ata

Most decentralized storage projects still talk like they are replacing a bucket in the cloud. Walrus feels different because its real product is not “space.” It is a verifiable custody event that becomes composable on Sui. The moment a blob is certified, an onchain proof marks the point at which a specific committee is now economically obligated to keep specific encoded slivers available, for a specific number of epochs. That sounds subtle, but it shifts Walrus from “file hosting” into “programmable service guarantees,” and that framing explains almost every technical and economic choice it makes.

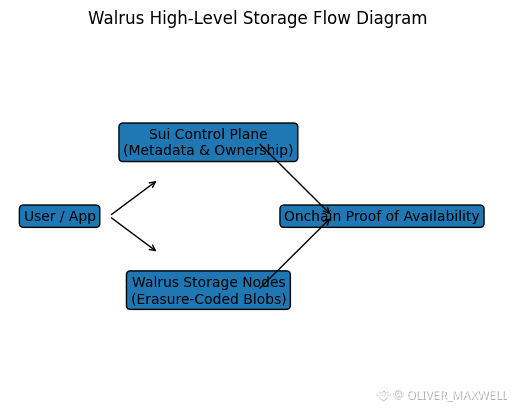

Architecturally, Walrus makes a clean bet that most competitors avoided. Instead of treating storage as a separate world where blockchains only pay for pointers, Walrus uses Sui as the control plane for metadata, ownership, and the Proof of Availability certificate. The write protocol culminates in an onchain artifact, and after that, applications can reason about data availability the same way they reason about tokens or objects, through deterministic onchain logic rather than offchain promises. In practice this is what “programmable storage” actually means in Walrus, not a marketing line. It is why Walrus can be described as “specialized for efficient and secure blob storage” while still inheriting composability from Sui.

The second architectural bet is that decentralization at scale is not primarily a consensus problem. It is a verification and repair bandwidth problem. Walrus’s Red Stuff encoding is built to reduce repair traffic and make “self healing” lightweight by design, using a two dimensional erasure coding scheme that creates primary and secondary slivers so recovery can be fast without turning every failure into a network storm. This matters competitively because traditional decentralized storage systems often pay for resilience twice, first through heavy replication and second through expensive recovery dynamics when nodes churn. Walrus is trying to pay once, in math, not in bandwidth.

Those same design choices drive Walrus’s economics in a way that is easy to miss if you compare it to Filecoin or Arweave at a headline level. Walrus prices storage as an epoch based resource purchase, and the protocol explicitly turns price formation into a stake weighted market. Nodes submit storage and write prices in advance, and the system selects the 66.67th percentile by stake weight, so two thirds of stake is priced below the chosen price and one third above it. That is not just a governance detail. It is Walrus declaring that storage pricing should be robust to outliers and resistant to a small set of high priced operators holding the network hostage. Then it adds a second economic lever: a write price that is multiplied by a factor that functions like a refundable deposit, returned more fully when the user actually pushes data directly to more nodes, because that is operationally cheaper for the network than having nodes repair missing symbols later. This is a rare example of a storage network explicitly paying users to behave in a way that reduces systemic bandwidth risk.

If you want a concrete feel for costs, Walrus itself publishes a simple reality check: most blobs incur around 5x overhead due to erasure coding, plus metadata overhead that can be up to 64 MB per blob. That single sentence is one of the most important adoption filters, because it tells you Walrus is structurally optimized for large blobs, not for millions of tiny objects unless developers batch them. It also explains why “Walrus Sites” as a primitive matters. Hosting a frontend becomes a large blob problem, not a small file problem.

Now layer in current price mechanics. The Walrus client examples show a storage price expressed per encoded storage unit per epoch, for example 0.0001 WAL per MiB per epoch, with a separate additional write price. With two week epochs on mainnet, you can translate that into a mental model where ongoing availability is paid like a subscription, but one where the subscription is prepaid and bounded by the resource object you buy. The whitepaper’s key economic point is that prepaid, fixed length contracts protect users from mid contract repricing and protect nodes from users exiting early without cost. That is another reason the “insurance market” framing fits. You are buying coverage for time, not buying a magical promise of permanence.

On privacy and security, Walrus is unusually honest in its base layer posture. The availability proof is public, the custody record is onchain, and the system is built around verifiability and auditability. That is the opposite of “private by default.” The privacy story is instead about controlled access and encryption layered on top of a public, attestable storage substrate. Walrus’s own decentralization at scale writeup points to access control via Seal as the mechanism that lets developers keep some data private while still relying on the same decentralized custody guarantees. This is a deliberate trade. Walrus maximizes composability and auditability first, then offers privacy as a programmable policy layer. For enterprises, that is often more usable than opaque privacy, because compliance teams can reason about custody and policy separately.

The enterprise question is usually where decentralized storage projects become hand wavy, so I prefer to look at what Walrus is doing that enterprises actually buy. Enterprises pay for three things: predictable service boundaries, provable custody, and integration surface area. Walrus’s PoA and the explicit “point of availability” event give a clean contractual boundary. Its prepaid epoch model makes cost predictability more realistic than systems where pricing can float continuously. And using Sui as the control plane gives a straightforward integration path for any workflow that already touches onchain logic, because the storage guarantee is represented in the same environment as the business logic. None of this automatically creates enterprise adoption, but it reduces the typical friction points. On the evidence side, public reporting around mainnet launch highlighted that Mysten Labs had already built a web hosting service on top of Walrus, and that mainnet went live March 27, 2025. That matters because it is the simplest enterprise adjacent test. If a network cannot reliably serve frontends, it will not serve serious data pipelines.

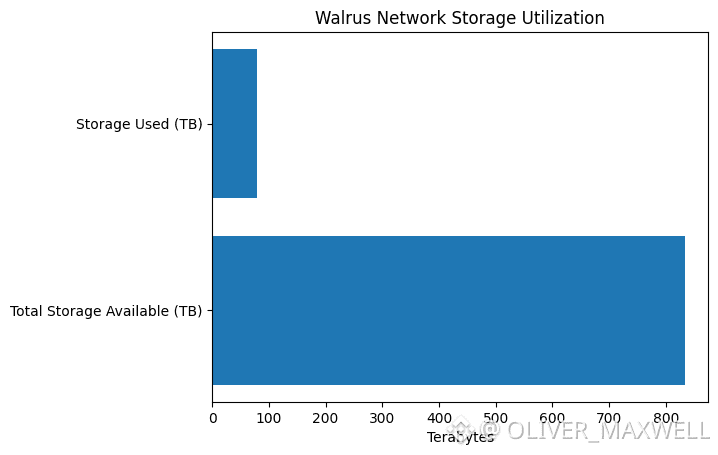

Real world usage signals are still early, but they are not imaginary. Around launch, Blockworks cited Walruscan metrics showing 833.33 TB total storage available, about 78,890 GB used, and more than 4.5 million blobs. I would not treat a single snapshot as a long term trend, but it does indicate that Walrus usage is not confined to a demo environment, and it aligns with the product posture of storing many blobs at scale rather than a small number of archival objects.

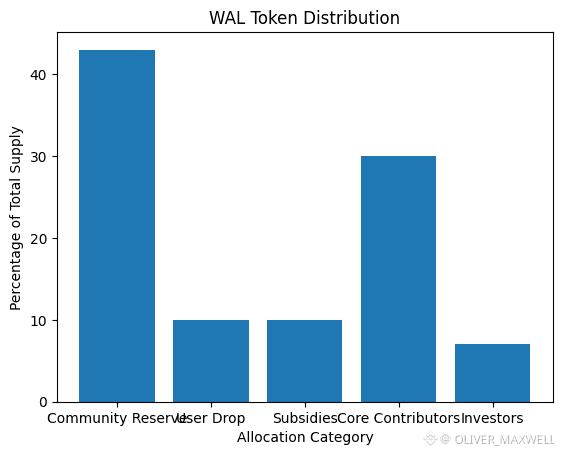

Network health and token sustainability come down to whether incentives reward performance more than size, and whether distribution creates durable alignment. Walrus leans hard into delegated staking as the security backbone, with governance operating through WAL and parameter changes decided by stake weighted voting among nodes. The token distribution is also explicit. Max supply is 5,000,000,000 WAL, initial circulating supply is 1,250,000,000 WAL, and allocations include 43% community reserve, 10% user drop, 10% subsidies, 30% core contributors, and 7% investors, with the project stating that over 60% is allocated to the community through airdrops, subsidies, and the community reserve. The subsidies line is not cosmetic. It is a recognition that bootstrapping a storage market requires smoothing the gap between what users will pay early and what nodes need to earn to run a viable business.

Two sustainability mechanics are worth watching because they reveal Walrus’s long term theory of decentralization. First, Walrus plans to penalize short term stake shifts because stake churn creates expensive data migration externalities, with part of those penalties burned and part distributed to long term stakers. Second, it plans to introduce slashing for poor performance, with a portion burned as well. Even before full slashing is live, the protocol’s public messaging is consistent: decentralization is protected by making “power grabs” expensive and making reliability the main profit center. You can see the same thesis in the January 8, 2026 post that emphasizes performance based rewards, penalties for rapid stake movement, and collective governance as explicit decentralization controls.

If you want a more grounded view of validator economics than “it is decentralized because we say so,” the best public quantitative snapshot I found is Everstake’s first half 2025 staking report, which recorded 103 node operators and total stake of 996.8 million WAL as of June 30, 2025, with the top operator holding 2.6% of total stake in that dataset. That distribution is not proof of permanent decentralization, but it is a healthier starting point than the common pattern where a handful of operators dominate from day one.

Strategically, Walrus’s tight coupling to Sui is both its moat and its risk. It is a moat because Sui gives Walrus a high throughput, object centric control plane where storage guarantees can be referenced, extended, and composed with application logic directly. The docs even describe extending storage by attaching a storage object with a longer expiry, which is exactly the sort of programmable lifecycle management that is awkward in storage networks that live entirely offchain. It is a risk because if Sui adoption stalls, Walrus loses part of its differentiated integration story. The counterpoint is that Walrus is actively positioning itself as multi ecosystem infrastructure, and partnerships like the Pipe Network integration are designed to improve bandwidth and latency at the edge, which is one of the real blockers for serving large blobs to users globally.

Forward looking, Walrus’s clearest path to durable relevance is not “cheapest storage.” It is “most usable programmable custody.” The market gap is obvious once you name it: applications increasingly need large, mutable, provable datasets that can be referenced by contracts, audited by third parties, and served efficiently to end users. That includes AI workflows where provenance matters, media where censorship resistance matters, and consumer apps where frontends and assets should not disappear because a single vendor account is suspended. Walrus is built around making that custody event explicit, tradable through pricing, and enforceable through staking incentives. The strategic inflection points to watch are therefore specific. One is whether access control via Seal becomes a widely adopted default pattern, because that unlocks serious enterprise and regulated workflows without sacrificing public auditability. Another is whether performance based rewards and stake shift penalties actually keep stake distribution healthy as TVL and attention increase. A third is whether the subsidy allocation transitions smoothly into fee driven node revenue, because the tokenomics admit that early adoption is subsidized by design. Finally, the investor allocation unlocks 12 months from mainnet launch, which is a real market event that can pressure narratives even if fundamentals are improving, so traders and long term allocators should treat it as a liquidity regime change rather than a moral judgement.