You don’t usually lose trust in a system when it breaks. You lose it when it hesitates.

That moment when a transaction doesn’t fail, but doesn’t quite move the way you expect either. A few extra seconds. A slight pause. Enough time for your brain to ask questions it normally wouldn’t. Is this delay harmless? Is something being exposed while I wait? Or is this one of those edge cases everyone ignores until it matters?

Once that doubt shows up, behavior changes. People stop testing. They stop pushing limits. Not because centralized tools are better, but because they’re predictable. Consistency becomes more valuable than ideals.

This is where most privacy-focused blockchains struggle. Privacy is often bolted onto public systems rather than designed into them. Mixers, bridges, additional layers — each one increases surface area, latency, and operational risk. That might be tolerable for retail experimentation, but it collapses quickly under regulated or institutional use. Compliance teams don’t care how elegant the cryptography is if settlement feels unpredictable.

Dusk is clearly attempting to avoid that trap by narrowing its ambition. Instead of chasing volume or consumer-scale use cases, it treats privacy as a base requirement rather than an optional feature. Transactions are confidential by default, with disclosure only when explicitly needed. No meme cycles. No throughput competitions. Just a deliberate focus on private financial infrastructure.

That narrow focus shows up across the roadmap. Tokenized assets don’t demand extreme speed. They demand reliability. A slightly slower transaction is acceptable if it finalizes cleanly every time. The early-2026 mainnet rollout reflected that philosophy: conservative parameters, stable execution, and no pressure to inflate activity metrics. The real test isn’t marketing traction — it’s whether integrations like NPEX behave smoothly under real compliance constraints.

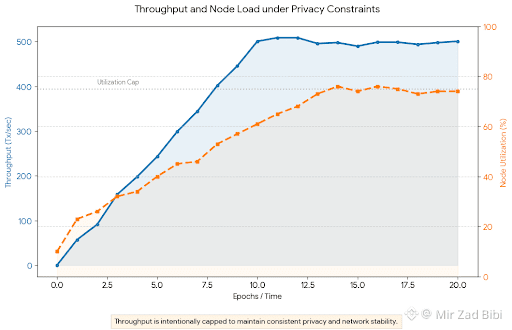

Architecturally, the choices follow the same logic. Consensus responsibilities are segmented to limit systemic exposure. Zero-knowledge proofs are used to verify state without revealing transaction details, but throughput is intentionally capped to protect node performance. Identity systems focus on proving attributes rather than revealing users. None of this is designed to impress at first glance. It’s designed to survive sustained use.

The DUSK token mirrors that restraint. It functions as payment for execution, collateral for network security, and incentive for correct behavior. Fees scale with computational complexity, which aligns with the reality that privacy isn’t free — but it is measurable. Governance exists, but it doesn’t dominate the user experience. The token behaves like infrastructure, not a narrative driver.

Market signals don’t tell you much here. Liquidity is steady. Volume responds to announcements and then fades. Price reacts to headlines rather than on-chain usage. That’s typical for systems still proving themselves. It also means price action isn’t a reliable proxy for product readiness.

The real risk lives in execution over time.

If proof generation slows under meaningful RWA volume, confidence erodes quickly. If finality stretches during busy periods, participants hesitate. If regulatory requirements evolve faster than the protocol adapts, the differentiation weakens. And if competitors deliver simpler systems that institutions trust sooner, focus alone won’t close the gap.

Dusk doesn’t need spectacle to succeed. It needs repetition without friction. The kind where users stop thinking about privacy mechanics entirely. Where the second and third transaction feel unremarkable. That’s when infrastructure stops being an idea and starts being something people depend on.

Until then, Dusk sits in a familiar but delicate position: a clear vision, sensible design decisions, and a roadmap that still has to prove itself under pressure.

That tension — between intention and execution — is the real long-term risk.

And if handled correctly, it’s also the opportunity.