As someone who has followed developments in blockchain and traditional finance for several years, I've often thought about the inefficiencies in how financial assets are settled today. Processes that involve multiple intermediaries and days of waiting seem out of step with modern technology. This is one reason Dusk Network interests me—it is a Layer 1 blockchain designed with privacy at its core, aiming to support the tokenization and direct settlement of real-world assets (RWAs) like securities. In my view, this approach could allow assets to settle directly on-chain, reducing reliance on central securities depositories (CSDs) and other legacy middlemen.

(An illustration highlighting the potential of blockchain to reduce intermediaries in financial processes.)

Understanding Traditional Asset Settlement

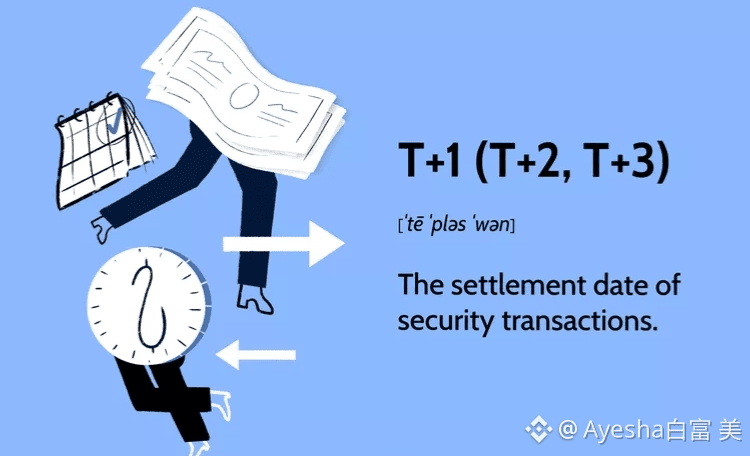

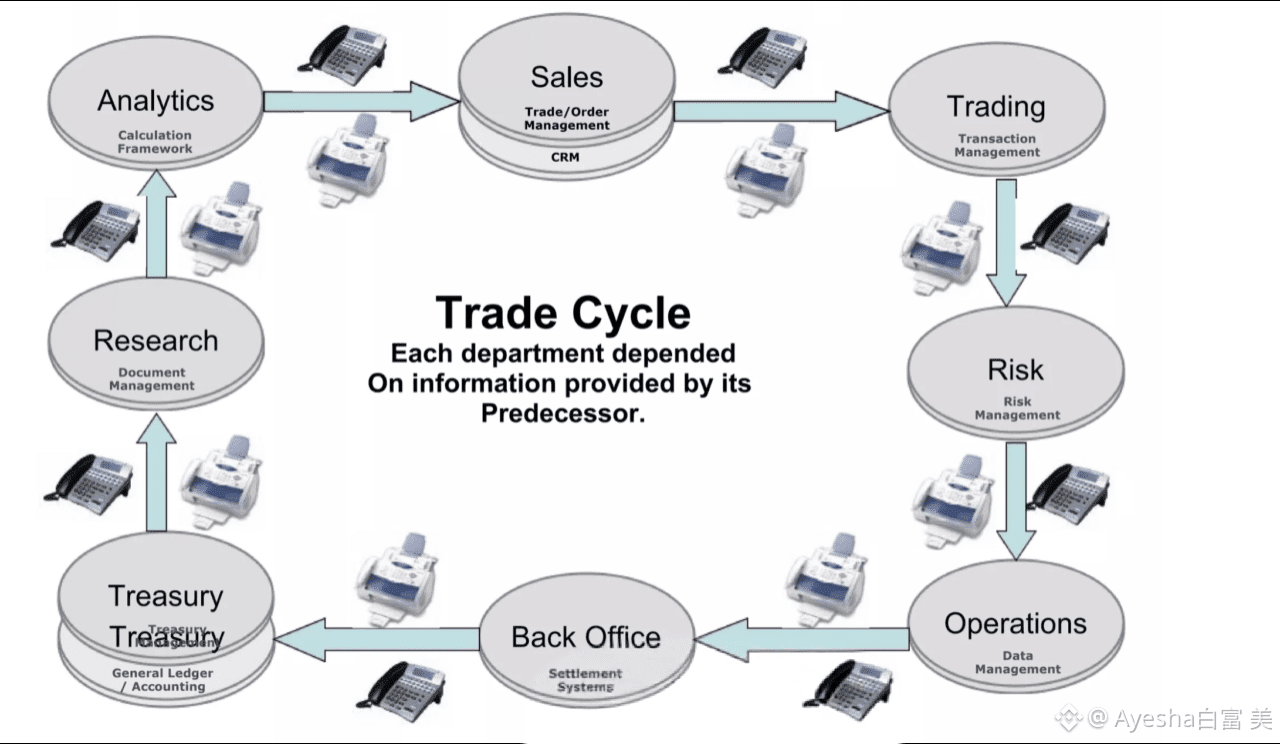

In conventional markets, when securities like stocks or bonds are traded, settlement—the actual transfer of ownership and payment—doesn't happen instantly. It typically takes one or two business days (T+1 or T+2), involving several parties:

1). Brokers facilitate the trade.

2. Custodians hold the assets.

3). Central Securities Depositories (CSDs) maintain records and enable transfers.

4). Clearing houses manage risk and netting.

This layered system provides checks and balances but also introduces delays, costs, and counterparty risks. From what I've read, these structures evolved for a pre-digital era, ensuring security in a world of paper certificates and manual processes.

(A clear explanation of settlement cycles, such as T+1 versus older T+2 or T+3 timelines.)

(A diagram outlining the steps in a typical trade settlement process involving multiple entities.)

The Potential of On-Chain Settlement

Blockchain technology, in principle, allows for atomic settlement: the simultaneous exchange of assets and payment in a single transaction. This could mean T+0—instant finality—without needing separate clearing or depository steps.

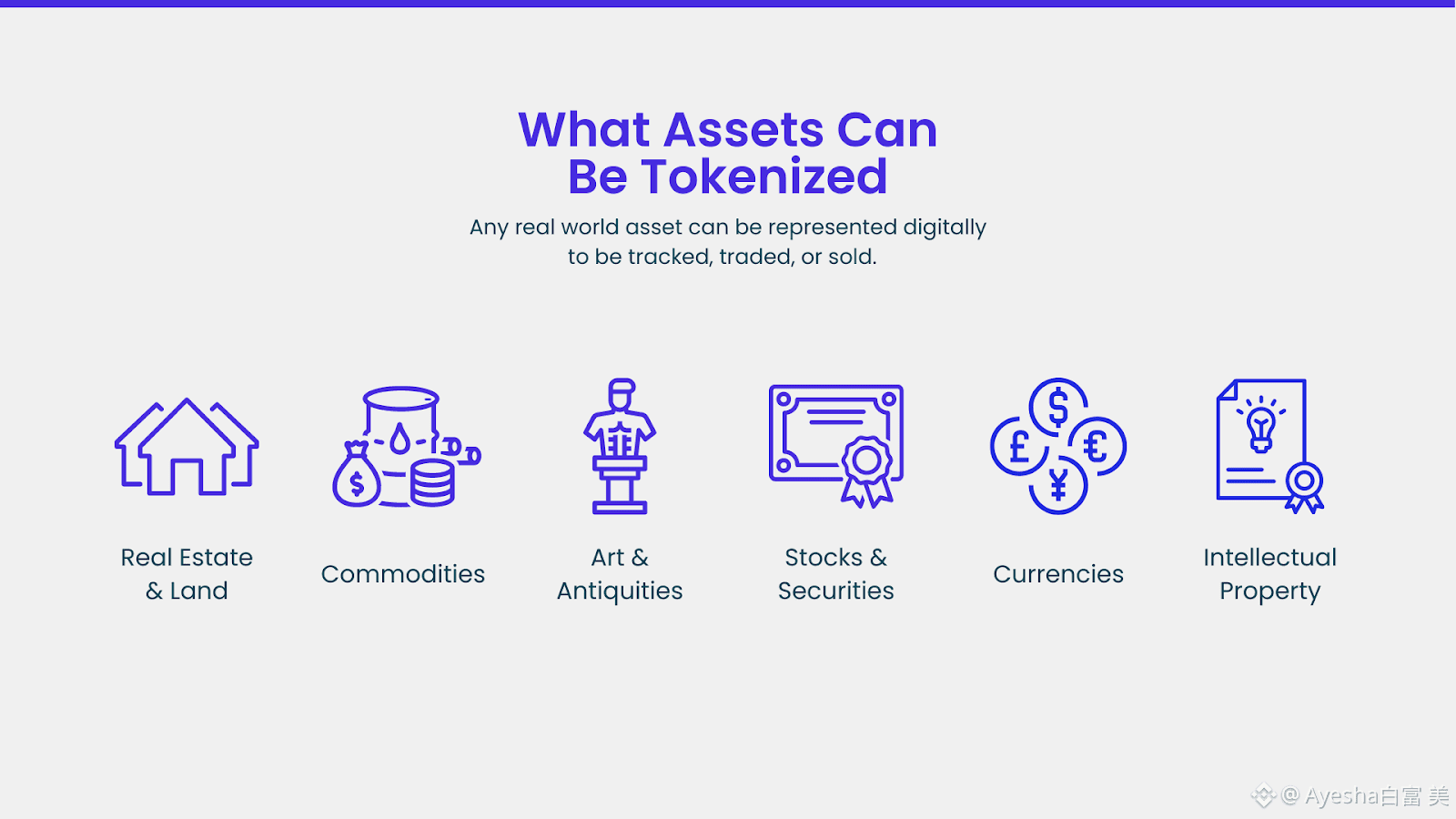

Dusk Network takes this further by incorporating privacy through zero-knowledge proofs and confidential smart contracts. Assets can be tokenized (represented as digital tokens on the chain), traded, and settled directly between parties. The blockchain itself acts as the immutable record, potentially bypassing traditional CSDs while still supporting regulatory oversight through features like selective disclosure.

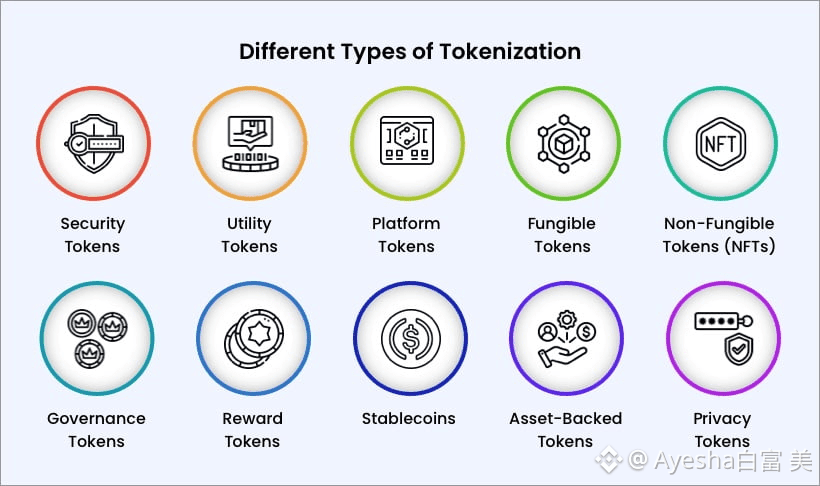

(An overview of how real-world assets can be brought onto blockchain through tokenization.)

(A step-by-step illustration of the asset tokenization workflow.)

In my observation, this design suits regulated environments, where full transparency isn't always desirable or required. Privacy helps protect sensitive details, while the on-chain nature ensures verifiability.

Some Practical Considerations

Of course, widespread adoption would require alignment with regulations, interoperability with existing systems, and robust security. Dusk's focus on compliance-oriented tools, like view keys for auditors—seems thoughtful in this regard. If successful, it could make asset ownership more accessible, reduce operational costs, and enable faster global transfers.

Closing Reflections

I see potential in projects like Dusk for gradually streamlining parts of finance. Moving settlement on-chain, with built-in privacy, might lessen dependence on centralized middlemen without sacrificing necessary safeguards. It's an evolving space, and outcomes will depend on real-world implementation, but the underlying ideas merit careful attention.

(This is my personal view, based on studying publicly available information about @Dusk Network and broader trends in tokenized assets.)