Imagine a world where businesses could handle money, assets, or contracts online without exposing sensitive information—but still follow all the rules. For most companies today, that idea feels impossible. Financial regulations are strict, data leaks are common, and traditional blockchain solutions often force a choice: privacy or compliance. Dusk Network is stepping in to solve this problem, showing how privacy and legality can coexist in a practical, real-world way.At its core, Dusk Network enables private and compliant smart contracts. That means organizations can run automated agreements or manage financial transactions on the blockchain without revealing personal or corporate data. The innovation here isn’t just about hiding information—it’s about doing so while following legal requirements. For regulated industries like banking, trading, or investment, that balance is crucial.

Why Privacy Matters in Finance

We live in an era where almost every transaction leaves a digital footprint. Bank transfers, investment trades, or even contract agreements often expose more data than intended. Leaks or misuse of this data can lead to serious consequences: identity theft, market manipulation, or regulatory penalties.Most public blockchains, like Ethereum or Bitcoin, show transactions openly. While this transparency has benefits, it’s not practical for companies that need confidentiality. Simply put, businesses cannot risk exposing client information or internal financial strategies in public ledgers. This is where Dusk Network steps in, offering confidentiality without sacrificing compliance.

How Dusk Achieves Private and Compliant Smart Contracts

How Dusk Achieves Private and Compliant Smart Contracts

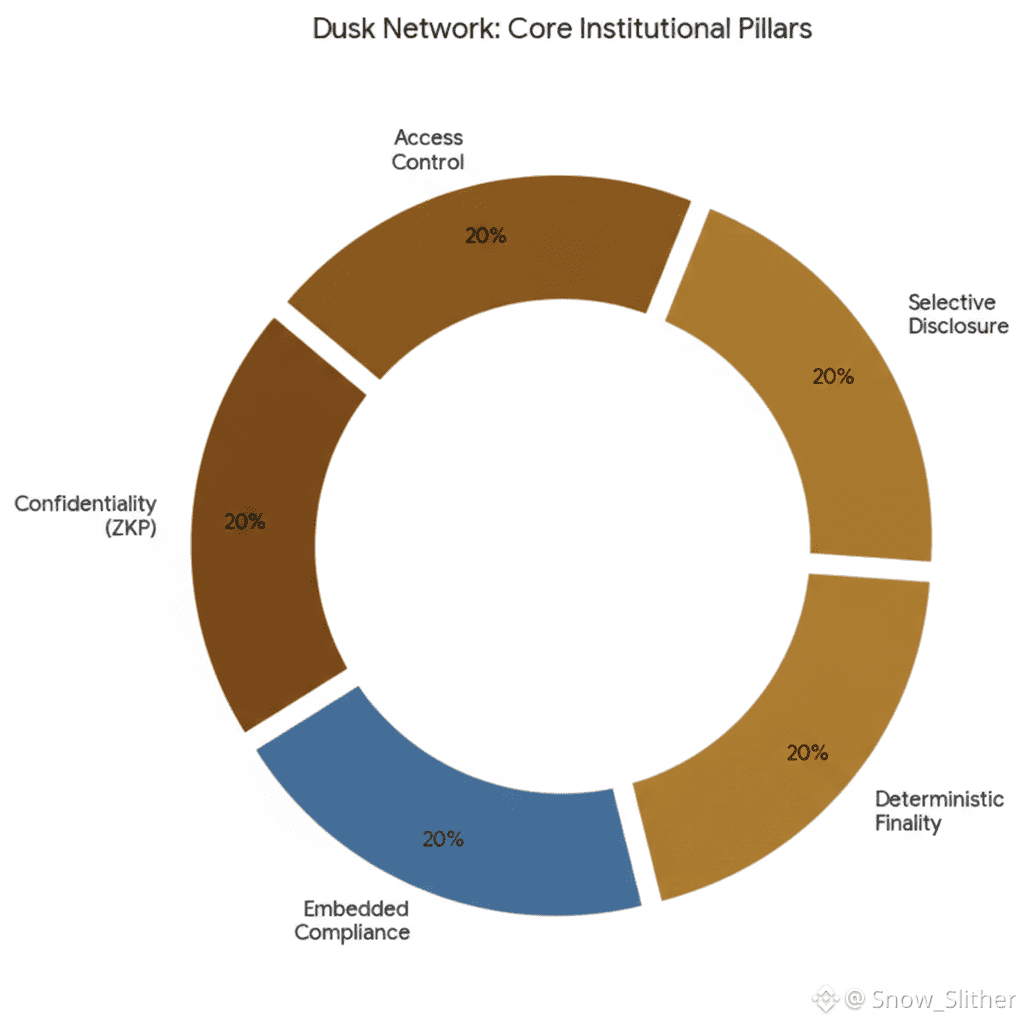

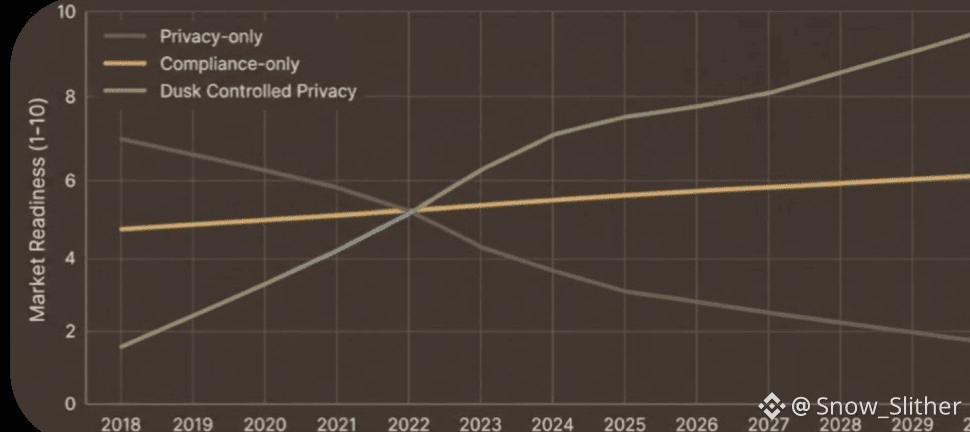

Dusk Network uses a mix of cutting-edge technologies to make privacy work for regulated finance. At the center is zero-knowledge cryptography, a method that allows one party to prove that a transaction is valid without revealing the transaction details. In practical terms, a bank could prove it transferred funds or executed a contract correctly without exposing the amount, the parties involved, or any sensitive details.This approach is complemented by compliance-focused design. Dusk isn’t just private; it’s privacy that regulators can trust. The network allows institutions to prove adherence to rules without revealing unnecessary data. This is a critical difference from fully anonymous systems: it’s not privacy for privacy’s sake—it’s privacy that works with the law.

Real-World Applications

Dusk Network’s architecture opens the door to many financial applications that were previously difficult on public blockchains. For example:

Confidential Asset Issuance: Companies can create digital assets without exposing the owner’s identity or transaction history.

Private Trading: Trades can occur on-chain without revealing sensitive market data, reducing risk of front-running or manipulation.

Automated Settlements: Smart contracts can execute payments or transfers securely, keeping confidential details hidden while ensuring accuracy.

These capabilities make Dusk particularly suitable for banks, investment firms, and fintech platforms that operate under strict regulatory frameworks. It also appeals to businesses handling sensitive data, such as payroll services, insurance platforms, or real estate tokenization.

The Role of the DUSK Token

The Role of the DUSK Token

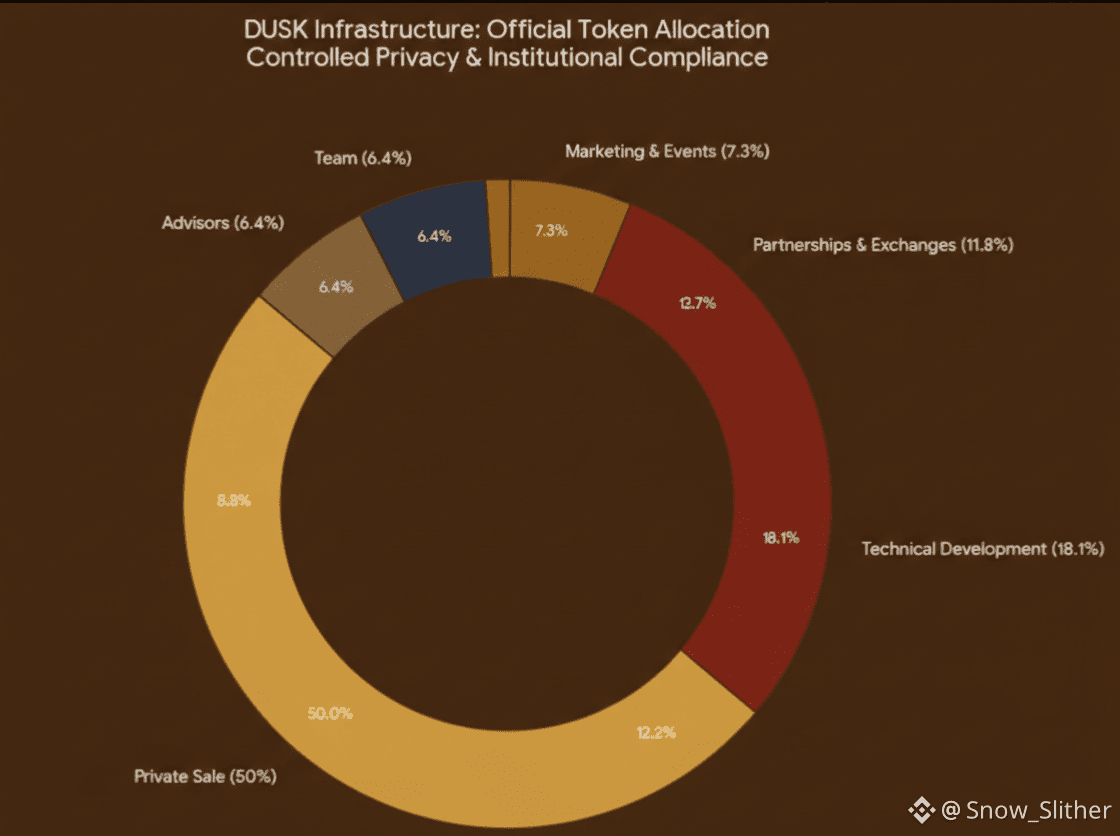

A key piece of the ecosystem is the DUSK token. Beyond being a standard utility token, DUSK powers the network’s security and governance. Validators stake DUSK to confirm transactions, which not only secures the network but also aligns incentives between participants. Users and validators benefit, creating a self-sustaining system where everyone has a stake in maintaining privacy, compliance, and network integrity.This staking mechanism is critical because it balances security with participation. Companies using Dusk don’t need to be blockchain experts—they can rely on the network to operate safely, knowing validators have a financial incentive to maintain the system’s reliability.

Why This Matters for the Future of Finance

Dusk Network is more than a technological experiment—it’s a blueprint for how finance can evolve in the digital era. Traditional financial systems rely on centralized trust, often requiring intermediaries to verify transactions and maintain privacy. Dusk shows that blockchain can handle these responsibilities in a decentralized, automated way, without exposing sensitive information or breaking regulatory rules.In other words, it proves that privacy and compliance are not opposing forces. They can work together to create systems that are secure, efficient, and legally sound. This has profound implications for the future of financial services, particularly as more businesses explore tokenization, decentralized finance (DeFi), and cross-border transactions.

Lessons from Dusk

Lessons from Dusk

For anyone interested in blockchain or financial technology, Dusk offers some important takeaways:

1. Privacy can be built into real-world finance: With the right cryptography and design, it’s possible to protect sensitive information without sacrificing functionality.

2. Compliance doesn’t have to be an afterthought: Privacy solutions that ignore regulations are impractical. Dusk shows how to align technical privacy with legal requirements.

3. Decentralized networks can support institutions: Blockchain isn’t only for public, permissionless applications. Networks like Dusk can handle regulated, high-stakes finance safely.

The broader lesson is simple: technology should solve real problems, not just exist for novelty. By focusing on privacy, compliance, and usability, Dusk makes blockchain relevant for businesses that operate under strict rules—something few other networks manage effectively.

In a world where data breaches, identity theft, and regulatory scrutiny are constant threats, Dusk Network offers a practical path forward. It demonstrates that blockchain can be both private and compliant, enabling smart contracts that work for real businesses today. For companies handling sensitive financial data, this isn’t just an innovation—it’s a tool that makes operations safer, faster, and more trustworthy.Dusk’s approach also hints at the future of finance: one where privacy and transparency coexist, where automation meets regulation, and where blockchain is a bridge rather than a barrier. By protecting sensitive information while following the rules, Dusk is turning what seemed impossible into something practical and accessible.In short, Dusk Network is teaching us that privacy doesn’t have to conflict with lawfulness, and compliance doesn’t have to compromise innovation. With networks like this, the next generation of financial applications can be secure, private, and fully on-chain—a lesson that both tech enthusiasts and financial professionals should pay attention to. #Dusk #dusk $DUSK @Dusk