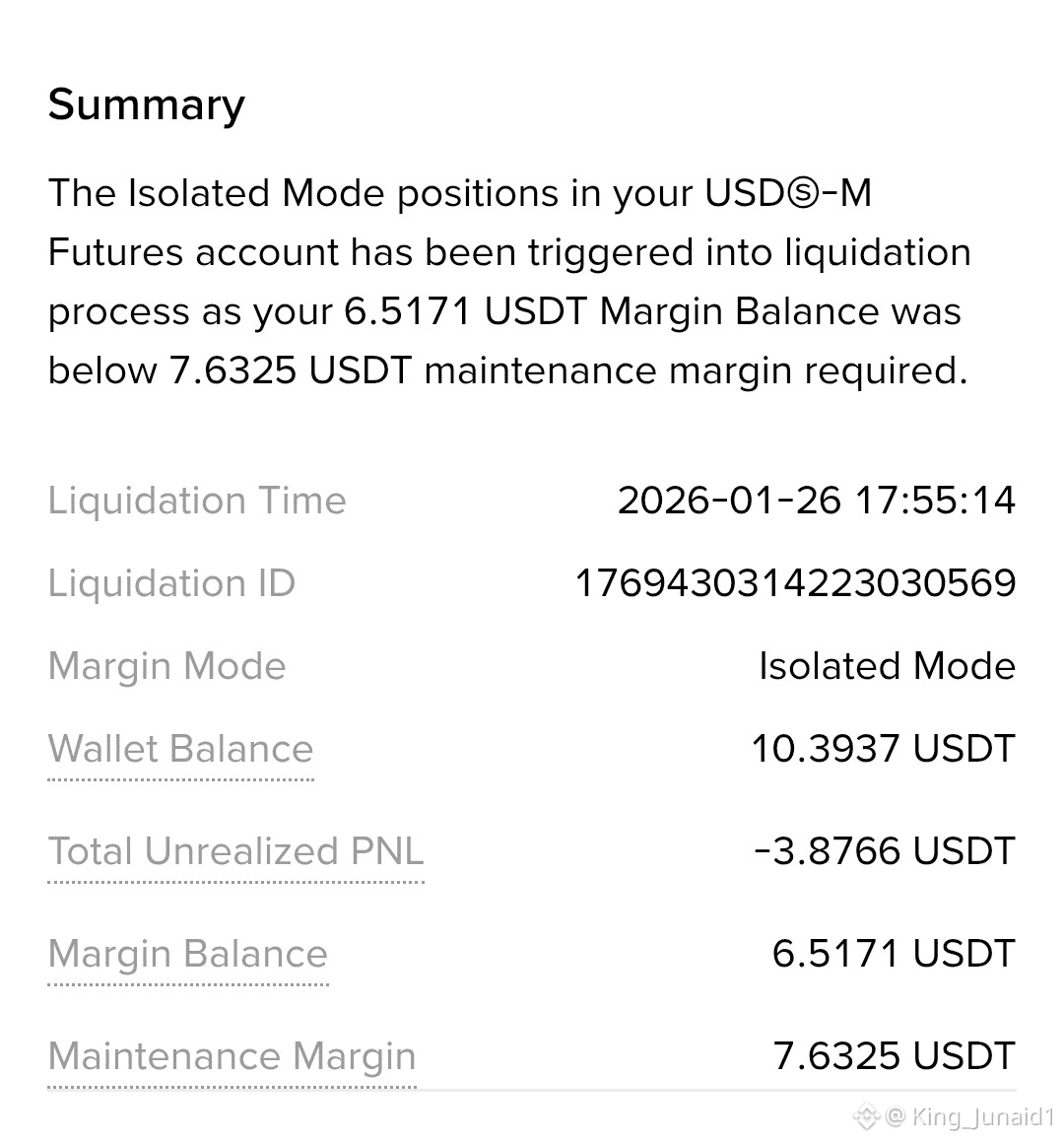

If you are new to Binance Futures, you might have experienced what I did today: opening a trade on $VANRY, only to see your entire balance vanish in a single second. It feels like a glitch, but it’s actually the way Isolated Margin and High Leverage work together. Let me explain it simply so you don’t lose your hard earned money the same way.

1. What is Isolated Margin?

When I opened my trade, I used Isolated Margin. This means I "isolated" a specific amount of money (like $9) for that one trade. In theory, this is safe because if the trade goes wrong, I only lose that $9, not my whole wallet. However, the catch is that the "buffer" you have is very small.

2. The Trap of 50x Leverage:

Leverage is like a loan from Binance. At 50x, my $9 was controlling a position worth $450. While this sounds great for big profits, it means a price move of only 2% against me wipes out 100% of my money.

3. The "Maintenance Margin" Secret:

This is where I got caught. Binance requires you to keep a minimum amount of money, called Maintenance Margin, to keep the trade open. In my case, I needed about $7.63 to keep my $450 position alive. As soon as $VANRY dipped slightly and my account value dropped below that $7.63 "red line," the system automatically closed my trade to protect itself.

4. Why did I lose $9 if my loss was only $0.47?

When the system liquidates you, it’s not free. Binance charges a Liquidation Clearance Fee. Because the fee is based on the total $450 position size and not just your $9, that fee often eats up everything left in your margin.

5. A Lesson for All Binance Traders:

I am still bullish on @Vanarchain because of their AI native tech and upcoming Dubai events, but I’ve learned my lesson. Don't use 50x leverage on $VANRY without a Stop Loss. High leverage gives you zero room for the natural price "wicks" that happen in crypto. Next time, I’m sticking to lower leverage to give my trade room to breathe!