Markets have stopped rewarding noise. In 2026, capital flows toward infrastructure that can survive audits, regulators, and institutional scrutiny. The speculative premium has thinned; what’s left is execution. This is where Dusk Network quietly fits—building a privacy-first blockchain that doesn’t run from regulation, but uses cryptography to meet it head-on.

What Dusk Is Actually Solving

Dusk is not trying to be another generalized Layer-1. Its focus is narrow by design: regulated financial assets on-chain, executed privately, but verifiably. In a market obsessed with Real World Assets (RWAs), that distinction matters.

Traditional finance doesn’t reject blockchains because of throughput—it rejects them because of compliance risk. Public ledgers leak sensitive data. Permissioned chains reintroduce trust. Dusk targets the middle ground.

Core Value Proposition

Privacy-preserving RWAs using zero-knowledge proofs (ZKPs)

Selective disclosure, not full opacity

On-chain compliance primitives, not off-chain workarounds

In short: institutions can transact privately, while regulators can still verify correctness when legally required.

ZK-Proofs as Infrastructure, Not a Feature

By 2026, ZK has matured from novelty to necessity. Dusk treats zero-knowledge proofs as a base layer, not a marketing hook.

Key architectural elements:

Confidential smart contracts: transaction logic executes without exposing sensitive inputs

Selective auditability: data remains private unless disclosure is explicitly authorized

ZK-friendly execution environment optimized for financial logic

This matters for RWAs like:

Tokenized bonds and equities

Private funds and structured products

Regulated secondary markets

Most chains can tokenize assets. Very few can do it without leaking counterparty data, positions, or settlement logic.

Why Dusk Is Positioned for the 2026 RWA Cycle

The RWA narrative has matured. Institutions are no longer asking if assets can be tokenized—they’re asking under what legal conditions.

Dusk aligns with this reality:

Identity and compliance are native, not bolted on

Privacy is granular, not absolute

Governance and staking reinforce network security without compromising confidentiality

This makes Dusk less attractive to yield tourists—and more attractive to entities managing billions under strict mandates.

Token Utility and Network Economics

The DUSK token is not a passive governance chip.

Primary functions:

Staking to secure the network

Transaction fees for confidential execution

Governance participation over protocol parameters

In a world where many tokens struggle to justify demand, DUSK’s utility is tightly coupled to actual network usage—especially if RWA issuance scales.

Technical Analysis: Key Levels to Watch

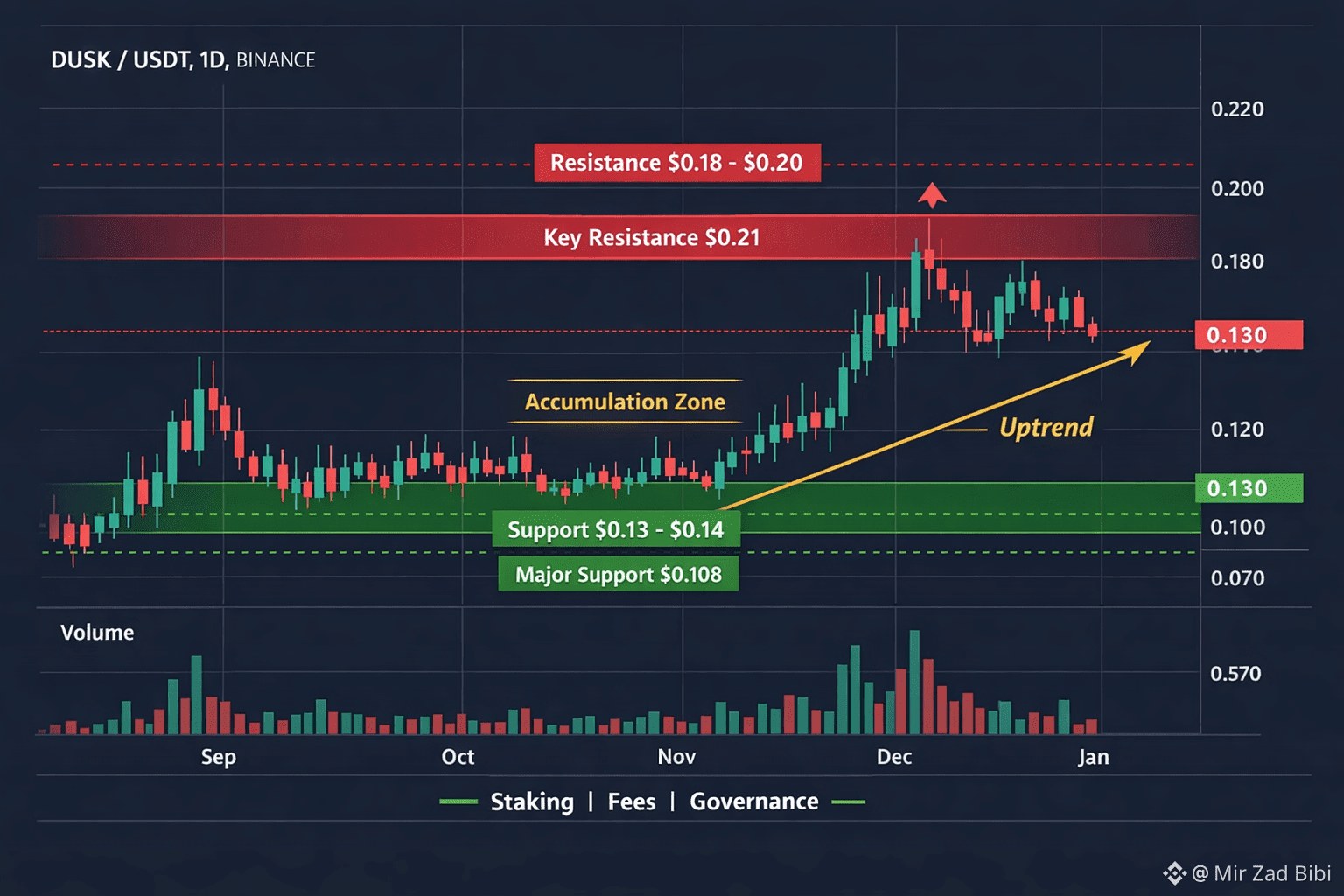

Market context: late January 2026

Support Zones

$0.13 – $0.14: short-term demand zone; buyers have repeatedly defended this range

$0.108 – $0.11: structural support; loss of this level weakens mid-term structure

Resistance Levels

$0.18 – $0.20: near-term supply zone aligned with previous breakdowns

$0.21 – $0.22: psychological and technical pivot; reclaiming this shifts momentum decisively

Structure & Momentum

Higher lows suggest accumulation behavior, not distribution

Pullbacks have remained controlled, indicating patient capital rather than speculative churn

A clean break above $0.20 with volume would confirm trend continuation

Price action reflects a market that is evaluating fundamentals, not chasing hype.

Key Takeaways

Dusk targets regulated finance, not retail speculation

Zero-knowledge proofs are used for compliance-compatible privacy

RWA infrastructure is the core thesis, not an add-on narrative

Technical structure suggests accumulation, not exhaustion

Success depends on institutional adoption—not influencer cycles

Final Thought for the Community

If RWAs become the dominant on-chain narrative, does the market eventually favor selective privacy models like Dusk, or will regulators force full transparency even at the cost of institutional confidentiality?

Where do you think that balance ultimately lands?