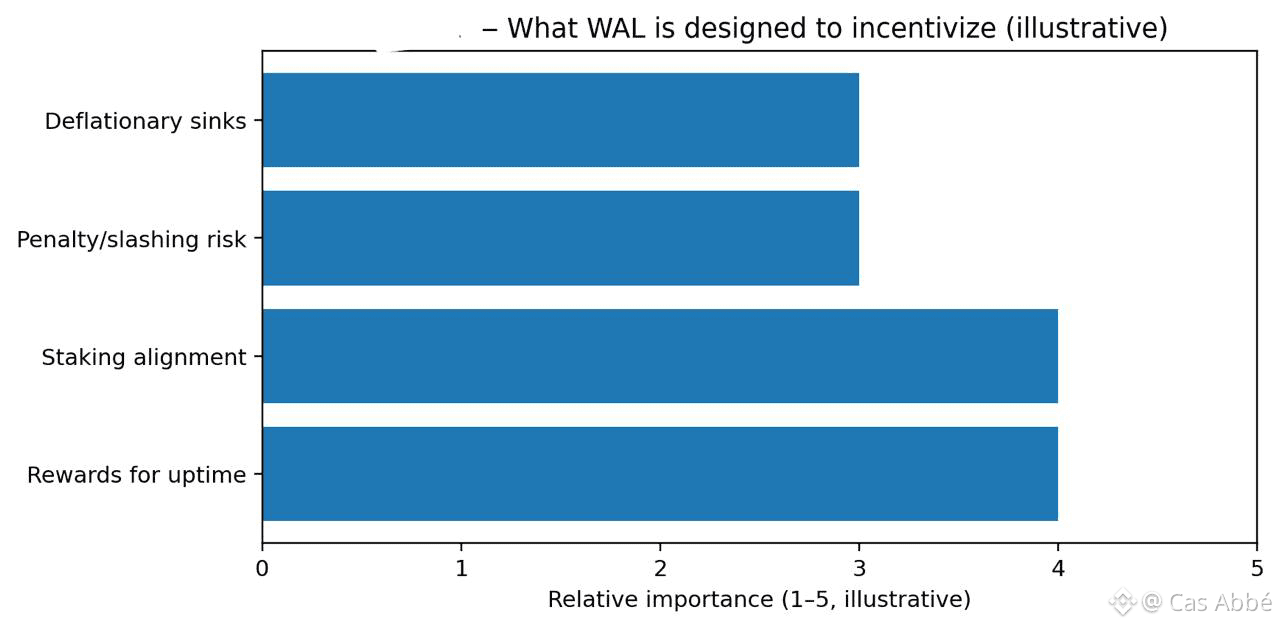

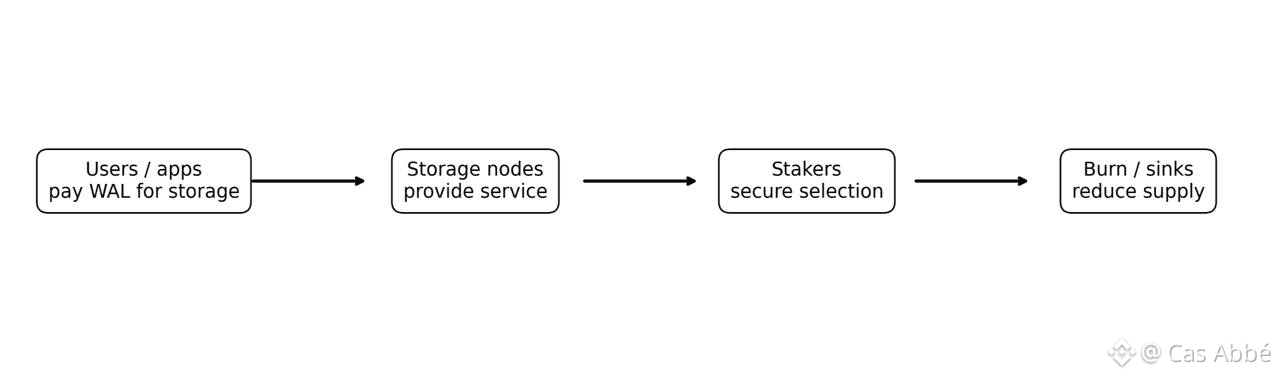

Walrus does not consider the token a number-go-up add-on, it uses WAL to manage actual behavior, who stores data, who is rewarded and who is penalized.

WAL is built on the concept of delegated staking, which requires token holders to delegate to storage nodes and the protocol uses the delegated stake to create responsibility assigned to storage and network security.

The model is intended to discourage short-term flipping in favor of long-term participation over the long-run: short-term changes of stake will be penalised (partially burned / partially redistributed), and underperforming nodes will be slashed, part of which is burned.

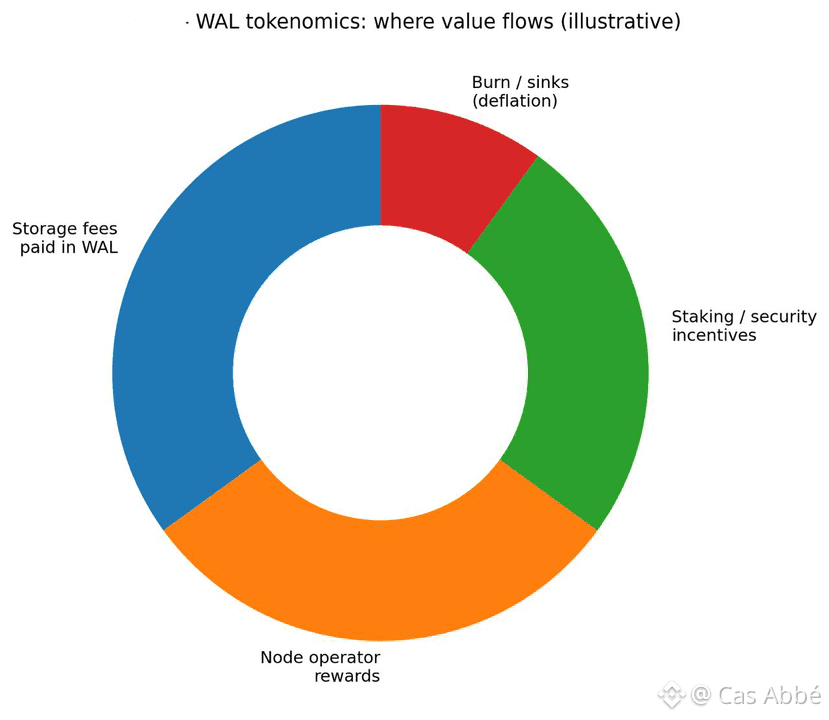

The interesting part is the direction: Walrus makes it quite clear that deflationary pressure is a result of usage (burning with transactions), i.e. supply can be decreased by adoption (more uploads / payments) mechanically. And their write-ups focus on economic sustainability in the long term: rewards can be low initially but intended to increase with the size of the network, and market forces can recapitalize the part of the gains to the users by reducing storage costs.

This gives a purer tale: storage demand - operator revenue - sustainable ops - a staking economy that is not so dependent on continuous emissions.