Overview

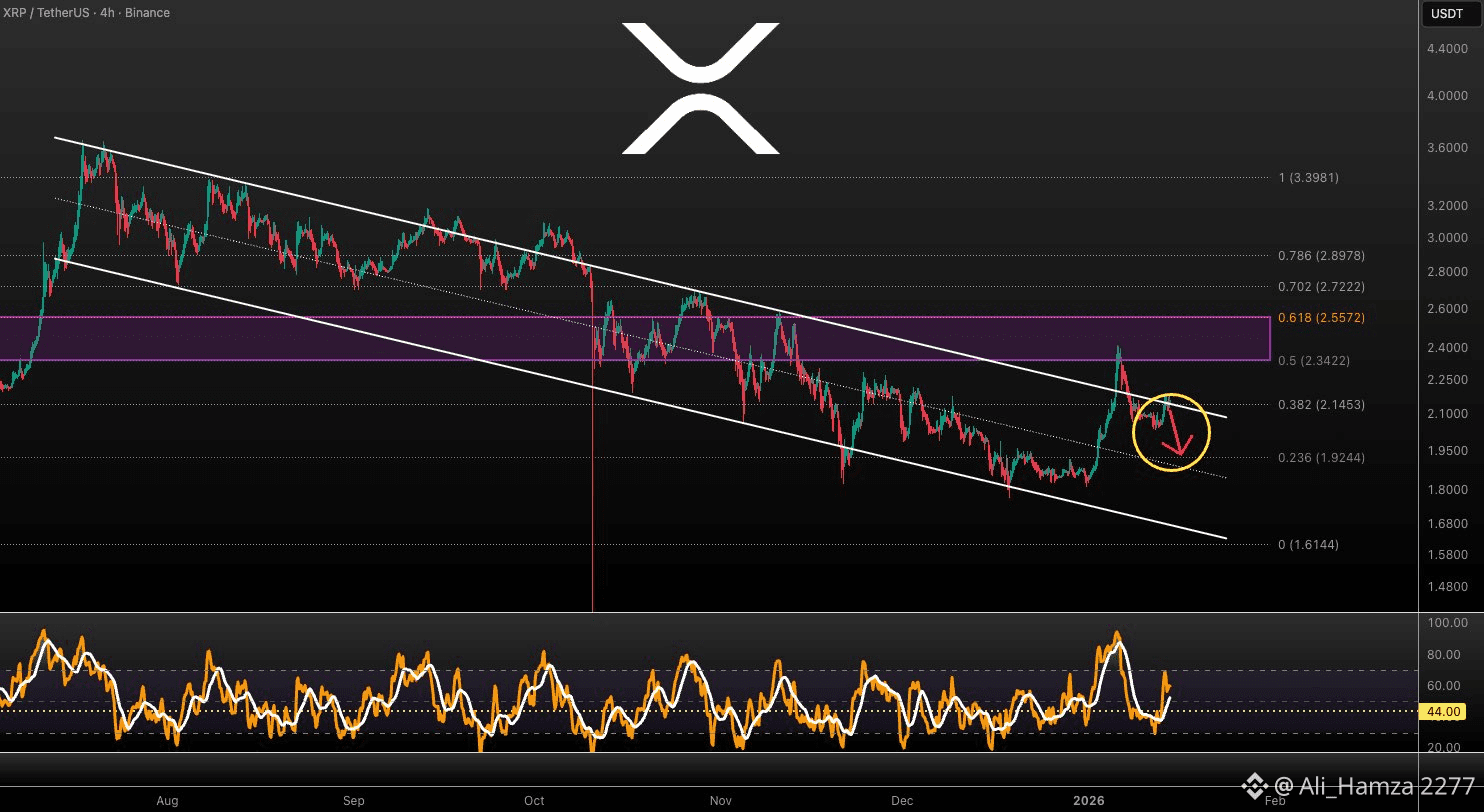

$XRP continues to trade under pressure as price remains confined within a well-defined descending channel on the 4-hour timeframe. Despite minor recovery attempts, the market has failed to produce a confirmed breakout, keeping the short-term bias bearish.

As long as XRP remains below channel resistance, downside continuation remains the higher-probability scenario.

Chart Details

Asset: $XRP

Pair: XRP / USDT

Exchange: Binance

Timeframe: 4-Hour (H4)

Market Condition: Bearish Consolidation

Technical Analysis

1. Descending Channel Structure

Price action has respected a falling channel since August, indicating controlled selling pressure.

Multiple rejection points from the upper boundary confirm the strength of this bearish structure.

2. Fibonacci Confluence Levels

0.618 Fibonacci Support: 2.5572 USDT

A key structural level that previously acted as demand.

0.236 Fibonacci Level: 1.9244 USDT

Located near the lower boundary of the channel and aligns with the projected short-term downside target.

3. Momentum Analysis

The Stochastic Oscillator is hovering near 44.00, reflecting weak momentum and a lack of bullish strength.

This reading supports the possibility of continued downside pressure rather than an immediate reversal.

Short-Term Outlook

If XRP fails to break above the descending channel resistance, price is likely to continue drifting lower toward the 1.92 USDT region. This level represents a confluence of Fibonacci support and channel structure, making it a natural magnet for price in the short term.

A trend shift would only be confirmed on a clean breakout above the channel, accompanied by improving momentum and volume.

Key Levels to Watch

Resistance: Upper boundary of the falling channel

Support: 2.5572 USDT

Short-Term Target: 1.9244 USDT

Conclusion

$XRP remains technically weak while trading inside a descending channel. Until a structural breakout occurs, bearish continuation toward $1.92 remains the dominant scenario.

📌 Always wait for confirmation, manage risk carefully, and conduct your own research.