$BTC Here’s a latest, data-backed Bitcoin (BTC) price & market analysis with visuals to help you understand where BTC is now and where it might be headed.

📌 Current Market Situation (Jan 20 2026)

Price Movements

Bitcoin has slipped near ~$91,000 amid rising economic uncertainty triggered by U.S.–EU trade tensions, pushing investors toward safer assets. �

The Economic Times

Recent days saw strong volatility with prices bouncing between the $92K–$97K range — showing consolidation after dips. �

The Economic Times +1

Market Sentiment

Sentiment remains bearish to cautious, with indices in “fear” zones, typically reflecting hesitant traders. �

AInvest

Reddit & social sentiment show BTC in a consolidation range, often “building energy” before a breakout attempt. �

Security & Risks

2025 saw record Bitcoin scams, with about $17 B stolen, driven by impersonation tactics using AI — a major risk factor for confidence. �

Tom's Hardware

📉 Technical Levels to Watch

Support Zones

~$90,000–$92,000: Key support — loss below could trigger deeper pullbacks.

Some analysts warn a break under this level might target $73,000. �

marketwatch.com

Resistance Levels

$97,000–$100,000 is the next ceiling — a psychological and technical zone.

Above this could pivot BTC toward fresh momentum.

Range Behavior

BTC is currently trading range-bound, not trending strongly — a hallmark of consolidation. �

The Economic Times

📊 Price Forecasts & Predictions

There is no single consensus, but models vary widely:

📈 Bullish/Optimistic

Some forecasts project BTC pushing above $100,000 and beyond later in 2026. �

changelly.com

Long-range models (non-mainstream) even stretch into the six figures or beyond — though these vary widely and are often speculative. �

CoinLore

🤝 Neutral / Moderate

Technical forecasts suggest BTC might hover around $95K–$105K if the consolidation breaks positively. �

ChangeHero

Early 2026 monthly forecasts lean toward range trading, not explosive rallies. �

DigitalCoinPrice

📉 Bearish Risks

Bearish scenarios see BTC staying capped below resistance or testing lower supports if macro pressure persists. �

CoinCodex

🔍 Key Factors Impacting Bitcoin Now

✅ Macro Environment

Geopolitical tensions, inflation outlook, and risk-off sentiment are influencing crypto markets today. �

The Economic Times

🏛 Regulation

Near-term rallies were previously sparked by crypto clarity legislation news in the U.S., though markets remain sensitive. �

Barron's

🧠 Market Psychology

Fear & greed metrics at extremes often indicate contrarian signals — extreme fear sometimes precedes rallies. �

AInvest

⚠️ Security & Adoption Risks

Increasing scam activity may erode investor confidence and slow adoption. �

Tom's Hardware

📆 Short-Term Outlook (next weeks)

Bullish scenario: Break above $100K, renewed upside momentum.

Neutral: Continued sideways between $90K–$100K.

Bearish risk: Drop toward support closer to $80K–$73K if risk sentiment worsens.

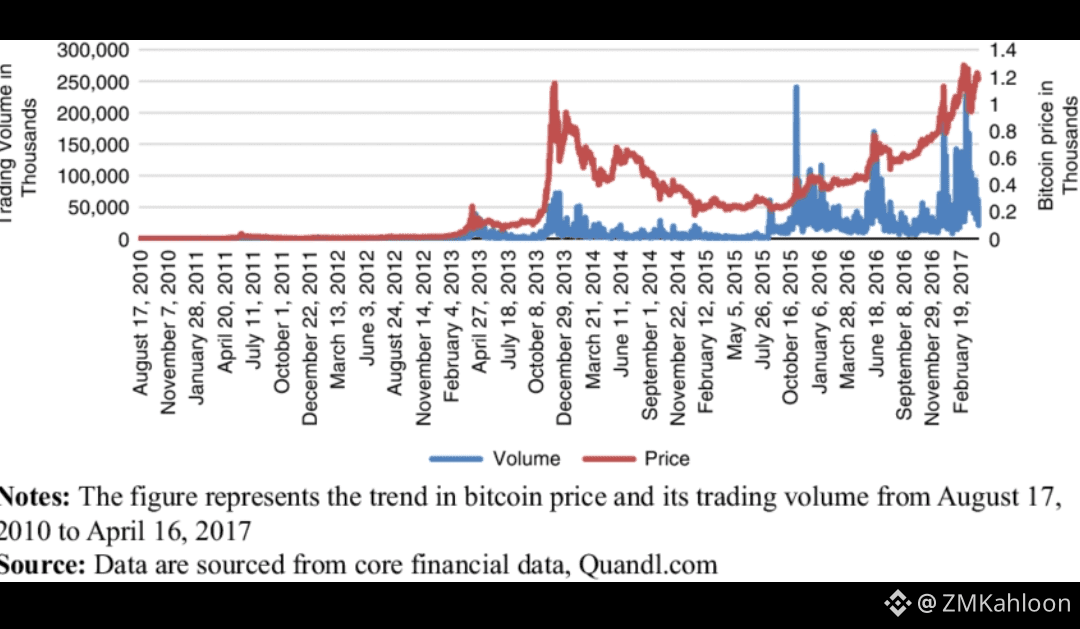

📊 Volume and trading indicators will be critical in confirming whichever scenario unfolds next.

🧠 Bottom Line

Bitcoin’s market right now is stable but cautious — price action shows range consolidation, not runaway trends. While some forecasts remain optimistic, macro pressure and sentiment will likely dictate BTC’s path over the next few months.

📍 No prediction here is financial advice—always do your own research before trading or investing.

📝 Sources

Major headlines referenced:

The Economic Times

Barron's

Bitcoin slips to $91,000 as US-EU trade war escalation weighs on sentiment

Bitcoin Jumps Above $97,000, XRP Surges. Why This Crypto Rally Can Roll.

Today

January 15

Price prediction data from multiple forecasts:

CoinLore, Changelly, DigitalCoinPrice forecasts & sentiment context. �

CoinLore +3

You can ask for a specific trading strategy or deeper technical chart interpretation next if you’d like!$BTC