$BTC Here’s a latest Bitcoin (BTC) analysis – including current price action, key levels, trends, and future outlook 📈📉 (with recent market context and visuals where relevant).

📊 1. Current Price Situation (Mid-January 2026)

Bitcoin is trading around ~$95,000–$96,000 levels with notable volatility:

BTC briefly climbed above $97,000 on bullish sentiment around U.S. regulatory developments. �

barrons.com

Today there are headwinds from regulatory worry, causing BTC to dip near $95,000. �

The Economic Times

📅 Recent price trends show BTC consolidating mostly between ~$90k and $97k so far this month. �

StatMuse

👉 This range-bound movement indicates neutral to slightly bullish momentum, with buyers defending key levels and sellers stepping in near resistance.

📈 2. Technical Levels — Support & Resistance

Key Levels to Watch:

Support:

• ~$84,000–$88,000 — strong accumulation support zone below current price.

• ~$80,600 — critical breakdown level that could intensify selling if breached. �

MEXC

Immediate Resistance:

• ~$95,000–$97,000 — short-term cap.

• ~$100,000 — psychological resistance.

• ~$105,000+ if bullish momentum resumes. �

MEXC +1

Technical indicators from some sources show higher bullish bias, with breakouts above $105,700 previously confirming upward pressure and moving averages pointing up. �

bitget.com

🧠 3. Market Sentiment & Macro Signals

📌 Bullish Factors

• Institutional demand may be strengthening — supportive flows into BTC and related ETFs. �

• Some analysts see limited resistance above current levels, suggesting a path toward $100k–$105k if momentum holds. �

• Binance highlights long-term crypto growth themes like institutional infrastructure and policy clarity. �

fxempire.com

Cointelegraph

The Economic Times

📌 Bearish / Caution Signals

• Regulatory uncertainty — especially in the U.S. — is weighing on traders. �

• Some analysts warn of downside risk toward $70k–$80k if key supports break. �

• Renowned strategists are diversifying away from BTC toward traditional assets like gold, signaling caution. �

The Economic Times

financemagnates.com

The Economic Times

📊 Market sentiment remains mixed — cautious bulls near support and skeptical bears awaiting breakdown triggers.

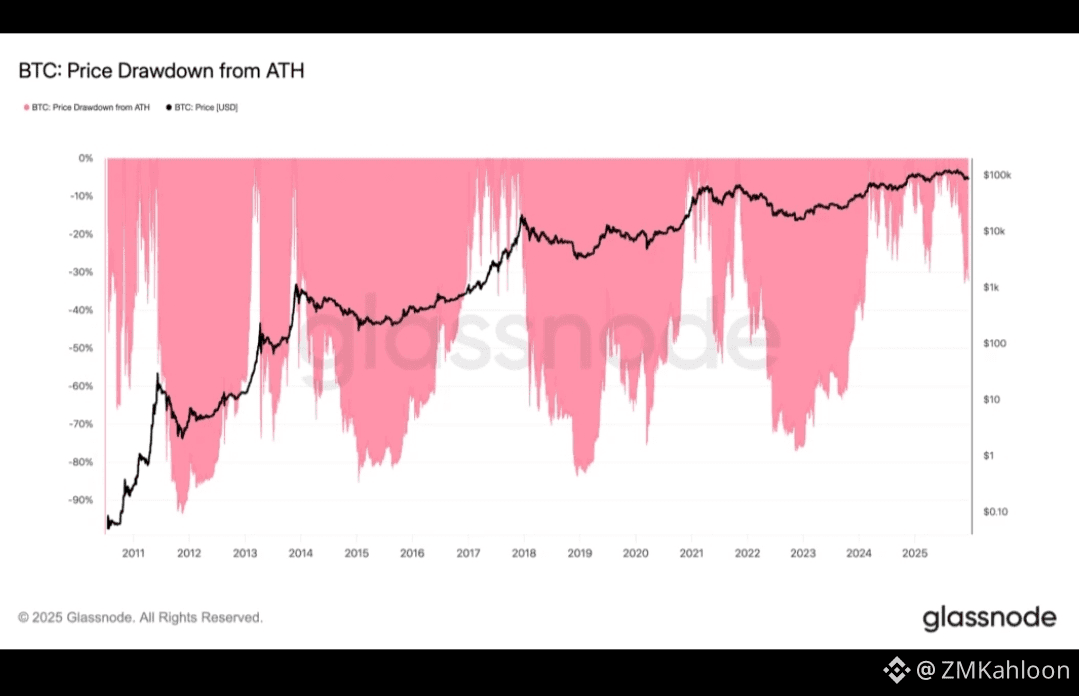

📉 4. Short-Term vs. Longer-Term Outlook

📅 Near-Term (Weeks)

If BTC sustains above $95k, expect more short-term upside tests toward $100k–$105k.

Below $88k, selling pressure could re-intensify.

📆 Longer-Term (2026)

Price forecasts vary widely among models — from $60,000–$250,000 through 2026 — showing high disagreement among analysts. �

Some projections even show BTC reaching ~$195k by late 2026 under strong bullish scenarios. �

CoinGecko

CoinLore

⚠️ Note: These long-term price forecasts are speculative — driven by cycles, macro conditions, and adoption trends rather than guaranteed outcomes.

🔎 5. Investor Strategies

For Traders:

Range trading: Buy near support ($88k–$90k), take profit near resistance ($97k–$100k).

Watch for volume spikes and breakouts with strong confirmation before committing.

For Long-Term Holders:

DCA (dollar-cost averaging) into dips may reduce timing risk in volatile markets.

Monitor macro catalysts such as regulation, ETF flows, and halving cycle updates.

📌 Summary

Bitcoin is in a consolidation phase near mid-January 2026, with:

Resistance ~$95k–$100k+

Support ~$84k–$88k

Bullish catalysts including institutional activity and on-chain strength

Bearish pressure from regulation and possible macro slowdown

This mixed picture means BTC could either break higher with conviction or retrace deeper before resuming trend direction. Adjust your strategy accordingly.$BTC