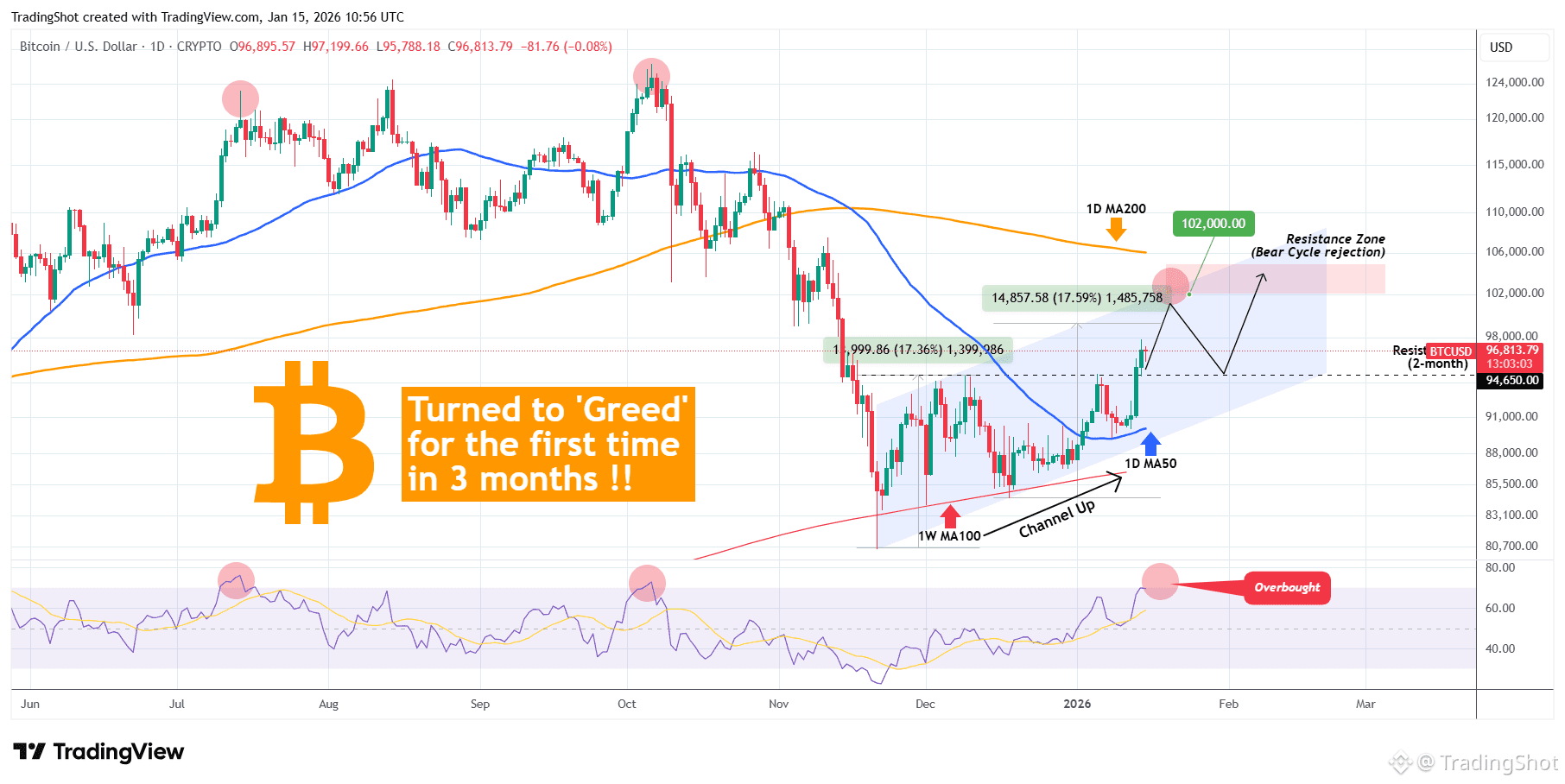

Bitcoin (BTCUSD) Crypto Fear & Greed index turned to greed for the first time in 3 months. Technically this was confirmed by BTC breaking (and closing) above its 94650 Resistance for the first time in 2 months.

With the 1D MA50 (blue trend-line) turning into a Support and getting confirmed by holding upon the January 08 test, we can see the emergence of a short-term Channel Up.

As we've explained for over a month now, this is potentially the typical market reaction that previous Bear Cycles have done historically, where after completing the first strong decline that gets most of investors off guard, it makes the first counter-trend rally (dead cat bounce) that technically tests the 1D MA200 (orange trend-line). This time, the rebound is being made after the 1W MA100 (red trend-line) got tested and held.

With the 1D RSI about to enter the Overbought Zone (70.00 and above), where the last two times (October 06 and July 14 2025) it got rejected, we may see the current Bullish Leg of the Channel Up extending to around +17.50% (where the previous one was rejected), make a Higher High, then pull-back to re-test the 1D MA50 and then finally go for the benchmark test of the 1D MA200.

We estimate a potential Bear Cycle rejection Zone within $102000 - 105000, before the Cycle starts Phase 2 with a new long-term sell-off.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!