In the early days of Web3, decentralization felt like liberation. Anyone could transact, anyone could build, and anyone could participate without permission. It was thrilling, raw, and necessary. But as the space matured, an uncomfortable truth began to surface. Freedom without structure does not scale into real economies. DeFi was powerful, yet isolated. Traditional finance was massive, yet locked behind walls of regulation, compliance, and legacy systems. Between these two worlds, there was a gap. Dusk exists in that gap.

Founded in 2018, Dusk was not created to chase hype or short-term narratives. It was built with a long memory and a long horizon. The team understood that real markets do not disappear just because a new technology arrives. Pension funds, bonds, equities, regulated exchanges, and institutional capital are not going to abandon compliance. At the same time, the future of finance cannot remain trapped in opaque systems that exclude innovation. Dusk was designed to reconcile these realities, not ignore them.

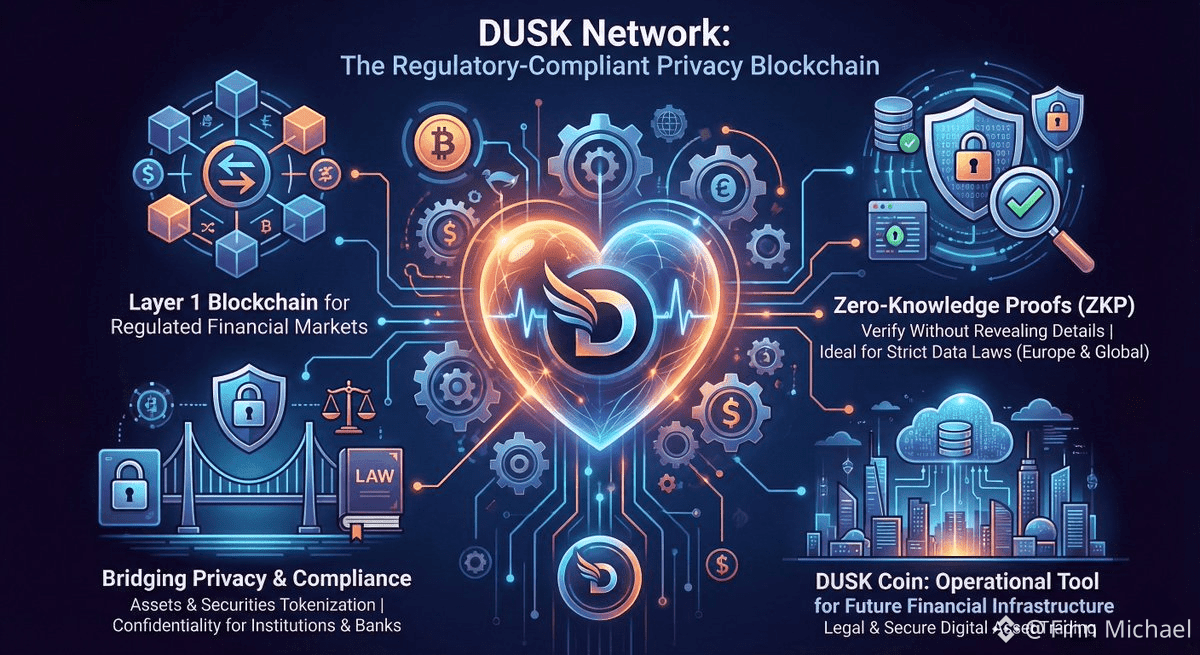

At its core, Dusk is a Layer 1 blockchain engineered for regulated and privacy-focused financial infrastructure. This single design choice sets it apart from most Web3 networks. While many chains optimize for speed or composability, Dusk optimizes for trust. Trust between users and institutions. Trust between privacy and transparency. Trust between innovation and law.

One of the deepest problems in blockchain-based finance has always been visibility. On most public chains, everything is exposed. Wallet balances, transaction histories, trading strategies. For retail users, this creates risk. For institutions, it creates impossibility. No serious financial entity can operate in an environment where every move is publicly traceable forever. Dusk addresses this through zero-knowledge cryptography, allowing transactions to remain private while still being verifiable. Rules can be enforced without data being exposed. Compliance can be proven without identities being broadcast. This is not a workaround. It is a rethinking of how blockchains should behave when real money is involved.

What makes this powerful is not just the cryptography, but how deeply it is embedded. On Dusk, compliance is not something added later through intermediaries. It lives at the protocol level. Assets can be issued, transferred, and settled under predefined regulatory conditions enforced by code. This means tokenized securities, regulated DeFi products, and real-world assets can exist on-chain without breaking the legal frameworks that protect markets and investors. For the first time, DeFi begins to look less like an experiment and more like infrastructure.

Dusk’s modular architecture reinforces this vision. Instead of forcing every use case into one environment, Dusk separates concerns. Settlement and finality are handled by a base layer built for reliability and instant confirmation. Smart contract execution is supported through environments that are familiar to Ethereum developers, lowering friction for builders. Advanced privacy and zero-knowledge modules enable complex financial logic that mirrors the realities of institutional finance. This modularity is not about elegance. It is about survival. Financial systems must evolve without breaking, and Dusk is built to adapt.

Consensus on Dusk reflects the same maturity. Its Proof-of-Stake design prioritizes deterministic finality. In real markets, uncertainty is not innovation, it is risk. Trades must settle when they settle. Ownership must be final when it is final. Dusk understands that financial confidence is built on predictability, not probability.

Where the vision becomes tangible is in real-world asset tokenization. Dusk does not treat this as a marketing term. It treats it as a responsibility. Bringing bonds, equities, and regulated financial instruments on-chain requires more than smart contracts. It requires respecting jurisdiction, investor rights, disclosure rules, and auditability. Dusk creates an environment where these assets can live digitally without losing their legal meaning. This is where the bridge between DeFi and real markets becomes real.

But beyond architecture and protocols, Dusk carries a quieter message. Finance is personal. It affects livelihoods, futures, and security. Privacy is not about hiding wrongdoing, it is about protecting people. Regulation is not about control, it is about trust at scale. Dusk does not position itself as anti-system or pro-system. It positions itself as post-naivety. It assumes the world is complex and builds accordingly.

As Web3 grows up, the question is no longer whether decentralized finance can exist. It already does. The real question is whether it can integrate with the systems that move global capital without losing its soul. Dusk suggests that it can. That decentralization does not have to mean chaos. That privacy does not have to mean opacity. That compliance does not have to mean exclusion.

Dusk is not loud. It does not promise overnight revolutions. It does something more difficult. It builds the missing layer. The one that allows DeFi to step into real markets without breaking them. And in doing so, it quietly redefines what serious Web3 infrastructure looks like.