Crypto is turning heads in Argentina once again. Lemon, one of the country’s largest exchanges, has just unveiled the nation’s first Bitcoin-backed Visa credit card, allowing users to access peso credit lines without selling their BTC.

🔒 Collateral, Not Conversion

To get started, customers lock up 0.01 BTC (around $960 at current prices) as collateral. In return, they receive an initial credit limit of 1 million pesos. Unlike traditional loans, the Bitcoin is held securely as a guarantee — it isn’t converted to fiat, letting Argentines preserve their crypto holdings while still gaining spending power.

Future plans include adjustable collateral and limits, as well as the ability to settle dollar-denominated purchases directly in stablecoins like USDC or USDT.

💸 From Cash Hoarding to Crypto Power

This move addresses a long-standing issue in Argentina: distrust of banks. Memories of the 2001 “corralito” freeze — which wiped out deposits — and repeated peso devaluations have left Argentines holding $271 billion in cash dollars, much of it under mattresses or overseas.

By enabling Bitcoin-backed credit, Lemon effectively turns a favored savings asset into liquid purchasing power, without forcing users to sell BTC or their dollar stash.

🌎 Crypto Rails Expanding in Latin America

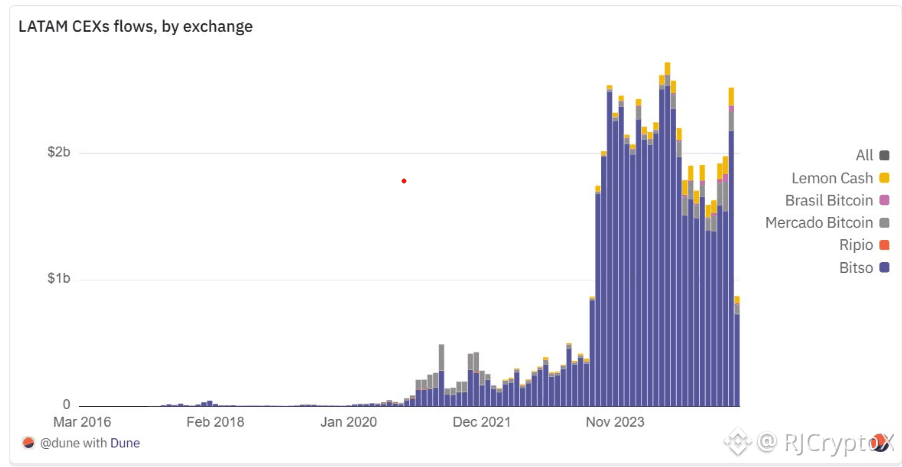

The card launch comes as crypto adoption grows across Latin America. Centralized exchanges have seen transaction flows jump ninefold over the last three years, with total regional crypto activity approaching $1.5 trillion between 2022–2025.

Platforms like Bitso, Mercado Bitcoin, and Lemon are increasingly central to remittances, hedging, and everyday payments — making a Bitcoin-backed credit card a natural next step.

🔑 Why This Matters

Crypto-collateralized credit is already gaining traction globally, but Lemon’s card is unique: it’s peso-denominated, Bitcoin-guaranteed, and designed for a highly dollarized, fragile banking system.

Even as inflation cools from triple-digit highs to the low-30% range, Argentines’ cautious saving behavior continues to favor alternatives like crypto. Lemon’s innovation bridges the gap between long-term savings and daily spending, signaling a new era for Latin American finance.

Follow for alerts