$BTC Here’s a latest Bitcoin (BTC) market analysis with charts and price outlook as of January 18, 2026. This covers current price action, technical levels, bullish & bearish signals, and forecast ranges.

📈 Current Price & Market Structure

Bitcoin has been trading in the low-to-mid $90,000s, showing consolidation after a volatile start to 2026. �

CoinDCX

Short-term technical momentum is mixed: BTC sits above key moving averages but lacks strong directional trend signals. �

Blockchain News

Prediction markets show resistance near $100,000, with traders placing higher odds on BTC staying below that level until month-end. �

FinancialContent

🔍 Technical Indicators

Bullish Signs:

Bounce off critical support near ~$90K–$95K suggests demand at lower levels. �

Blockchain News

Some chart setups (e.g., triangle break & retest) imply continuation toward $100K+ if confirmed.

Long-term holders are selling less aggressively, historically supportive of bullish continuation. �

fxempire.com

Bearish / Neutral Signals:

Price strength has been limited near resistance zones ($95K–$100K). �

FinancialContent

Momentum indicators at neutral levels — bullish potential without decisive breakout. �

Blockchain News

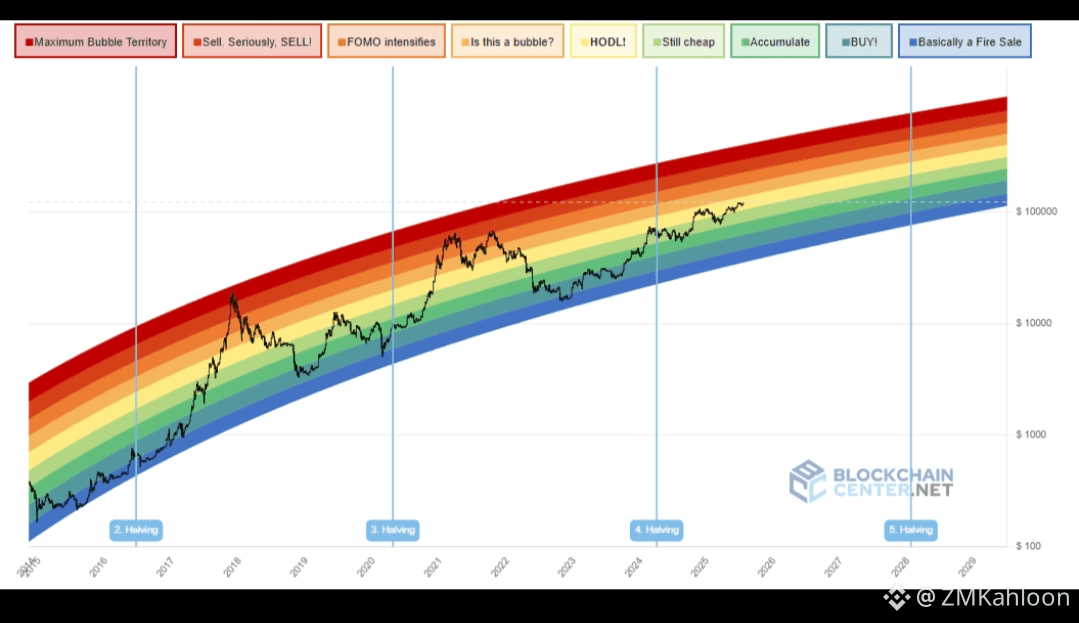

📊 Price Forecast Ranges

Analyst consensus currently shows wide target scenarios:

Near-term (1–4 weeks):

Bullish breakout range: up to $105,000–$110,000 if BTC clears immediate resistance. �

MEXC

Neutral consolidation range: $90,000–$95,000 with support intact. �

Blockchain News

Medium / Full-Year Outlook (2026):

Some models project strong upside toward $150K–$195K by year-end (long horizon forecasts). �

CoinLore

Bearish analogs and range plays suggest possible correction depth before resuming trend (less common in current price action).

🔎 Market Sentiment & Macro

Bullish Factors:

Ongoing institutional accumulation and ETF flows provide structural demand support. �

Seeking Alpha

Macro liquidity easing phases historically favor BTC accumulation.

Caution Points:

Short-term speculative markets cooling off as prediction markets adjust probabilities. �

FinancialContent

Weakness in rate-sensitive risk assets can dampen crypto appetite if macro tensions rise. (general observed sentiment, not a specific citation)

📌 Summary — BTC Outlook

✅ Bullish scenario: Sustained breaks above ~$96K unlock momentum toward $100K+/110K

⚠️ Neutral scenario: Range-bound between $90K–$95K in short/medium term

❌ Bearish scenario: Deeper pullbacks if support breaks, potentially retesting lower zones

📰 Latest Related Market Headlines

Here are some real-time news snippets about BTC’s price action and sentiment:

TradingView

CoinDCX

Bitcoin Price Analysis: Could BTC Surge Above $100K Next Week?

Bitcoin Price Prediction 2026–2030: Can BTC Rally to $105K in Jan 2026?

Yesterday

January 16

These cover support holds, bullish rebounds, institutional demand, breakout tests, and volatility in prediction markets — helpful context for the current BTC trend.

Disclaimer: This is informational analysis, not financial advice. Always do your own research before trading or investing in cryptocurrencies.$BTC