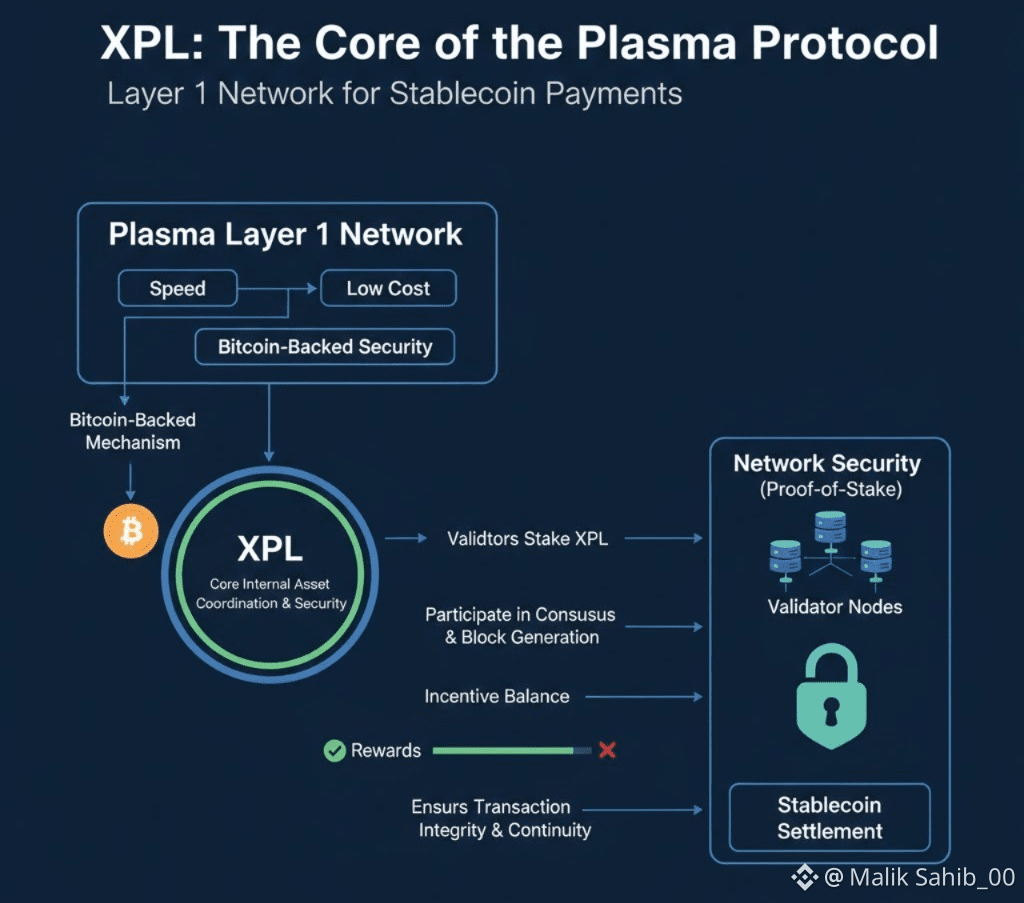

XPL is the core token of the Plasma blockchain protocol layer. Plasma is a Layer 1 network designed specifically for stablecoin payments, prioritizing speed, cost-effectiveness, and Bitcoin-backed security over speculation. In this design, XPL serves as an internal asset for coordination and security, maintaining the system's reliability and economic balance.

At the network security level, validators stake XPL according to Plasma's Proof-of-Stake (PoS) model. Validators stake XPL to participate in the consensus process, block generation, and transaction confirmation. This staking mechanism balances incentives: honest behavior is rewarded, while violations may be excluded, ensuring high continuity and integrity of transactions—crucial for stablecoin settlement.

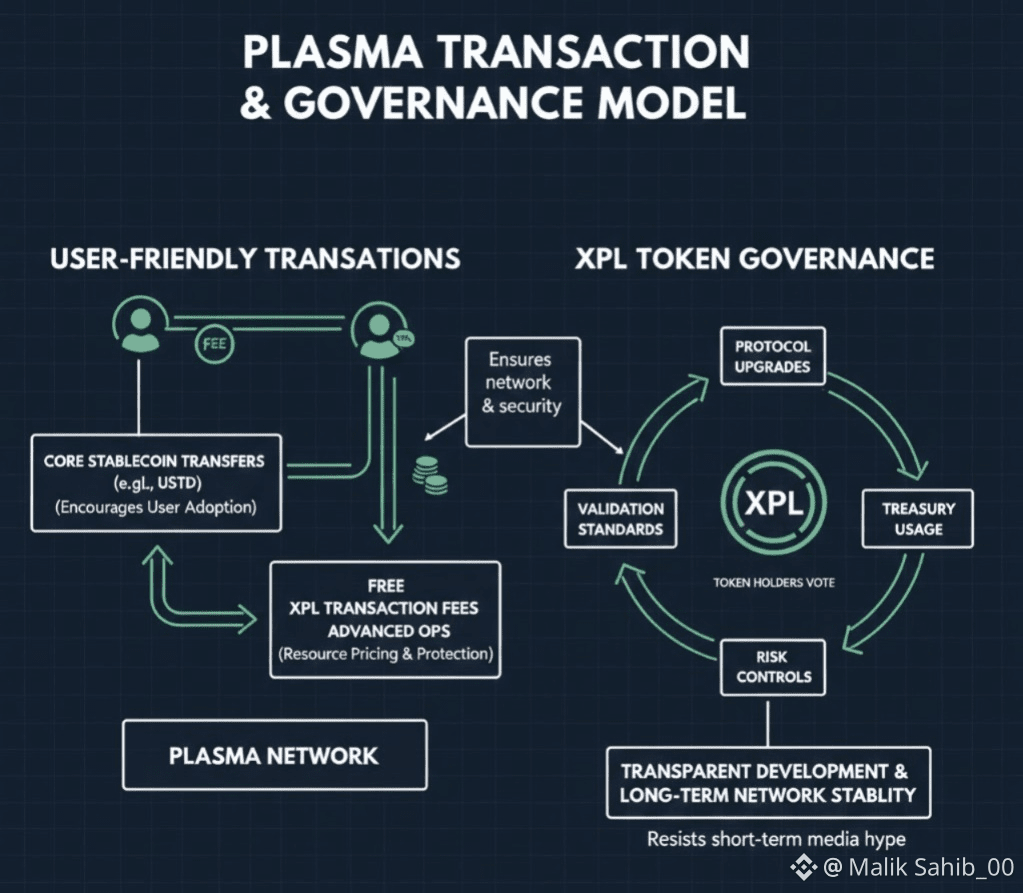

To facilitate transactions, Plasma offers a user-friendly model. Core stablecoin transfers (such as USDT payments) are free to encourage user adoption. However, executing smart contracts, interacting with core decentralized finance (DeFi) tools, or performing advanced operations require the use of XPL tokens to pay transaction fees. This ensures the pricing and protection of network resources without imposing a payment burden on users.

The XPL token also supports on-chain governance. Token holders can vote on protocol upgrades, validation standards, treasury usage, and risk controls. This governance layer allows Plasma to develop transparently while maintaining long-term network stability, rather than being influenced by short-term media hype.

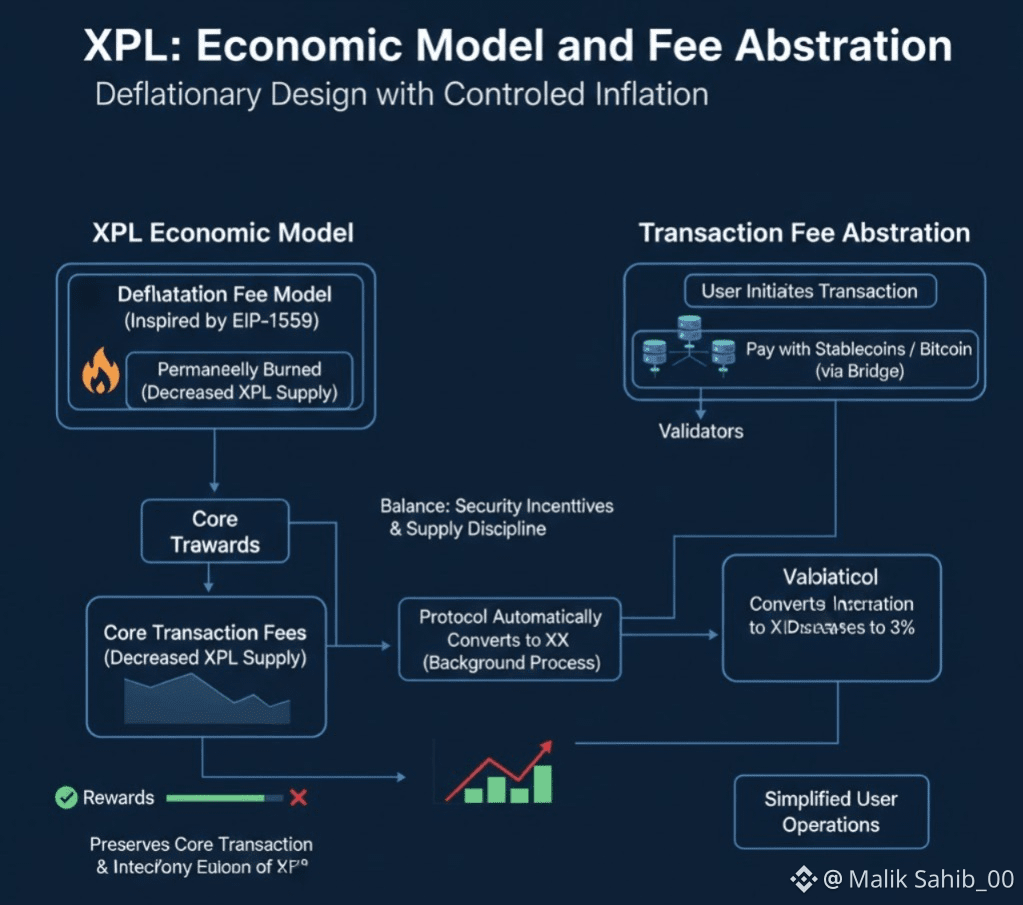

Economically, Plasma employs a deflationary fee model inspired by EIP-1559. A portion of core transaction fees is permanently burned, and the circulating supply of XPL gradually decreases as usage increases. Validation rewards introduce controlled inflation—an initial annual growth rate of 5%, gradually decreasing to 3%—thus striking a balance between security incentives and long-term supply discipline.

Transaction fee abstraction is a key innovation. Users can pay fees using stablecoins or Bitcoin via a bridge, and the protocol automatically converts these fees to XPL in the background. This simplifies user operations while preserving the core economic functions of XPL.

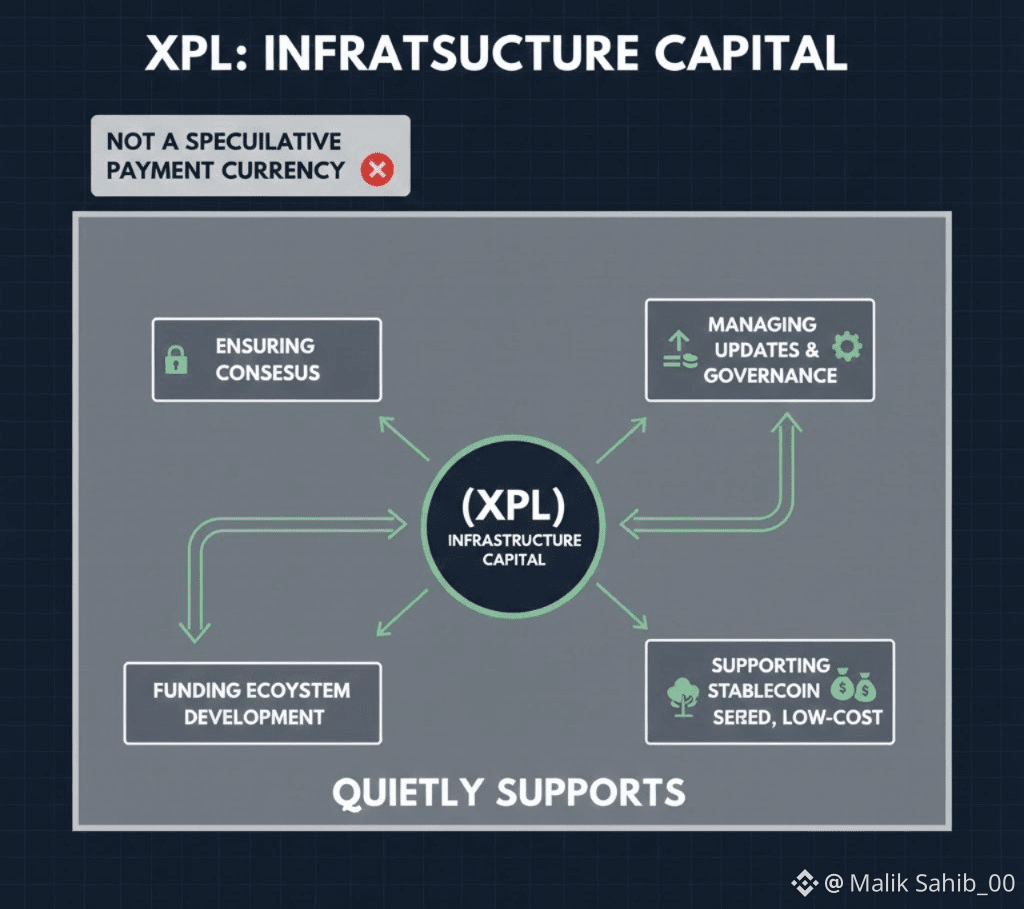

Overall, XPL is not a speculative payment currency. Instead, it serves as infrastructure capital, ensuring consensus is reached, managing updates, funding ecosystem development, and quietly supporting large-scale, high-speed, low-cost settlement of stablecoins.