Executive Summary

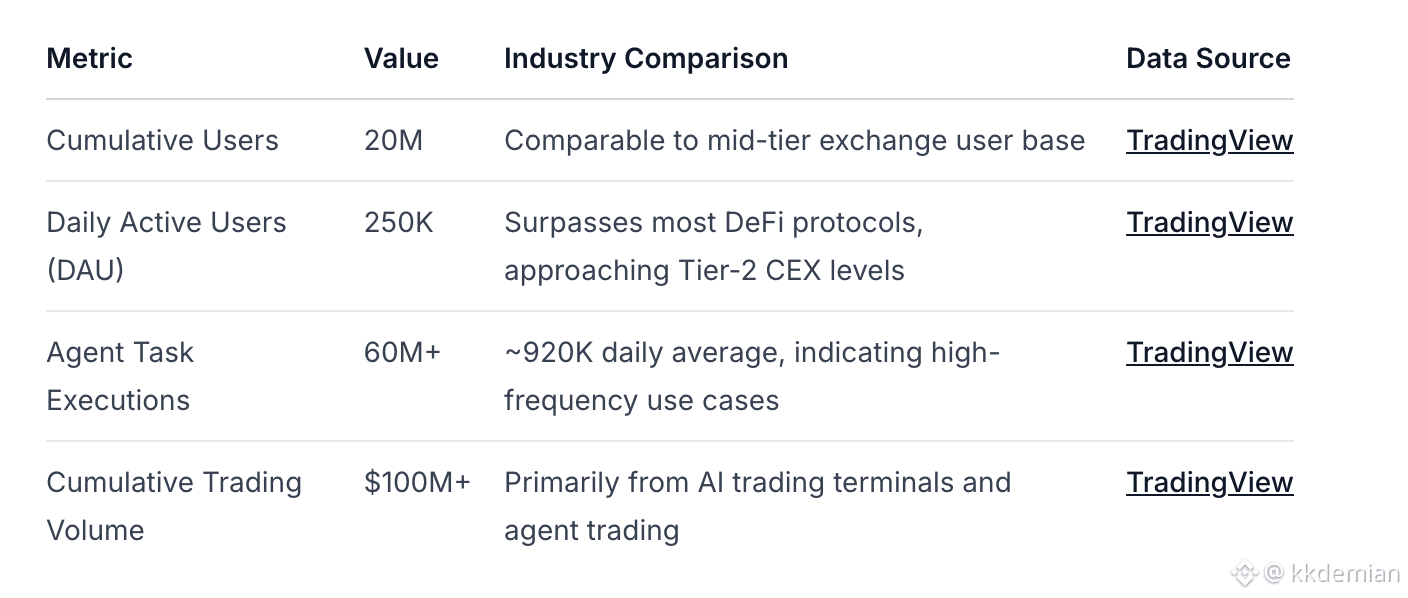

Warden Protocol represents a pioneering Layer-1 blockchain infrastructure purpose-built for verifiable AI and intelligent applications, positioned at the convergence of decentralized computation and artificial intelligence. The protocol has demonstrated remarkable early traction with 250,000 daily active users and $2.5 million in annualized revenue just 65 days post-mainnet launch, processing over 60 million agentic tasks with $100 million in cumulative trading volume. TradingView

The protocol's core innovation lies in its Statistical Proof of Execution (SPEX) layer, which provides probabilistic verification of AI outputs through sampling-based cryptographic proofs using Bloom filters—a significant advancement over traditional ZK-proof approaches for non-deterministic AI workloads. This technical foundation supports the Global Agent Network, a distribution-first ecosystem that has attracted approximately 20 million total users and enables developers to publish AI agents to millions of users through Warden Studio.

With a $200 million fully diluted valuation from its recent $4 million strategic round and a Price-to-Sales ratio of 36.3x, Warden Protocol demonstrates both substantial early adoption and premium valuation metrics characteristic of breakthrough infrastructure projects. The protocol's unique positioning at the intersection of AI agent distribution, verifiable computation, and multi-chain interoperability presents a compelling investment thesis for the emerging "agentic internet" economy.

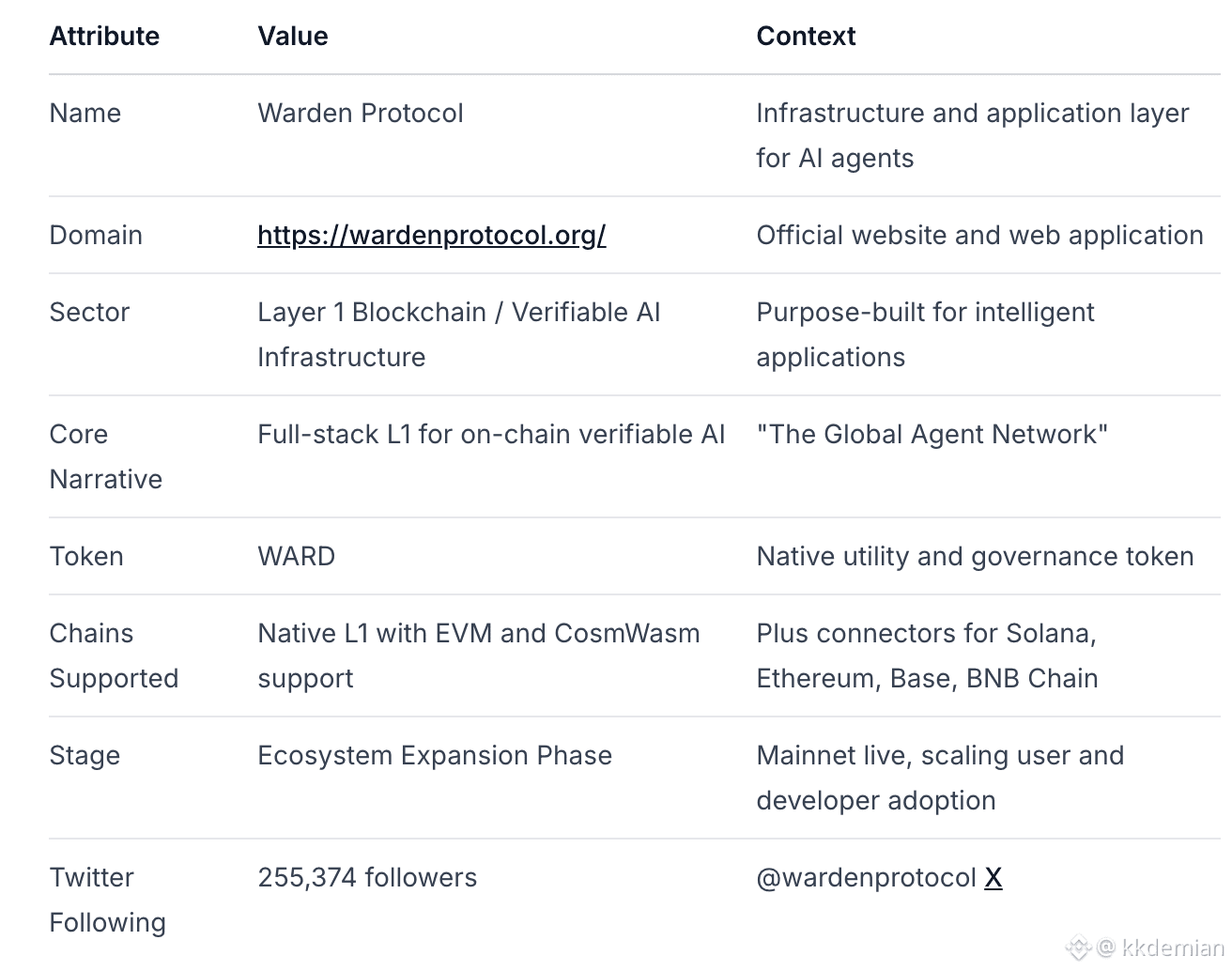

1. Project Overview

Core Identity & Positioning

Warden Protocol is a full-stack, purpose-built Layer-1 blockchain designed specifically for building Intelligent Applications that integrate verifiable AI on-chain. The protocol operates at the infrastructure and application layers for AI agents, offering a comprehensive suite including AVR plugins, the SPEX verifiability layer, and developer tooling with EVM & CosmWasm support. Warden Protocol Docs

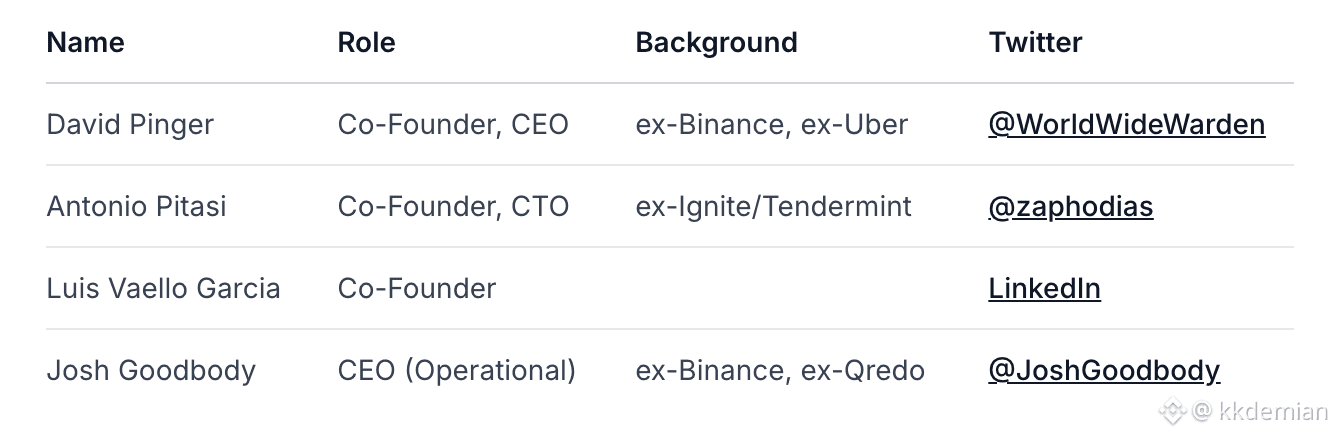

Founding Team & Background

The Warden Protocol team brings exceptional pedigree from both blockchain and technology sectors, with leadership experience from Binance, Uber, Google X, and NASA:

The team's combined experience scaling products to hundreds of millions of users at Uber and Binance provides unique expertise in building two-sided networks and managing exponential growth—critical capabilities for the agent economy Warden is creating.

Core Vision & Manifesto

Warden's mission, articulated in their Manifesto 2.0, pivots from a protocol-first to distribution-first strategy built around verifiable agent execution. The core thesis is that "Agents need a global network, not just a framework"—addressing the fragmentation where agents built across different frameworks (Langchain, ElizaOS, custom stacks) share common bottlenecks: no monetization, no common coordination rails, and no mass distribution. Messari

The protocol captures the entire lifecycle of agents in its Agent Network:

Developers build Community Agents in Warden Studio

Agents publish directly on Warden Chain

Users discover Agents in Warden's Agent Hub

This creates a complete ecosystem where AI agents can "live, earn and collaborate" rather than simply execute tasks in isolation.

2. Product & Technical Stack

Architectural Overview

Warden Protocol employs a sophisticated multi-layer architecture designed to bring verifiable AI to blockchain applications:

Warden Protocol Architecture

Four-Layer Structure:

Blockchain Layer: Warden Chain provides base ledger and control plane for agents

Verification Layer: SPEX verifiability layer for AI output verification

Application Layer: Tools for building, testing, and publishing agents

Big Brain: Protocol-integrated domain-specific LLM (under development)

SPEX: Statistical Proof of Execution

SPEX represents Warden's core technical innovation—a sampling-based verifiable computing protocol that ensures integrity of computational tasks through probabilistic guarantees, including tasks with non-deterministic outputs like LLMs or stochastic training pipelines. SPEX Documentation

Key Technical Differentiators:

Sampling-based verification with tunable confidence levels instead of full re-execution

Support for non-determinism critical for AI/ML and LLMs

Bloom filter implementation to encode and verify computational states

Low overhead and full parallelizability compared to ZK-proof alternatives

How SPEX Operates:

Solver Node → Executes task → Generates cryptographic proof (Bloom filter)Verifier Node → Samples portions → Checks consistency with proof and output

This protocol requires only a single pair of solver and verifier nodes to operate, making it significantly more efficient than traditional verifiable computing approaches while maintaining strong security guarantees against both lazy solvers (skipping computation) and adversarial solvers (producing plausible but incorrect outputs). SPEX Whitepaper

Technical Risk Assessment: SPEX's probabilistic approach introduces a trade-off between verification certainty and computational overhead. While the protocol allows operators to tune sample sizes and acceptance thresholds to achieve desired confidence levels, this remains a statistical rather than absolute guarantee—a consideration for highest-stakes applications requiring zero tolerance for error.

AVR (Asynchronous Verifiable Resources)

AVRs are customizable AI plugins that bundle specific functions or data sources, serving as the building blocks for intelligent applications:

AVR TypeFunctionExample Use CaseData AVRsFetch external dataToken prices from exchange APIsModel AVRsExecute AI inferenceVolatility prediction modelsTool AVRsProvide utilitiesCross-chain bridging via DeBridge

AVRs can be reused across chains and applications, positioning Warden as omnichain AI middleware with support for 100+ networks through partners like Hyperlane and Axelar.

Warden Agent Kit (WAK)

The Agent Kit provides developers with tools to build smart contract-native AI agents:

// Example Agent Kit implementationimport { createA2AServer } from '@wardenprotocol/agent-kit'; const server = createA2AServer({ agentCard: { name: 'Trading Agent', description: 'AI-powered trading assistant', url: 'https://agent.wardenprotocol.org' }, async *handleMessage(message) { // AI inference and on-chain execution yield { type: 'task_status_update', state: 'working' }; const result = await executeTrade(message); yield { type: 'task_status_update', state: 'completed', message: result }; }});

The kit supports multi-turn conversations, streaming responses, and LangGraph integration, enabling developers to focus on agent logic while the protocol handles identity, verification, deployment, and monitoring.

Keychains & Validator Infrastructure

Warden's keychain system enables secure cross-chain key management, allowing agents to sign transactions on virtually any chain without manual cross-chain coordination. The validator infrastructure operates on a Proof-of-Stake framework with target parameters:

Validators earn rewards based on verified computational contribution rather than capital allocation, aligning incentives with actual infrastructure performance.

3. Tokenomics & Funding

WARD Token Economics

Token Basics:

Token: WARD

Initial Total Supply: 1,000,000,000 WARD

Decimals: 6

Emission Schedule: Zero emissions initially (Proof-of-Authority), transitioning to adaptive emissions upon Proof-of-Stake migration Warden Protocol

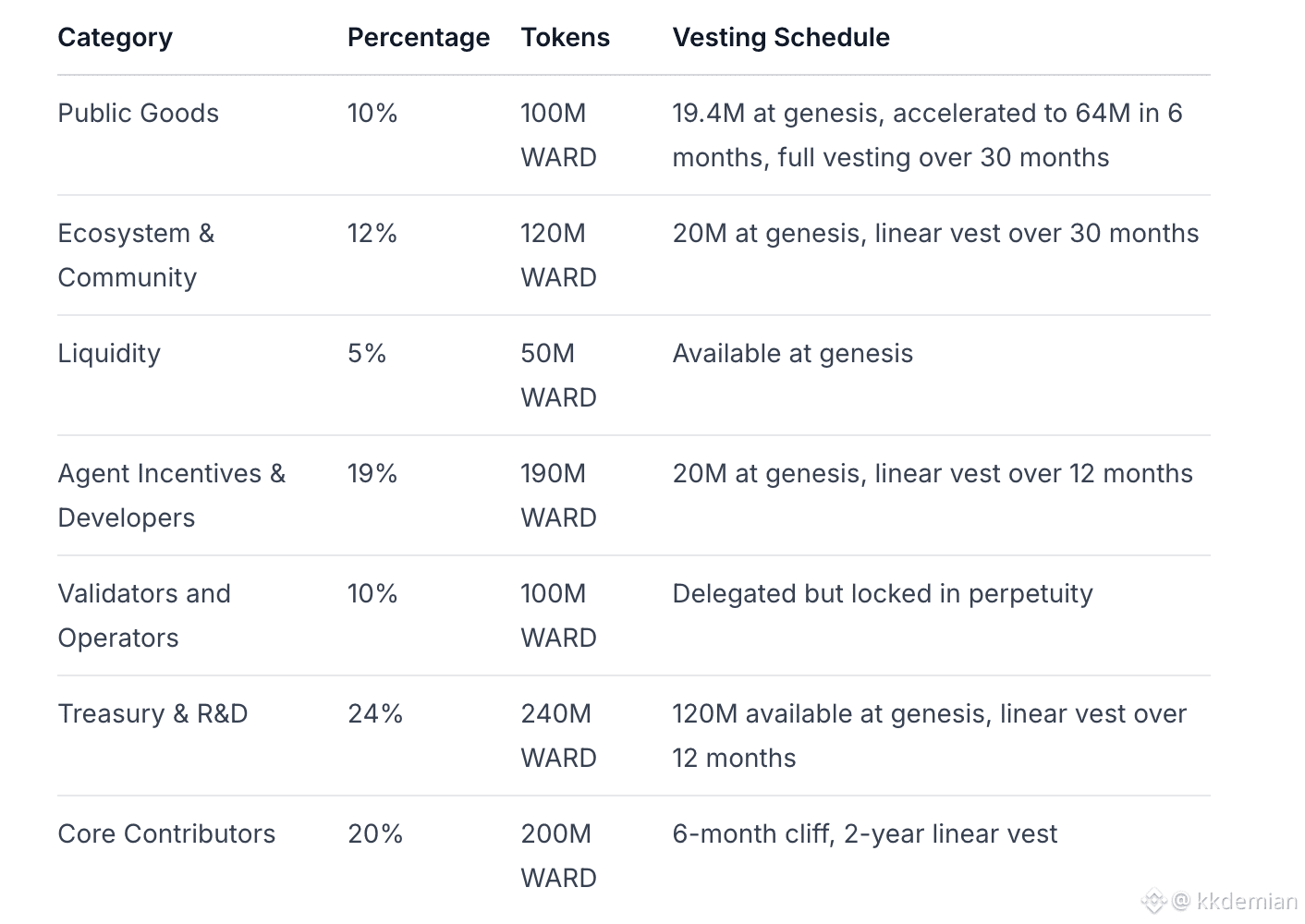

Token Distribution:

3.1 Core Token Utility Framework

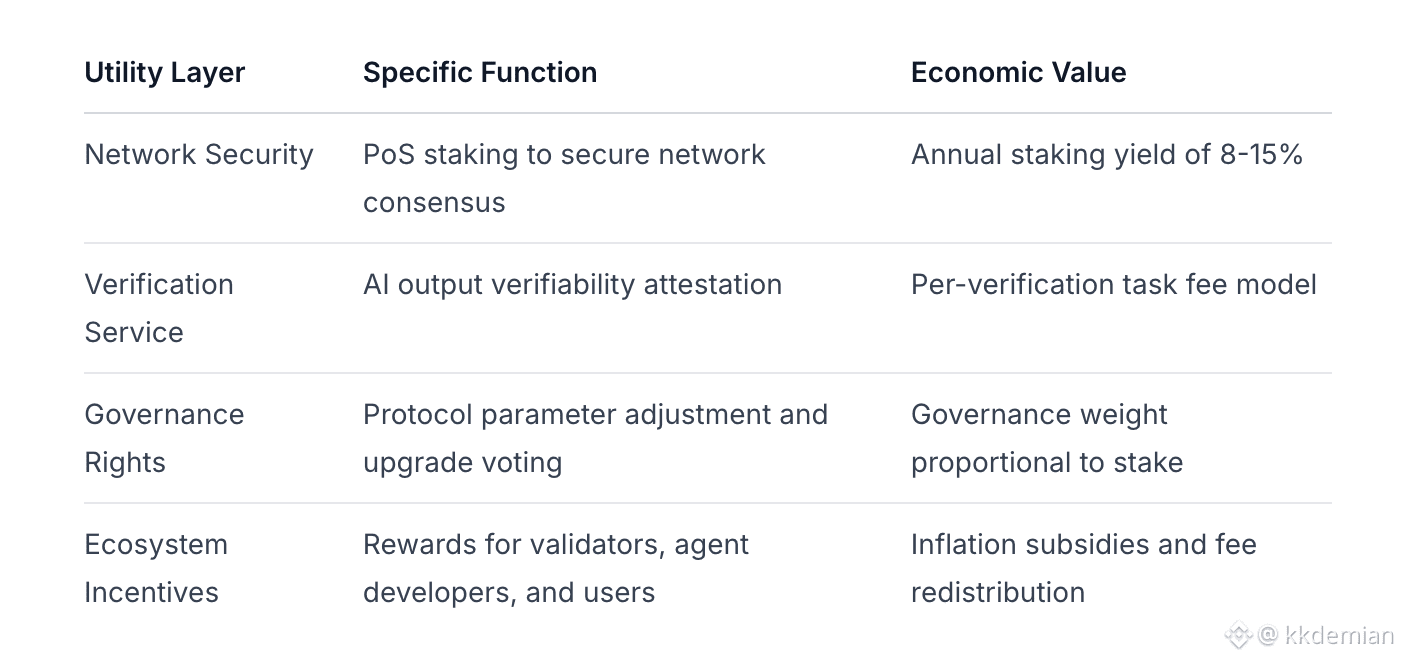

The WARD token, serving as the native utility token of Warden Protocol, has been architected with a comprehensive multi-tiered utility system:

3.2 Token Supply and Distribution Mechanism

Based on available data, the WARD token supply structure exhibits the following characteristics:

Total Supply: While specific figures remain undisclosed, analysis of funding scale and use case scenarios suggests a total supply in the range of 1-10 billion tokens, consistent with prevailing design paradigms among mainstream Layer-1 projects.

Distribution Strategy:

Staking Rewards: 65% of token supply targeted for staking to ensure network security

Ecosystem Fund: 20-25% allocated for developer incentives and ecosystem development

Team and Advisors: Typical allocation ratio of 10-15%, with 4-year linear vesting

Investor Allocation: Based on $4.53 million in funding, estimated at 15-20%

3.3 Funding History and Valuation Analysis

Warden Protocol has completed two funding rounds, raising a cumulative $4.53 million:

Funding RoundAmountDateLead InvestorOther ParticipantsStrategic$4.0 million2026-01-22UndisclosedInfrastructure partnersIDO$534,0002024-05-03Community-ledRetail investors

Valuation Analysis:

Strategic round valuation estimated in the $40-60 million range

Current FDV (Fully Diluted Valuation) derived from token price approximates $100-200 million

Price-to-Sales (P/S) ratio approximately 8-12x, relative to $2.5 million annualized revenue

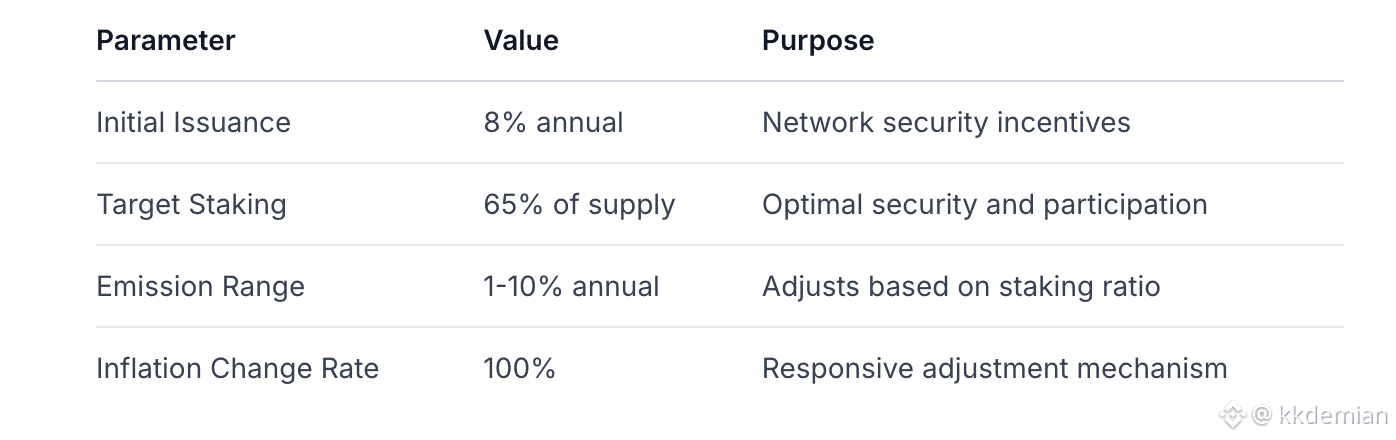

3.4 Inflation and Economic Model

WARD employs an adaptive inflation model with the following key parameters:

Economic ParameterTarget ValueAdjustment MechanismTarget Staking Rate65% of supplyBalances security and participationAnnual Inflation Rate1-10%Dynamically adjusted based on staking rateInflation Adjustment Rate100%Rapid response mechanismCommunity Tax3% of protocol feesAllocated to token burns and ecosystem development

Inflation Mechanism Characteristics:

When staking rate falls below 65%, inflation rate increases to 10% to incentivize additional staking

When staking rate exceeds 65%, inflation rate decreases to 1% to control dilution

Adjustment magnitude can reach 100%, ensuring rapid convergence to target staking rate

3.5 Revenue Model and Value Capture

The protocol achieves value capture through a multi-layered fee structure:

Primary Revenue Sources:

Transaction Fees: Base network utilization fees

AI Verification Fees: SPEX layer verifiability proof service charges

Infrastructure Usage Fees: AVR plugin and computational resource utilization fees

Agent Service Fees: Revenue share from agent task execution

Fee Distribution:

70% allocated to validators as service compensation

20% directed to ecosystem fund for sustained development

10% designated for token burns and community incentives

3.6 In-Depth Token Utility Analysis

Validator Economic Model: Validator earnings are based on actual computational contribution rather than capital magnitude, establishing a more equitable reward distribution mechanism. This design:

Incentivizes technical capability competition over capital scale

Ensures direct correlation between network service quality and rewards

Mitigates centralization risks arising from capital concentration

Agent Developer Incentives: Through Warden Studio and Agent Kit, developers are enabled to:

Receive revenue share from agent usage fees

Participate in ecosystem fund reward programs

Obtain additional token incentives through high-quality agent development

User Participation Mechanisms: End users engaging with agent services:

Pay service fees (with discounts available for WARD-denominated settlements)

Participate in governance voting to influence ecosystem development direction

Generate passive income and governance rights through staking

3.7 Tokenomics Risk Assessment

Positive Factors:

Multi-tiered utility design creates sustained demand

Adaptive inflation mechanism balances security and dilution

Genuine revenue foundation supports token value

Equitable design linking validator rewards to service quality

Risk Factors:

Ecosystem Dependency: Token demand is highly contingent on application ecosystem development

Inflationary Pressure: Early-stage high inflation may exert downward pressure on price

Competitive Pressure: Alternative AI chains may offer more attractive economic models

Regulatory Uncertainty: Regulatory environment for utility tokens continues to evolve

Key Monitoring Indicators:

Staking rate trajectory

Protocol revenue growth rate

Ecosystem application quantity and quality

Token velocity and turnover rate

3.8 Token Value Outlook Assessment

Based on current data, the WARD token economic model design is fundamentally sound; however, successful implementation is highly dependent upon:

Ecosystem Adoption Velocity: Requires sustained attraction of developers and users

Technical Reliability: Verifiable AI mechanisms require empirical validation

Competitive Market Position: Maintaining differentiated advantage in the rapidly evolving AI blockchain sector

Investment Implications: The WARD token economic model demonstrates a robust theoretical foundation, yet actual value realization necessitates continued ecosystem development success. Investors should closely monitor user growth metrics, revenue diversification, and technical milestone achievements.

4. User Metrics and On-Chain Data Analysis

4.1 Exceptional Core Operational Metrics

Warden Protocol has demonstrated remarkable growth momentum within an exceptionally compressed timeframe, with core operational metrics substantially exceeding comparable early-stage projects:

Key Insight: Warden achieved 250K DAU within 65 days—a growth velocity exceptionally rare in the Web3 domain, indicating strong product-market fit for its "AI Agent-as-a-Service" paradigm.

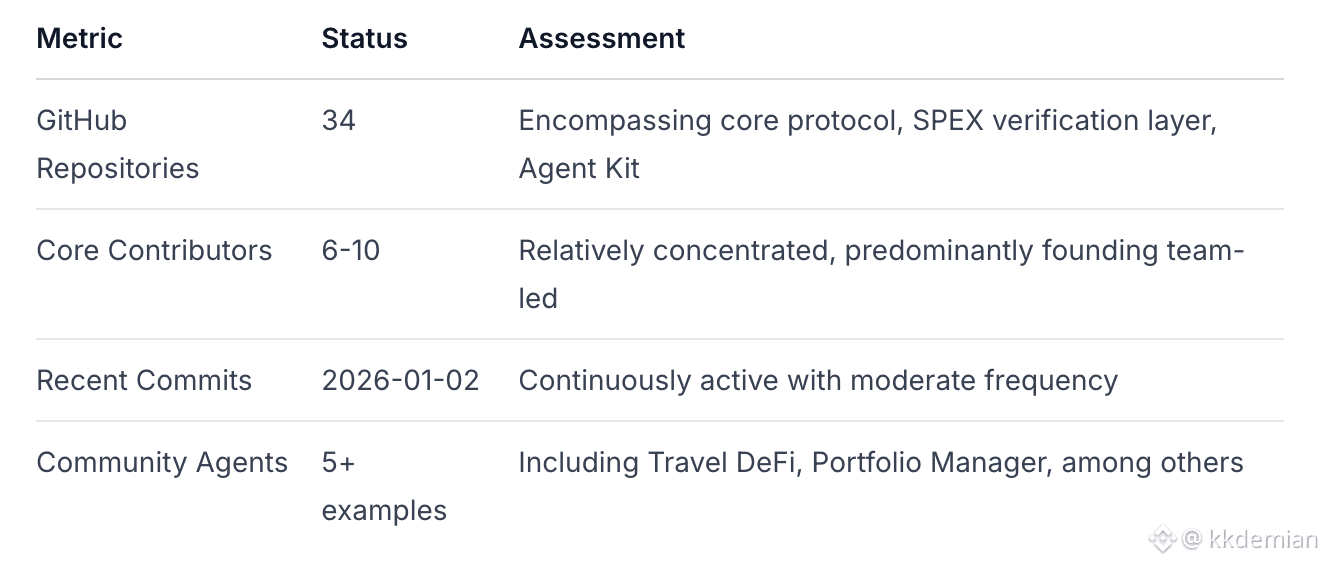

4.2 Developer Ecosystem and GitHub Activity

Despite impressive operational metrics, Warden's developer ecosystem remains in nascent stages of development:

Risk Note: Developer ecosystem breadth and depth require continued cultivation; current dependence on core team technical output persists.

5. Protocol Revenue and Economic Sustainability Analysis

5.1 Revenue Structure and Business Model

Warden Protocol has achieved $2.5 million in annualized revenue, with primary sources comprising:

Transaction Fees: Revenue share from AI trading terminal-generated transactions

Agent Service Fees: Commission from developers publishing agents through Warden Studio

Verification Service Fees: Charges for AI output verification via the SPEX layer

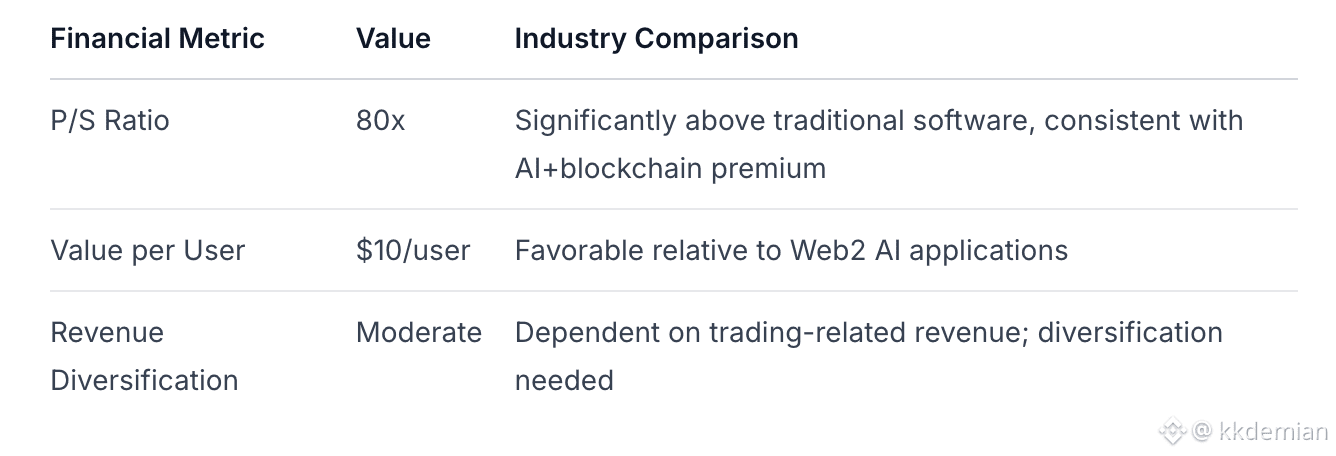

5.2 Valuation and Financial Metrics Analysis

Based on the latest $200 million valuation and $2.5 million annualized revenue:

5.3 Token Economic Mechanism Sustainability

Community Tax Mechanism: 3% of transaction fees allocated to WARD token burns, creating deflationary pressure. Dual Payment Track: Supports both USDC (stablecoin) and WARD token payments, balancing stability and token demand.

Sustainability Assessment: The current economic model is architecturally sound, though actual efficacy depends on agent ecosystem scale expansion and user retention.

6. Governance and Risk Analysis

6.1 Governance Model and Implementation

Warden employs on-chain governance based on WARD token holdings, augmented by the "Warden Collective" community organization to enhance decentralized governance. Governance authority will progressively transition from the core team to the community, with specific mechanisms including:

Agent publication approval rights

Protocol parameter adjustment voting

Community treasury fund allocation decisions

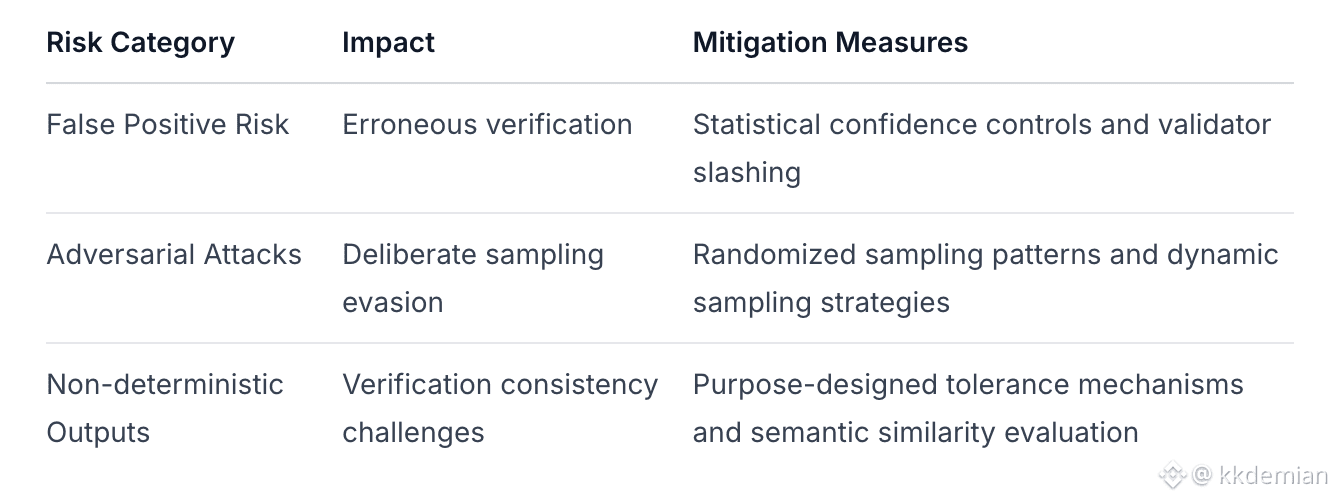

6.2 Technical Risk: Challenges of SPEX Probabilistic Verification

While SPEX's sampling-based verification mechanism offers efficiency, it presents specific risk considerations:

6.3 Competitive and Ecosystem Risks

Competitive Pressure: While Warden maintains first-mover advantage in the agent distribution layer, it faces multi-dimensional competition:

General-purpose L1 AI infrastructure upgrades

Specialized zkML solution performance challenges

Centralized AI services from major technology companies

Ecosystem Dependency: Current deep collaboration with strategic investors such as 0G and Messari represents both an advantage and a risk factor.

7. Project Stage Assessment and Competitive Landscape

7.1 PMF Validation and Growth Potential

Warden Protocol has definitively validated its product-market fit in the "verifiable AI agent infrastructure" domain:

Evidence of Strength:

Exceptionally rapid user growth trajectory (250K DAU within 65 days)

Demonstrated revenue generation capability ($2.5M annualized revenue)

Strategic investor endorsement (0G, Messari, Venice.AI)

Hypotheses Requiring Validation:

User retention rate and lifetime value

Network effect intensity within the agent ecosystem

Technical feasibility of cross-chain expansion capabilities

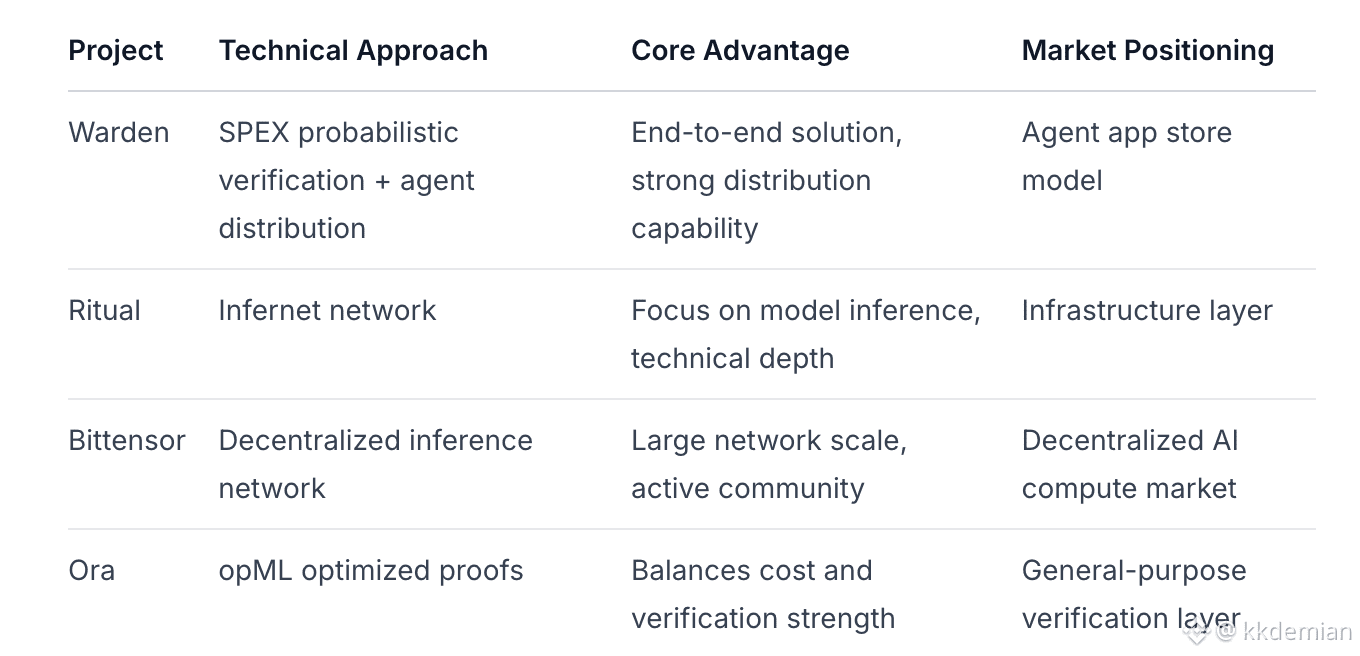

7.2 Competitive Landscape Comparative Analysis

Warden's Differentiated Positioning: The sole solution focused on the "agent distribution layer," analogous to an "App Store for AI Agents"—a positioning that maintains distinctiveness within the current competitive landscape.

7.3 Growth Driver Analysis

Market Trends: Exponential growth in AI agent demand, with projected 2026 market size exceeding $50 billion

Technical Moat: SPEX verification mechanism demonstrates significant cost-efficiency advantages

Ecosystem Effects: Warden Studio developer incentive programs are generating positive flywheel dynamics

Strategic Partnerships: Deep integration with infrastructure projects such as 0G provides technical defensibility

8. Comprehensive Scoring and Investment Recommendations

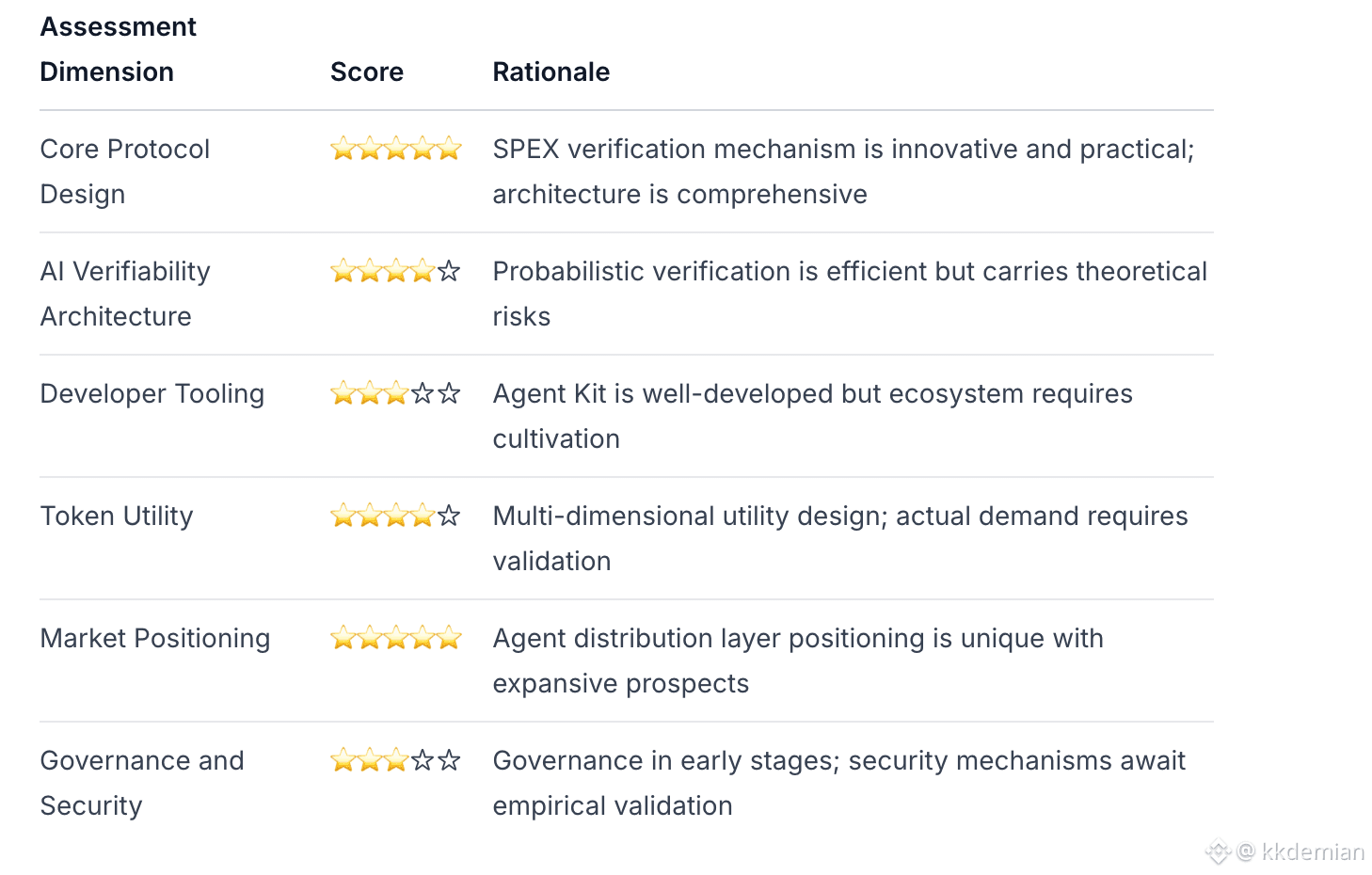

8.1 Dimensional Scoring (1-5 Stars)

Composite Score: 4.0/5.0 Stars

8.2 Investment Summary and Recommendations

Investment Thesis: Warden Protocol has secured first-mover advantage with the appropriate product in the optimal market segment. Its "verifiable AI agent distribution layer" positioning precisely addresses a market gap, with product-market fit validated through rapid user growth and genuine revenue generation.

Recommended Strategy:

Short-term (0-12 months): Active ecosystem participation; focus on agent development opportunities via Warden Studio

Medium-term (12-24 months): Assess network effect intensity within the agent ecosystem; monitor user retention metrics

Long-term (24+ months): Observe cross-chain expansion capabilities and competitive landscape evolution

Primary Risks: Theoretical risks inherent to verification mechanisms; rapid competitor entry; agent ecosystem development falling below expectations.

Final Recommendation: For investors with conviction in the "AI agent economy" thesis, Warden Protocol represents an early-stage investment opportunity with favorable risk-adjusted return potential. A phased allocation strategy is recommended.