Privacy has long been blockchain’s double-edged sword. Early networks promised freedom, anonymity, and the ability to transact without oversight. For enthusiasts, this ideal was appealing. For institutions and regulated entities, it was a liability. Many blockchains offered what I call pseudo-privacy: a veneer of secrecy that collapses when compliance, audits, or operational accountability are required. Transactions might appear private, but MEV bots, exchanges, or regulators could reconstruct activity, making these systems impractical for professional finance. Dusk Network changes that paradigm. Founded in 2018, Dusk focuses on privacy that works for institutions, integrating zero-knowledge proofs (ZKPs) into a regulation-ready Layer-1 blockchain. This architecture protects sensitive data while enabling authorized parties—regulators, auditors, or internal compliance teams—to verify transactions. Privacy on Dusk is no longer theoretical; it is provable, auditable, and fully compliant, designed for real-world, regulated financial workflows.

Pseudo-privacy has long limited adoption in institutional DeFi. Platforms that advertised anonymous transactions often left sensitive positions exposed, making front-running or regulatory breaches possible. For banks, asset managers, and institutional investors, client confidentiality is mandatory, and regulatory penalties are severe. Moreover, pseudo-privacy often sacrifices usability. Systems that hide data from everyone make compliance difficult, audits slow, and integration cumbersome. Dusk recognized this gap: it doesn’t just hide transactions—it enables practical, verifiable privacy that institutions can rely on.

At the core of Dusk is a Layer-1 zero-knowledge framework designed for regulated environments. Unlike systems that hide data universally, Dusk supports selective disclosure. Transaction details remain confidential to the public but can be verified by regulators, auditors, or other authorized parties to ensure compliance with laws, internal policies, and industry standards. A fund managing tokenized securities on DuskTrade can execute trades fully on-chain without revealing client identities, portfolio allocations, or trading strategies. Zero-knowledge proofs mathematically validate each transaction, proving correctness without exposing sensitive data.

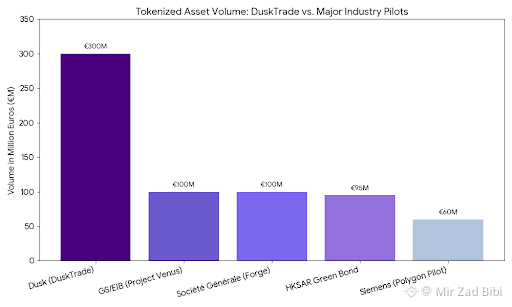

During a DuskTrade demonstration, over €300M in tokenized securities flowed through the system. Every step—from settlement to compliance verification—was executed on-chain, preserving privacy while meeting regulatory standards. This demonstrates that privacy on Dusk is operational, not theoretical.

Dusk treats privacy and compliance as complementary, not conflicting. Traditional blockchains often force institutions to choose between protecting sensitive information and meeting regulatory obligations. Dusk removes that compromise. Its protocol enforces regulatory rules natively, eliminating complex off-chain reconciliations, while zero-knowledge proofs allow selective verification, ensuring regulators can confirm compliance without accessing confidential details. Banks, asset managers, and regulated financial entities can transact confidently, knowing both privacy and accountability are preserved. This transforms blockchain from a speculative playground into a secure, production-ready financial infrastructure, where private trading, confidential tokenized assets, and auditable workflows are practical realities.

Regulated DeFi, or RegFi, is the next frontier. Tokenized real-world assets (RWAs) are increasingly on-chain, demanding privacy, auditability, and compliance simultaneously. Dusk is at the forefront. A fund manager overseeing multiple tokenized securities pools can operate fully on-chain without risk of position leaks, front-running, or manual compliance checks. Sensitive information remains encrypted for outsiders while regulators receive selective proofs for verification. The operational efficiency gains are substantial: reduced risk, simplified audits, and greater trust from regulators and institutional participants.

While Dusk offers revolutionary privacy and compliance features, institutions must consider risks such as evolving regulatory frameworks, potential data leakage, front-running, integration challenges, and operational errors. Dusk mitigates these by embedding compliance rules into Layer-1, enabling selective verification via zero-knowledge proofs, and designing workflows that integrate seamlessly with institutional systems. Its production-tested DuskTrade platform demonstrates that high-value tokenized securities can flow on-chain securely, privately, and auditable, giving regulated entities confidence while minimizing exposure to common blockchain risks.

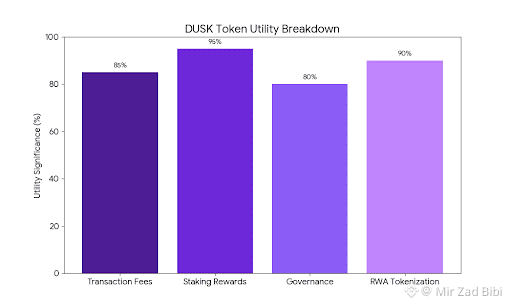

The $DUSK token is a core component of the ecosystem. It is used to pay transaction fees, stake for network security, and participate in governance decisions that shape protocol upgrades and compliance features. Stakers validate zero-knowledge proofs, ensuring network integrity and aligning incentives between developers, regulators, and institutional participants. Dusk’s community drives adoption across regulated finance, DeFi, and tokenized real-world assets. Developers, financial institutions, and ecosystem partners contribute to governance proposals, provide feedback on Layer-1 enhancements, and expand DuskTrade applications. This active community ensures transparency, accountability, and continuous innovation.

DuskTrade exemplifies how Dusk’s Layer-1 and zero-knowledge architecture function in production. Built with NPEX, a regulated Dutch exchange, DuskTrade allows tokenized securities to move fully on-chain, preserving privacy while meeting strict regulatory standards. Over €300M in tokenized securities have been demonstrated flowing securely, with all compliance checks enforced via ZKPs. This proves that Dusk provides institution-grade, auditable privacy, enabling banks, brokers, and asset managers to operate confidently on-chain.

Dusk demonstrates that zero-knowledge technology can be applied effectively for regulated finance. Privacy is no longer a philosophical luxury—it is operationally essential. Dusk sets a new standard for confidential, compliant, and auditable blockchain infrastructure, enabling institutions to transact at scale without regulatory concerns or client data exposure. The future of finance will demand both confidentiality and accountability. Dusk’s Layer-1 ZKP framework, $DUSK token, governance model, staking mechanisms, and DuskTrade platform show how privacy, compliance, and operational efficiency coexist, bridging crypto innovation with institutional trust.

Pseudo-privacy is dead. Dusk Network proves blockchain privacy can be practical, enforceable, and fully aligned with regulatory expectations. By combining Layer-1 zero-knowledge proofs, selective disclosure, compliance-ready architecture, token utility, staking, governance, and community participation, Dusk transforms blockchain from a speculative experiment into a trusted, institutional-grade financial system. For regulated entities and forward-looking financial institutions, Dusk isn’t just relevant—it is essential.