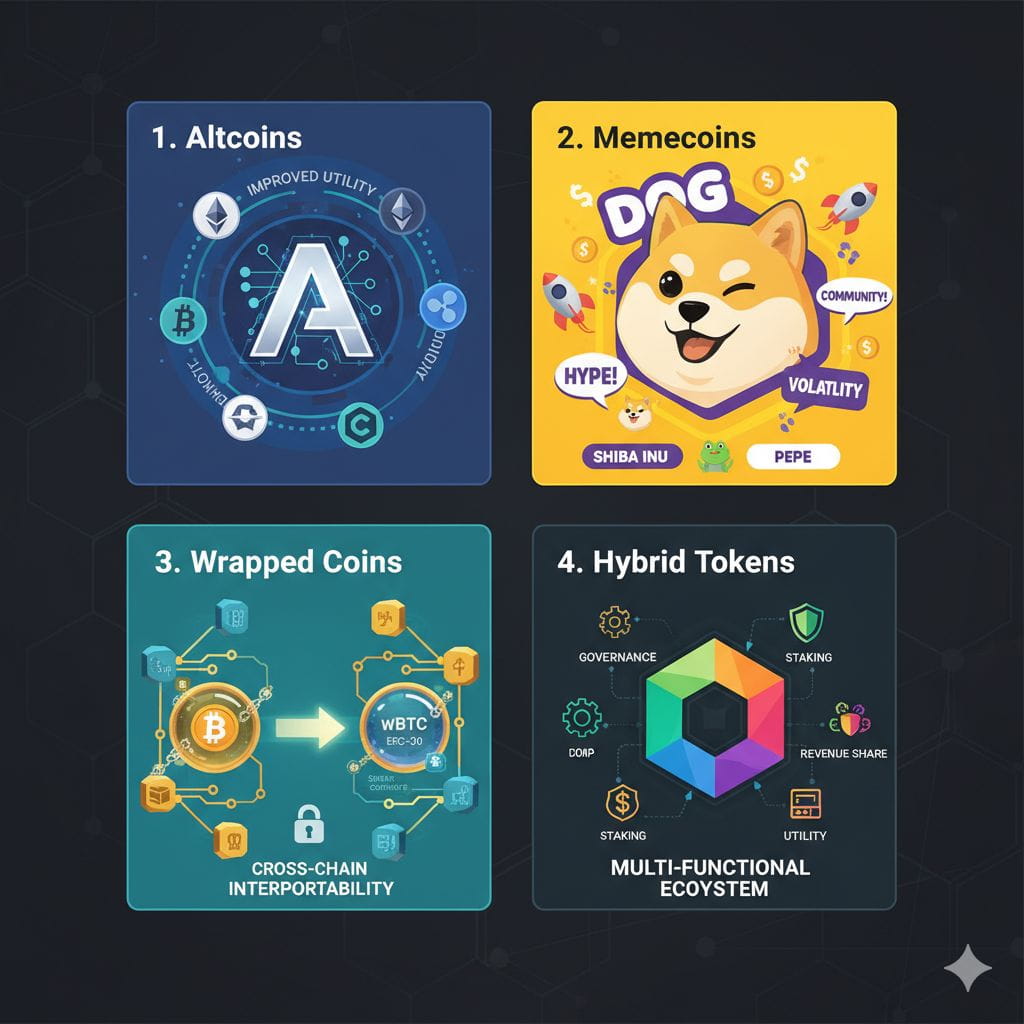

Altcoins vs. memecoins vs. wrapped coins vs. hybrid tokens

Scroll through the charts, and you'll notice something pretty fast:

Crypto is not just Bitcoin.

There are hundreds of other coins and tokens - some serious, some experimental, some… questionable.

Today's Back to Basics topic is how to make sense of that pile.

We're breaking down the main types of crypto you'll run into once you leave Bitcoin territory: altcoins, memecoins, wrapped coins, and hybrid tokens - and why they exist in the first place.

Let's take a look 👀👇

1/ Altcoins

Altcoins literally means alternative coins. It's the umbrella term for any crypto that isn't Bitcoin.

Think of Bitcoin as the original blueprint - altcoins are all the remixes. Some aim to be faster or cheaper, others are more programmable, and some are built to do entirely different jobs.

Over time, altcoins have split into different flavors. They can:

👉 Power blockchains or applications;

👉 Represent real-world or digital assets;

👉 Stay price-stable (like stablecoins);

👉 Solve very specific problems Bitcoin wasn't designed for.

Overall, altcoins are where experimentation happens in crypto.

Common examples you'll hear about: Ethereum (ETH), Solana (SOL), Cardano (ADA), Litecoin (LTC).

2/ Memecoins

Memecoins are a specific type of altcoin that start with a joke, meme, or internet moment and sometimes turn into multi-billion-dollar assets because… the internet.

They usually don't launch with cutting-edge tech. What they do have is:

👉 Strong online communities;

👉 Viral momentum;

👉 Prices driven mostly by attention and hype.

That makes memecoins wildly volatile. They can rip up fast, crash just as fast, and often ignore traditional fundamentals.

Basically, memecoins aren't about utility - they're about collective belief and vibes.

Classic examples: Dogecoin (DOGE), Shiba Inu (SHIB), Floki Inu (FLOKI).

Source: @naiivememe

Source: @naiivememe

3/ Wrapped coins

Blockchains don't naturally talk to each other very well. Wrapped coins exist to solve that problem.

A wrapped coin represents another crypto on a different blockchain, usually backed 1:1 by the original asset.

The idea is simple:

👉 Lock the original asset;

👉 Mint a wrapped version on another chain;

👉 Use it inside that new ecosystem.

This lets assets move across networks and be used in places they normally couldn't.

Wrapped coins aren't new value - they're bridges.

Popular examples: Wrapped Bitcoin (WBTC) (Bitcoin usable on Ethereum), Wrapped Ether (WETH) (ETH in a standardized token format for apps), renBTC (another wrapped version of Bitcoin).

4/ Hybrid tokens

Hybrid tokens are tokens that are deliberately designed to do more than one core job at the same time.

In many crypto projects, a token has one clear main role. Everything else is secondary.

Hybrid tokens are different. Their value comes from combining multiple essential functions into a single token - usually things like:

👉 Being used inside the platform;

👉 Governing how the protocol evolves;

👉 Securing the system or aligning incentives.

These roles are intentionally linked. Remove one, and the setup weakens or breaks.

Common examples: Uniswap (UNI), Aave (AAVE), Compound (COMP).

And why does any of this matter?

Because not every coin should be judged the same way.

You don't analyze a memecoin, a wrapped asset, a governance token, and a base-layer altcoin with the same expectations or risk lens.

Knowing what category a token belongs to helps you understand what gives it value - and what kind of rollercoaster you're signing up for.

Source: Binance News / #BitDegree / Coinmarketcap

"Place a trade with us via this post mentioned coin's & do support to reach maximum audience by follow, like, comment, share, repost, more such informative content ahead"