$BTC Here’s the latest Bitcoin (BTC) market analysis (January 2026) — price action, technical levels, sentiment, catalysts, and forecasts — with visuals to help you understand the trends 👇

The Economic Times

financemagnates.com

Bitcoin hovers near $90,000 after Trump eases Greenland tone. Here is what experts say

Why Bitcoin Is Falling? Losses Extend to 6th Day and BTC Price Prediction Signals 40% Slump to $50K

Today

Yesterday

📉 Current Price & Market Sentiment

BTC is trading near $90,000, reflecting mixed sentiment between bulls and bears early this year. �

The Economic Times

Recent declines mark one of the longest losing streaks in weeks, pressured by macroheadwinds. �

financemagnates.com

Macro uncertainty, geopolitical factors (e.g., tariff news changes) have weighed on momentum. �

IG

Key indicators suggest bearish signals are flashing, but markets remain range-bound rather than crashing. �

BeInCrypto

Price is chopping around key zones as traders watch fresh US economic data for cues. �

ad-hoc-news.de

BTC, Ethereum, and XRP steadied somewhat after minor corrections — Bitcoin down ~5% in recent sessions. �

FXStreet

Over $1.5 billion flowed into BTC investment products recently, signalling renewed institutional attention. �

Cryptonews

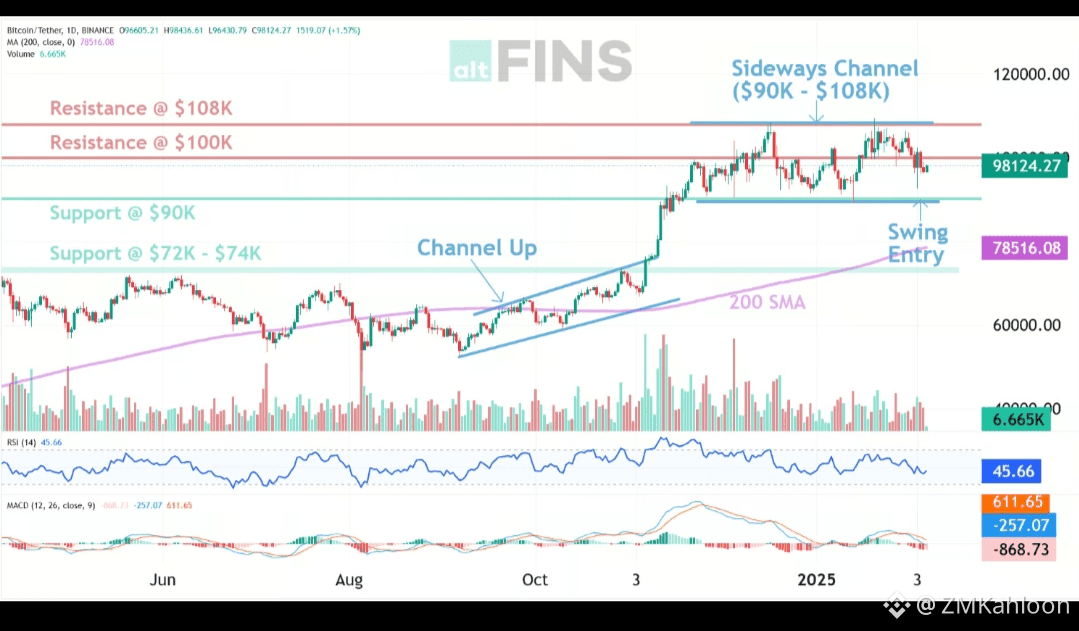

📊 Technical Analysis (Current Levels & Chart Signals)

🔹 Price Structure & Levels

Bitcoin’s price has been consolidating around $89k–$95k, a tight range signaling indecision. �

MEXC

Key resistance: ~ $94,500-$95,000 — reclaiming this zone is essential for bullish momentum. �

MEXC

Critical support: ~ $84,000-$85,000 — breaking below could accelerate selling. �

news.wikibit.com

Recent CME gap closure near $88k suggests traders may use this as foundation for next move. �

Cointelegraph

📈 Short-term scenarios

Bullish: Break above $95k could open paths toward $104k+, $110k, or higher if momentum builds. �

tradingnews.com

Bearish: Failure to hold ~$85k might trigger deeper correction toward $80k or below. �

MEXC

📉 Indicators & Momentum (AI & Quant Views)

Machine learning models project slight stability or modest gains by end of January, but are not highly bullish short-term. �

MEXC

Resistance levels from EMAs (20, 50, 100, 200) hover around price — bullish reclaim necessary to confirm trend. �

Traders Union

🧠 Macro & Institutional Drivers

🔸 ETF & Institutional Flow

Bitcoin spot ETFs remain a strong influence, with significant inflows stabilizing price structures. �

AInvest

Institutional caution appears amid mixed signals — some reducing exposure while others launch crypto-focused funds. �

Reuters

🔸 Geopolitical & Economic Factors

Macro uncertainties (trade policy, Fed policy, liquidity) continue to affect BTC as risk asset sentiment. �

IG

🔮 Price Forecasts & Analyst Targets

Scenario

Target / Outlook

Bullish near-term

$95k–$110k if resistance is broken and volume supports move. �

news.wikibit.com

Bearish risk

$80k support zone if range break ensues. �

MEXC

Mid-full year 2026

Some analysts project $120k–$140k by year-end under positive macro and ETF flows. �

tradingnews.com

Longer term

Mixed forecasts from modest growth to multi-year bull case > $200k-$300k (varies greatly by model). �

The Economic Times

📌 Important: All forecasts are probabilistic, not guaranteed. Crypto markets are volatile and sensitive to macro swings.

🧾 Summary — What Traders Should Watch Next

Bullish catalysts

Break above $95k with strong volume

Dovish Fed or lower yields

Continued ETF accumulation and institutional buy-ins

Bearish triggers

Breakdown below $84k-$85k support

Macro tightening or risk-off sentiment

Large sell-offs or on-chain outflows

Price action currently suggests consolidation and indecision — meaning careful attention to key levels and volume is crucial. The next breakout or breakdown could set the tone for weeks ahead.

If you want, I can also generate a live BTC price chart or detailed buy/sell strategy analysis! Just tell me your time frame (e.g., day trading vs. long-term).$BTC