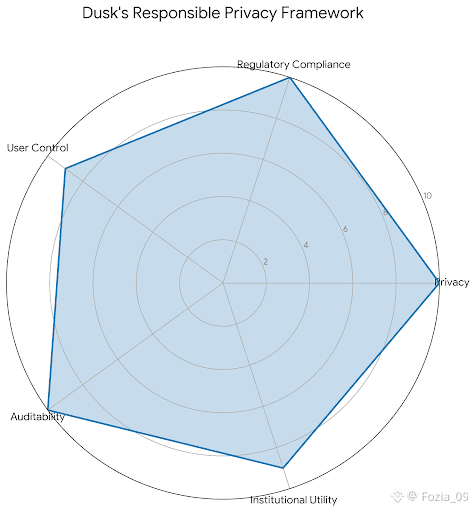

Doesn’t make you choose between secrecy and accountability.Old school blockchains force everyone into that corner:either everything’s out in the open,or it’s locked away and can’t be verified.Dusk takes a smarter route.It uses cryptography to keep things private,but still lets regulators and institutions do their jobs.

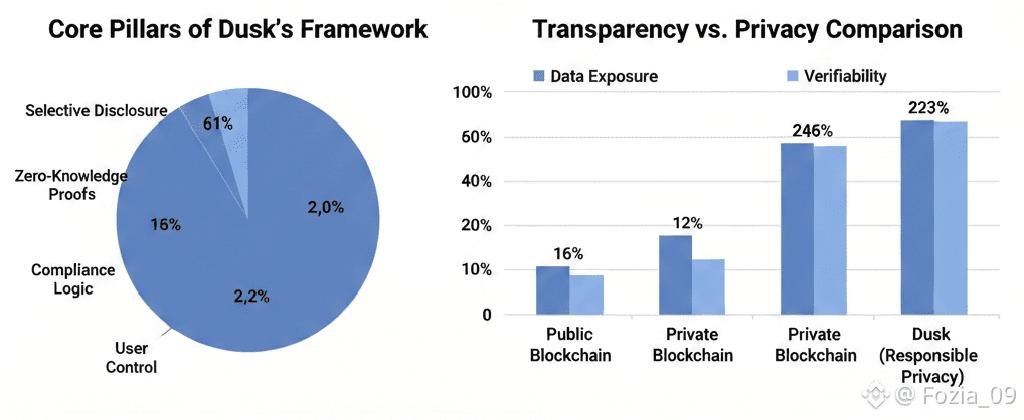

Selective disclosure sits at the heart of this framework.You only show what’s needed nothing more.If a transaction or compliance check calls for specific info,that’s all you reveal.Everything else stays hidden.Zero knowledge proofs make this possible;you prove something’s true without spilling the actual details.So instead of sharing your personal or financial data with the whole network,you just show that you meet the rules maybe you’re a real person,your balance is enough,or your transaction checks out.Trust comes from math and protocol,not from exposing your private life.

Responsible privacy isn’t just a technical trick;it’s about sustainability.Dusk aims for the heavy duty stuff tokenized securities, regulated financial products,places where you need audit trails and legal certainty. Compliance logic isn’t an afterthought; it’s baked into every transaction.Privacy doesn’t weaken oversight.If anything,it strengthens it by cutting out unnecessary data leaks while keeping records fully verifiable.

User control matters,too.With Dusk,you own your data.You decide what to share,when, and with whom.There’s no giant central database waiting to get hacked.Instead, cryptographic models let you grant or revoke access as needed.

At the end of the day,Dusk’s framework flips the script on digital finance.It proves you can have strong privacy,regulatory compliance, and transparent operations all at once. Privacy preserving tools aren’t bolted onbthey’re part of the foundation.The result? Secure,scalable financial interactions that don’t compromise on ethics or trust. @Dusk $DUSK #dusk