I was on a call once where a risk lead said something that stuck with me. “We like crypto speed,” he went, “but we can’t leak our book to the whole world.” Then he paused. The kind of pause that means the room is waiting for an adult answer. That’s the real wall for big firms. Not just tech. Not just law. It’s the mix. They need rules, proof, and privacy in the same place. And that’s exactly where Dusk Foundation (DUSK) tries to live.

Because in real markets, data is power. A trade size, a buyer name, a bid plan… these are not “nice to have” secrets. They are edge. If you force all of that onto a fully open chain, you don’t get “fair.” You get “front-run.” You get fear. And fear kills adoption fast. So when people ask why banks don’t rush in, I don’t start with “compliance.” I start with the simple human thing. Nobody wants to play poker with their cards face-up.

Dusk’s pitch is not “privacy for the sake of privacy.” It’s privacy that can still pass an audit. That’s the key. It’s the difference between “trust me” and “here is proof, but not my whole life story.”

I have seen a lot of chains say they are “built for institutions.” Most mean faster blocks and nice slides. Dusk aims at a sharper problem: how to move value when you must keep some parts hidden, yet still prove the rules were followed.

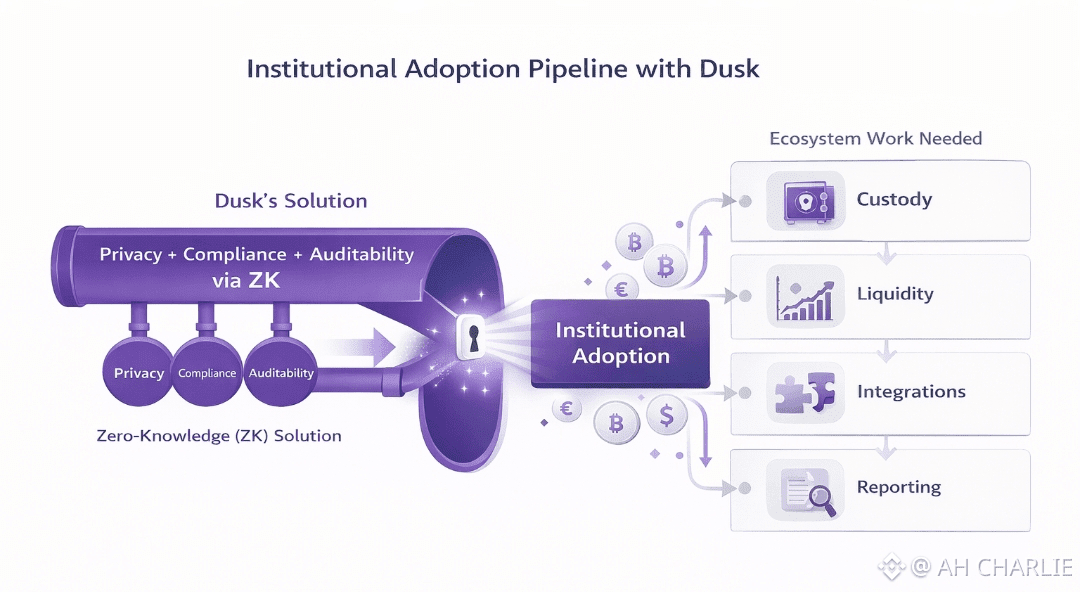

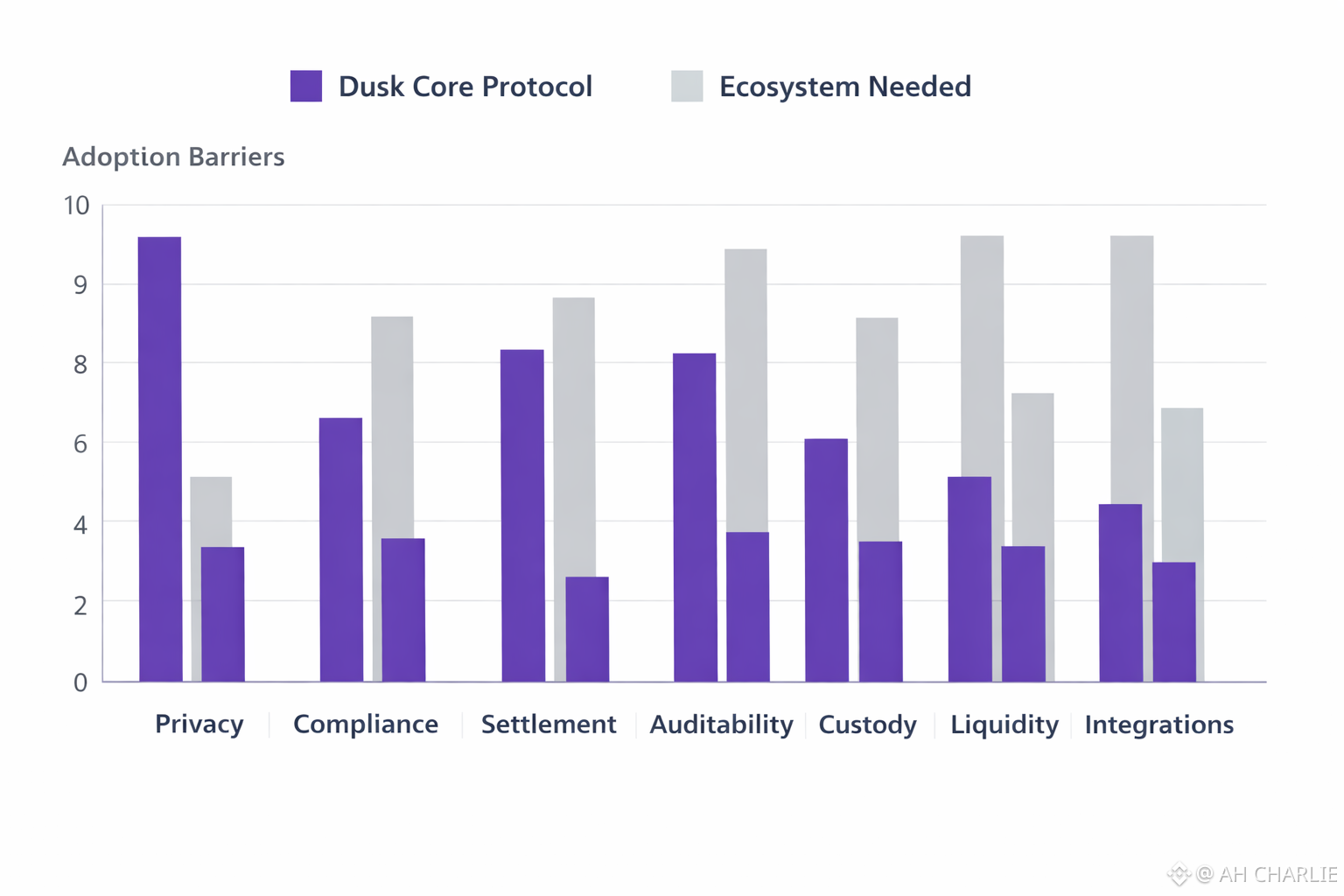

Dusk leans on something called a zero-knowledge proof. Big words, simple role. It’s a math receipt. It lets you show “this transfer met the rules” without showing the private data inside the deal. Like showing you are old enough to enter, without showing your full ID card. That matters for things like funds, bonds, or token shares, where the “who” and “how much” can’t always be public.

Then there is selective disclosure. That means you can keep a deal private by default, but open the needed parts to the right party when it’s time. A reg team. An auditor. A court. Not the whole internet. In a best case, that turns privacy from a risk into a tool. It also helps with a huge pain point: rules at transfer time. Not after a mess. Not after a breach. At the moment the asset moves, the chain can check if the move is allowed.

So what does Dusk solve, in plain words? It tries to make a market that can be quiet when it must be quiet, and loud when it must be proven. That is rare. It’s also why the DUSK story often fits real-world assets. Those assets live under rules. They have limits. They have reports. They have people whose job is to say “no.”

But even if the core idea is strong, core ideas don’t ship products by magic. Which is where the next part gets real.

This is the part many fans skip, but I won’t. Even if Dusk nails the tech, big adoption still needs an ecosystem that feels boring. Safe. Logged. Insured. Easy to plug in. And, honestly, slow to build.

First is custody. Big firms do not want one laptop key. They want shared key control, hard rules, and clear blame lines. They want service teams on call. They want the kind of key setup that survives a bad day and a staff change. If custody support is thin, adoption stays in “pilot mode.”

Then there’s the workflow gap. Firms run on old pipes. Ticket tools. Risk checks. Trade logs. Some of it is messy. Some of it is strict. A chain can be great and still fail if it can’t slide into that world without breaking it. Dusk needs more bridges into the tools people already use, plus clean ways to report, monitor, and prove what happened on chain.

Liquidity is another quiet wall. A bank can like a new rail and still avoid it if exits are weak. Thin order books mean price slip. That is not a “market issue.” It’s a risk issue. You need venues, market makers, and deep pairs that don’t vanish on a red day.

Audits and proof tooling also matter. Not just “we audited once.” I mean repeat checks, clear docs, test kits, and simple ways for teams to review the proof logic. If proofs are a black box, risk teams get nervous. If they are easy to test and easy to explain, you get trust.

And last, there’s the human layer. Legal comfort. Clear roles. Shared terms. Who is allowed to see what. Who can freeze what, if ever. How disputes work. A chain can’t write the whole rule book alone. The firms, the builders, the reg folks, the data teams… they all have to meet in the middle. That takes time. No hype can skip it.

So my take is calm. Dusk Foundation (DUSK) tackles one of the most real barriers: “privacy, but provable.” That’s a hard, useful target. Still, the next wins won’t come from slogans. They’ll come from plumbing. Custody. Tools. Liquidity. Proof kits people can trust. When that boring stuff stacks up, the door opens wider. Not all at once. But for real.

@Dusk #Dusk $DUSK #InstitutionalAdoption