Binance Futures Lists TSLA/USDT Perpetual Contract

Hey Binancians, buckle up! If you’ve ever stared at Tesla’s stock price whipsawing and thought, “I wish I could trade this momentum with the flexibility of crypto,” then mark your calendars. Binance Futures is supercharging its offerings by launching a game-changing new instrument: the TSLAUSDT Equity Perpetual Contract.

Let’s break down why this isn’t just another listing—it’s a potential game-changer for your trading portfolio.

The Core Announcement: Your New Trading Tool

As per the official word from the Binance team, in their ongoing mission to expand our trading choices and juice up our experience, they’re rolling out the following:

· Launch Time: 2026-01-28 14:30 (UTC)

· Contract: TSLAUSDT Perpetual Contract

· Leverage: Up to 5x

That’s right. Starting January 28th, you won’t just be watching Elon’s next tweet from the sidelines. You’ll be able to take a position on Tesla’s equity price directly with USDT, using the familiar (but always-to-be-respected) power of leverage on the world’s largest crypto exchange. This bridges two of the most innovative and volatile worlds: legacy tech brilliance and crypto-native trading.

Why This is a Big Deal: More Than Just a Stock Tick

For years, trading traditional equities like Tesla meant dealing with traditional market hours, cumbersome brokers, and settlement times. Binance Futures has been steadily tearing down those walls. Listing TSLA as a perpetual contract means:

1. 24/7 Trading, Tesla-Style: Imagine reacting to late-night product announcements or earnings calls in real-time, not waiting for the NYSE bell. The crypto market never sleeps, and now your Tesla trades don’t have to either.

2. Seamless Portfolio Integration: You can now manage your exposure to a leading tech giant within the same ecosystem as your Bitcoin, Ethereum, and altcoin positions. All collateralized in USDT or other supported assets. It streamlines everything.

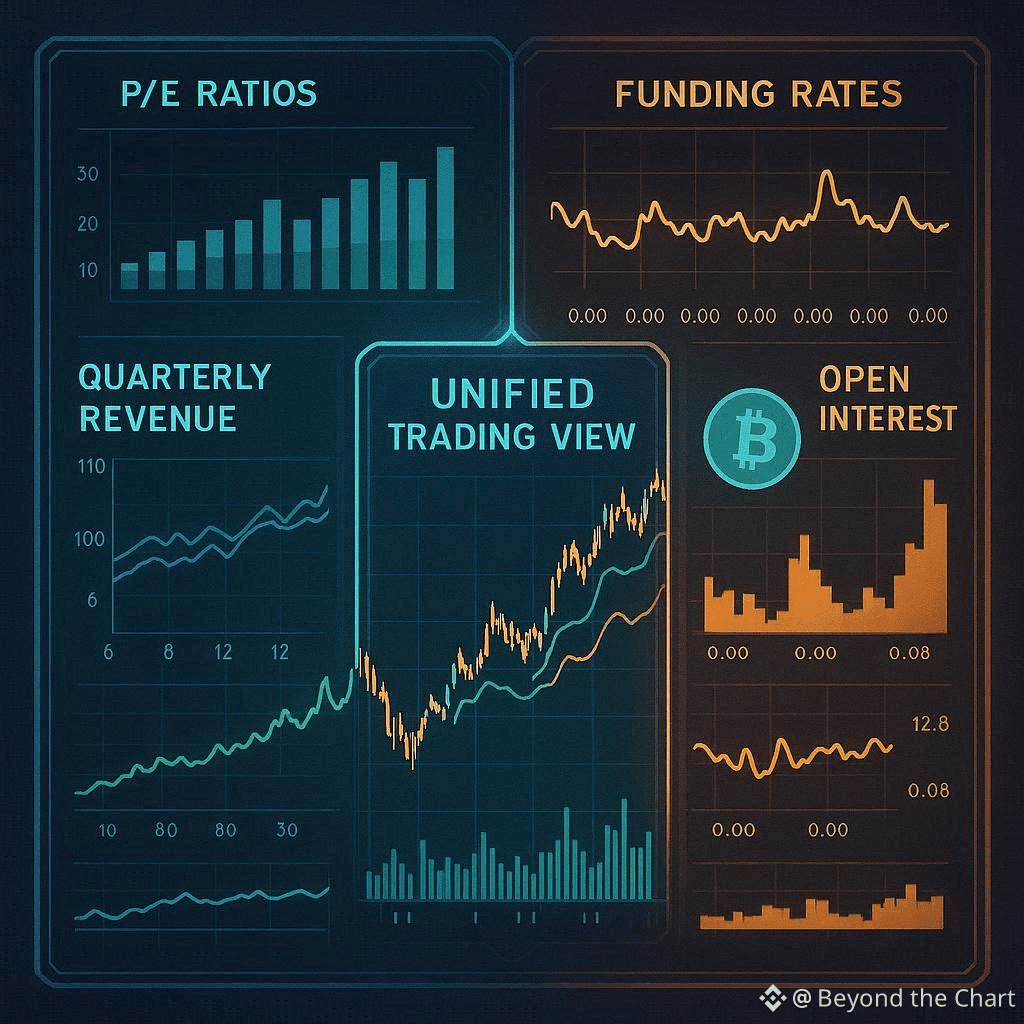

3. Strategic Flexibility with 5x Leverage: This is the turbo button. It allows for more significant capital efficiency on your convictions. A critical prompt for your thinking here: "Visualize a graph comparing TSLA's stock volatility during market hours versus after-hours. Now, overlay the potential effect of a 5x leverage position during a major news event." This tool is powerful—always use risk management.

Navigating the New Landscape: A Trader’s Mindset

Trading an equity perpetual is similar to crypto perpetuals, but the underlying driver is different. You’re not just analyzing blockchain activity; you’re now also parsing EV delivery numbers, battery tech breakthroughs, and the ever-present… ahem… social media factor.

This move by Binance feels like a clear vote for the future of finance—a future where asset classes converge on efficient, accessible platforms. It democratizes access to one of the most watched stocks on the planet.

The TSLAUSDT Perpetual Contract is more than a listing; it’s an invitation. An invitation to trade the future, around the clock. Do your own research, understand the risks of leverage, and get ready. The trading session starts January 28th.

Trade wisely, Binancians. The road ahead is exciting.

$TSLA #TSLAUSDT #TSLA #BinanceSquareTalks @Binance Square Official