitcoin Price Levels

BTC Price Levels (Last 3 Months)

$130k ┤

$120k ┤

$110k ┤ ■

$100k ┤ ■

$95k ┤ ■

$90k ┤ ■

$85k ┤

$80k ┤

└──────────────────

Nov Dec Jan

Interpretation:

Bitcoin peaked near $126k in late 2025.

Price dipped through November and December.

January 2026 saw renewed strength with a breakout above key resistance near $95k to the current $97k+ zone.

Analysis: What This Means for Crypto

Bullish Factors

Regulatory clarity: Progress on the market structure bill reduces uncertainty, a key driver for institutional participation.

ETF and institutional inflows: Sustained capital entering BTC markets suggests deeper liquidity support.

Bearish Risks

Security weaknesses: Record scam losses erode retail confidence and underline systemic risks in on-chain security.

Political pushback: Ongoing debates in the Senate — especially around stablecoin incentives and regulatory jurisdiction — could delay meaningful legislation or weaken its impact.

Outlook Investors should watch regulatory developments and on-chain safety metrics closely. While price momentum has returned, underlying risks from fraud and legislative gridlock remain significant headwinds.