I started paying closer attention to blockchains built for regulated finance when I realized a pattern recurring in market cycles. Many aggressively optimized networks for speed, throughput, or composability struggled to answer the simpler institutional question: can this system operate within real financial rules without breaking its core guarantees? For banks, for asset issuers, and for regulators, innovation is not just about going faster-it's about being precise, auditable, compliant, and durable over decades. It is in that context that DUSK Network and the DUSK token become relevant, not as a speculative experiment but as a system for disciplined financial infrastructure.

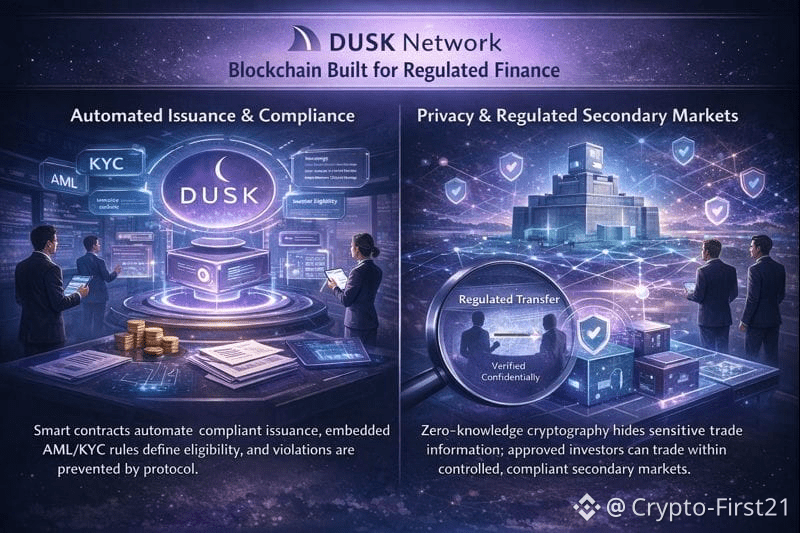

DUSK Network is a blockchain built for regulated financial instruments. As such, it does not seek open-ended experimentation in issuing, trading, and settling assets like equities, bonds, funds, and other tokenized securities in a compliant environment. In contrast to general-purpose blockchains, where transparency is default and permissionless access is assumed, DUSK starts from another premise: financial markets require selective privacy, rule-based participation, and enforceable compliance. In practical terms, it means DUSK is designed to support assets that have to comply with KYC, AML, and investor eligibility, but still benefit from blockchain automation. The network does not seek to replace regulation; it tries to encode it into the system itself.

Of the most important design choices in DUSK, perhaps its approach to privacy is considered the biggest. In TradFi, transaction details are not broadcast to the world. They become visible to authorized parties, positions, counterparties, and settlement data. DUSK reflects this reality by using zero-knowledge cryptography to enable confidential transactions that remain verifiable. Without privacy, institutions cannot use public blockchains for regulated assets.

Developers are expected to build compliance checks into smart contracts or off-chain processes. DUSK takes a more systemic approach by making compliance part of the protocol logic itself. Issuances on the DUSK network may have rules regarding which entities are permitted to own and/or trade a particular asset, when, and where. Such rules are automatically enforced on the network and do not require the intervention of intermediaries. In turn, problems that could have been avoided are instead avoided, rather than being caught after the fact and resulting in additional risk and expense for the issuer, providing clarity for investors, and proactive instead of reactive for the regulator.

The other very important feature of DUSK’s architecture is the automation that can be applied throughout the entire asset lifecycle. In a standard security, there are many parties who act as intermediaries. There are also many manual reconciliations that must be done on the system. The settlement in such systems can take a long time. DUSK’s architecture ensures that all these processes are replaced with deterministic processes that are done through smart contracts. With DUSK’s system, it can easily be able to execute such processes as dividend payments, events, voting processes, and even the settlement process. The system’s focus isn’t just on speed but on accuracy.

The secondary market is also a challenging area for many tokenization endeavours. Open liquidity may not be compatible with regulatory compliance, and too much regulation may stifle market activity. The DUSK solves this by supporting regulated secondary markets with controlled transfer of ownership that is not affected by issuance. This facilitates regulated trading between appropriate parties without resorting to off-chain solutions. Liquidity in such markets may not be completely free, but it is legal, auditable, and enforceable. For institutional investors, such regulated liquidity may be preferable over fully open access. For a company, it maintains control over ownership structures. For a regulator, it is an assurance that market integrity is upheld at all stages of an asset's existence.

In this regard, the DUSK token could be seen as having a functional purpose as opposed to a narrative or storytelling function. It is employed with regard to facilitating transaction costs, staking, and securing the network. Validators can be economically incented to move in the correct manner, with malfunctions being punished. This presents an obvious alignment between the interests of those within the network and that of stability. Staking is securing the network, and this security enables institutional involvement, and this involvement is integral to its sustained relevance. Its use is therefore not reliant upon current market trends but upon its usage of existing infrastructure.

Talking in terms of a system, DUSK can be understood to be a set of blockchain projects that are focused on discipline in preference to speed. It is expected to be relatively invisible in phases related to market speculations, but at the same time, it is also much more in tune with realities related to financial adoption. In terms of issuers, DUSK can be considered to be a platform whereby capital market modernization is enabled without necessarily having to do away with compliance. From an investment context, DUSK is a system whereby compliant on-chain products with defined risk channels are accessible. It is a system of blockchains from the viewpoints of policymakers in terms of showing reduced opacity and not increased opacity.

Not all blockchains are supposed to go be financial infrastructure, and not all financial infrastructure needs to be fast, open, or permissionless. Projects like DUSK matter because they address the less visible but more enduring requirements of capital markets: trust, compliance, privacy, and automation under rules. In the long run, the most impactful blockchain systems may not be the loudest or the fastest but the ones which quietly integrate into the existing institutions and continue working when market cycles fade.