And here’s the part most people are completely missing…

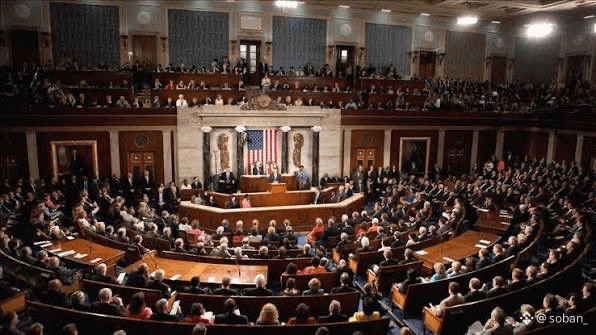

Today, Coinbase’s CEO dropped a bombshell — Coinbase will NOT support the Crypto Market Structure Bill.

Why? Because the so-called “CLARITY” Act is anything but clear for crypto.

Let’s break it down 👇

1️⃣ Zero Yield on Stablecoins

The bill bans yield for stablecoin holders.

Who benefits? Banks.

Who loses? Users.

Even JP Morgan’s CFO admitted the truth:

If stablecoins offered yield, banks would see massive capital outflows.

So instead of competing… they chose to block it.

2️⃣ Silent Ban on Tokenized Stocks

The Act pushes tokenized equities into the SEC’s rigid securities framework.

What does that mean?

Centralized control

Heavy compliance

No peer-to-peer innovation

In simple words: DeFi-style stock tokenization is dead on arrival.

3️⃣ DeFi Under Attack

Mandatory AML/KYC requirements would:

Eliminate anonymity

Kill permissionless protocols

Force surveillance on every transaction

That’s not DeFi — that’s TradFi wearing a crypto mask.

Now connect the dots 🧩

The CLARITY Act isn’t written for crypto.

It’s written for banks.

Big banks are terrified of losing their monopoly.

They know the shift is inevitable.

And as history always shows…

👉 First they ignore you.

👉 Then they laugh at you.

👉 Then they fight you.

We are officially in the “they fight you” phase. 🔥

#StrategyBTCPurchase #BTC100kNext? #Binance #crypto