$BTC Here’s a latest Bitcoin (BTC) market analysis covering price action, technical/fundamental outlook, forecasts, and risks, with helpful visuals to understand the trend.

کوائن ڈیسک

CryptoSlate

Bitcoin price analysis: BTC bulls mull price weakness as gold soars near $5,000

Bitcoin’s $150,000 forecast slash proves the institutional "sure thing" is actually a high-stakes gamble for 2026

Yesterday

Yesterday

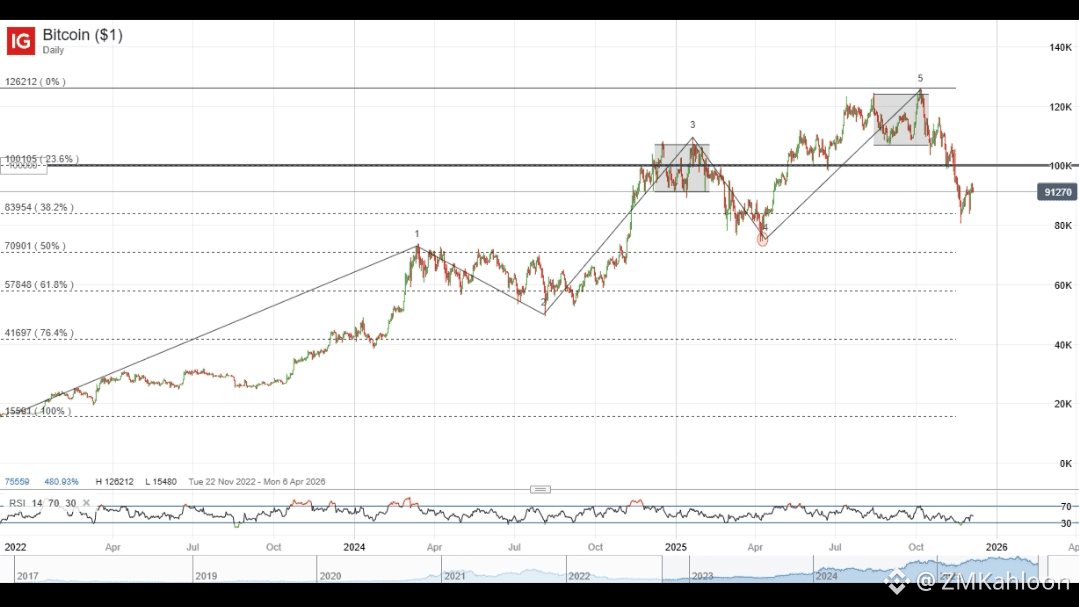

📌 Current Price Action (Early 2026)

Bitcoin has been trading around the high-$80,000s to low-$90,000s, with pressure from macroeconomic uncertainty and technical resistance near key levels. �

IG

Recent bearish momentum marked BTC’s longest losing streak in months, dragging price below some short-term support zones. �

Finance Magnates

However bulls remain active — near-term setup suggests BTC could rebound toward $95K–$107K if it maintains support above ~$87K. �

Brave New Coin

📈 Technical Outlook

Key levels to watch

Support: ~$87,000–$89,000 — critical for sustaining stability. �

Brave New Coin

Resistance: ~$95,000–$100,000 — break above here could ease short-term selling pressure. �

MEXC

Bullish target zone: ~$105,000–$110,000 in the coming weeks if momentum picks up. �

MEXC

Chart signals

RSI remains neutral to slightly bullish — not overbought yet, implying room for upside. �

MEXC

MACD and volume trends are mixed, meaning BTC needs decisive breakout confirmation. �

MEXC

🔮 2026 Price Forecasts — Mixed But Bullish Potential

Analyst and institutional outlooks for Bitcoin in 2026 vary widely:

Bullish scenarios

Some forecasts see BTC rallying above $150,000–$200,000 by year-end if institutional demand and ETF flows persist. �

MEXC +1

Long-range forecasts (from statistical/price models) even project averages near ~$190,000 for 2026. �

CoinLore

Neutral to cautious views

Base-case scenarios indicate BTC trading between $95K–$150K as markets digest macro risks and demand cycles. �

MEXC

Bearish possibilities

Less optimistic analysts caution BTC could revisit $60K–$80K if markets weaken or risk assets sell off. �

MEXC

👉 Consensus: wide forecast range exists because BTC’s price is sensitive to macro conditions, adoption, regulation, and investor behavior.

🧠 Fundamental Drivers

Bullish factors

Continued institutional interest — including hedge funds and ETF inflows — adds potential upside. �

Reuters

Strong miner commitment and rising mining difficulty suggest deeper network health. �

BTCC

Neutral/Negative factors

Global macro uncertainty (e.g., interest rates, geopolitical stress) weighs on risk assets like BTC. �

IG

Broader regulatory developments and delayed clarity in some jurisdictions still cloud sentiment.

⚠️ Key Risks

Volatility: BTC remains highly fluctuant — sharp moves up or down are common.

Macro shocks: Rate decisions, inflation surprises, or banking stress could hit crypto markets.

Technical breakdowns: A decisive break below key supports opens the risk of deeper correction toward lower ranges.

🧾 Summary

Short-term (weeks): BTC consolidates, with breakout potential toward ~$100–$110K if support holds.

Medium-term (2026): Diverse scenarios from $60K to $250K+ — trend hinges on macro, institutional flows, and regulation.

Long-term: Still widely viewed as a flagship digital store-of-value with adoption tailwinds and network growth.

Would you like an annotated Bitcoin price chart with key support/resistance levels tailored to current data? 📊💡$BTC