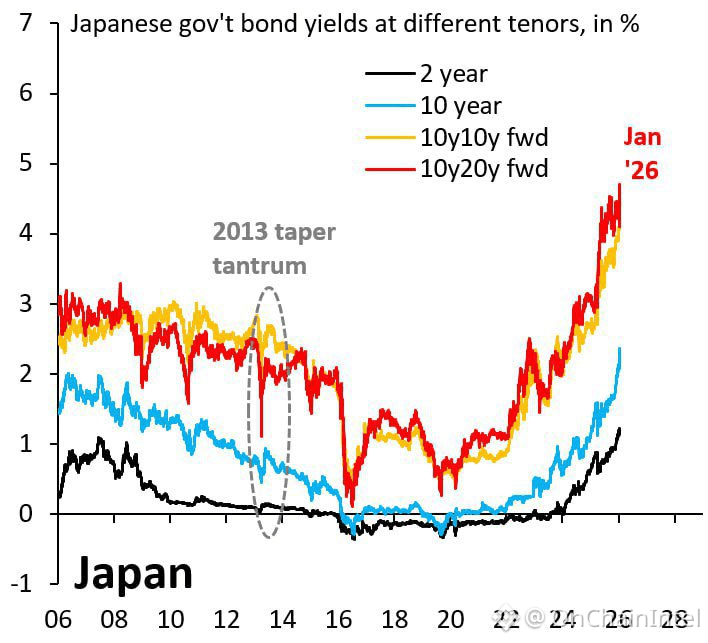

Something extremely unusual is happening in Japan’s bond market.

Yields on Japanese government bonds — across 10Y, 20Y, 30Y, and even 40Y maturities — have surged to their highest levels this century.

This kind of move almost never happens in a stable, low-risk economy like Japan.

So why does this matter to global investors?

💴 Japan Was the World’s Cheapest Money Printer

For decades, Japan offered near-zero (and even negative) interest rates.

Global investors borrowed yen cheaply and poured that capital into:

Stocks

Crypto

Commodities

Emerging markets

Risk assets worldwide

This “yen carry trade” quietly fueled global market rallies for years.

Now that engine is breaking.

⚠️ Why Japan’s Bonds Are Cracking

Japan is facing a brutal macro reality:

📉 Collapsing birth rate

👴 Shrinking workforce

💣 Highest debt-to-GDP ratio on Earth

When long-term growth collapses but debt keeps rising, bond investors lose confidence.

So they sell.

And when they sell…

Yields explode higher.

That is exactly what’s happening now.

🏃 Capital Is Not Disappearing — It’s Rotating

The money fleeing Japanese bonds isn’t vanishing.

It’s moving into gold and silver.

That’s why:

Precious metals and Japanese yields are rising together

Investors are dumping government debt

Capital is hiding in hard assets

🌊 Why This Is a Global Liquidity Event

Japan is not a regional problem.

It’s a global liquidity fault line.

Recently, the S&P 500 erased over $1.3 trillion in market value —

largely due to fears tied to Japan’s bond market stress.

When the world’s biggest source of cheap money breaks,

everything feels it.

🏦 What Happens Next?

If Japanese yields keep rising:

The Bank of Japan will be forced to stop tightening

Bond buying will restart

Yield suppression will return

When that happens:

Yields stabilize

The rush into gold and silver peaks

Metals likely form a blow-off top

Capital rotates back into risk-on assets

🎯 The Smart Money Moment

That rotation point is the real opportunity.

When everyone is panicking…

When metals are euphoric…

When yields are capped again…

That’s when smart capital will start going heavy into risk assets.

Most people will wait for an even bigger crash.

The smart ones will buy the turn.