Institutions don’t adopt financial infrastructure because it’s exciting. They adopt it because it’s predictable. In regulated finance, reliability is not a feature it’s a prerequisite. Systems must behave the same way today as they did yesterday, and as they will tomorrow, even under stress. This expectation is what separates experimental technology from infrastructure that can actually support real markets.

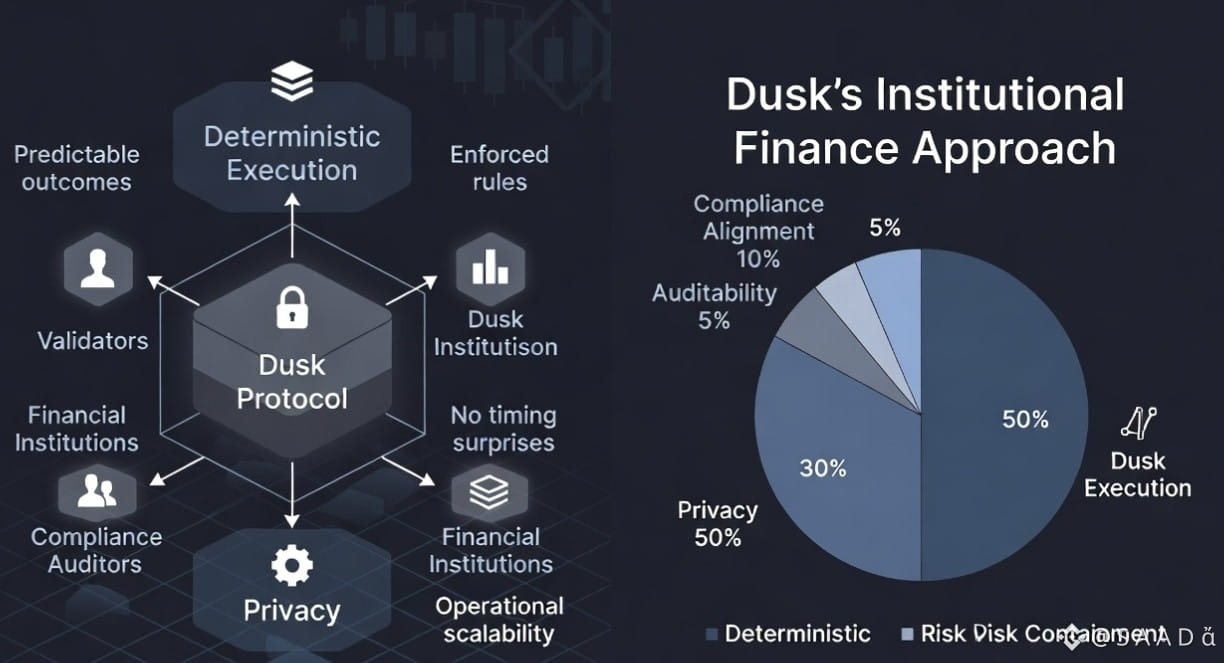

This is where many blockchain systems run into friction with institutional needs. While public ledgers excel at openness and composability, they often sacrifice determinism and privacy two properties that institutions quietly depend on. Dusk’s approach starts from the opposite direction: assume institutional constraints are real, then design the system around them.

Deterministic execution is the foundation. In simple terms, determinism means that given the same inputs, the system produces the same outputs every time. For financial institutions, this is not negotiable. Settlement timing, transaction ordering, and execution outcomes must be predictable so that downstream systems like risk engines, accounting software, and compliance tools can function correctly.

In many public blockchains, execution is probabilistic. Transaction inclusion depends on fee markets, mempool behavior, and network congestion. Ordering can be influenced by external actors, and execution costs can fluctuate unpredictably. These dynamics might be acceptable for retail experimentation, but they introduce operational uncertainty for institutions. When outcomes vary, reconciliation becomes complex, audits become slower, and automation breaks down.

Determinism enables institutions to plan. It allows them to model liquidity needs, forecast settlement windows, and enforce internal controls without constant exception handling. A deterministic system behaves like infrastructure, not a marketplace for block space. This is why traditional financial rails from payment systems to clearing houses prioritize predictable execution over raw throughput.

But determinism alone isn’t enough. Privacy is the second pillar that institutional finance cannot function without. Contrary to common narratives, finance is not built on radical transparency. It is built on selective disclosure. Counterparties reveal what is necessary, to whom it is necessary, and no more.

Fully transparent ledgers expose transaction amounts, participant behavior, and strategic timing to everyone. In institutional contexts, this creates real risk. Trade sizes signal intent. Wallet activity reveals treasury movements. Corporate actions become visible before they are finalized. These leaks can lead to front-running, market manipulation, and regulatory complications.

Privacy is not about hiding wrongdoing; it’s about protecting legitimate economic activity. Institutions must comply with regulations while preserving confidentiality. They need systems where transactions are verifiable, auditable, and enforceable without broadcasting sensitive details to the entire network.

Dusk treats privacy as a core system property, not an optional add-on. Confidentiality is embedded into how transactions are validated and settled. This allows participants to prove correctness without revealing underlying data. Validators can confirm that rules were followed, balances are conserved, and conditions are met without seeing private inputs.

The key insight is that privacy and determinism reinforce each other. When execution is deterministic, private transactions still produce predictable outcomes. When privacy is enforced at the protocol level, determinism doesn’t require full transparency. Together, they create a system that institutions can reason about mathematically and operationally.

This combination unlocks financial workflows that are difficult or impossible on fully public systems. Consider regulated asset issuance. Institutions need to issue tokens representing securities, funds, or real-world assets while controlling who can hold them, how transfers occur, and what information is disclosed. Deterministic rules enforce compliance. Privacy ensures that ownership and transfer details are shared only with authorized parties.

Corporate actions are another example. Dividends, voting, mergers, and restructurings require precise execution and confidentiality. Outcomes must be final and auditable, but intermediate states often cannot be public. Dusk enables these actions to occur on-chain without forcing institutions to expose sensitive corporate data.

Even basic transfers look different in an institutional context. Large transactions cannot leak intent. Treasury movements should not become trading signals. Privacy preserves market integrity, while deterministic execution ensures that transfers settle exactly as expected, without timing surprises or ordering risks.

Importantly, Dusk does not try to retrofit institutional behavior onto public-first assumptions. It acknowledges that finance already has rules, processes, and constraints and designs infrastructure that aligns with them. Validators play a crucial role here. They enforce protocol rules and verify transactions without accessing private details. This maintains decentralization while respecting confidentiality.

From a compliance perspective, this model is powerful. Institutions can demonstrate adherence to rules without over-disclosing data. Auditors can verify outcomes without reconstructing entire transaction histories from public traces. Regulators can gain assurance without forcing systems into incompatible transparency models.

Scalability, in this context, is not about peak transactions per second. It’s about operational scalability. Can the system handle sustained volume without degrading predictability? Can institutions onboard more participants without increasing information leakage? Can workflows scale without manual oversight growing linearly?

By combining deterministic execution with privacy, Dusk addresses these questions directly. Predictable behavior reduces operational overhead. Confidentiality prevents information risks from compounding as activity grows. Together, they enable scale that looks like real finance: steady, controlled, and resilient.

This approach also changes how success is measured. Instead of optimizing for visible metrics, Dusk optimizes for what institutions care about but rarely advertise settlement reliability, auditability, compliance alignment, and risk containment. These qualities don’t trend on dashboards, but they determine whether infrastructure survives contact with real markets.

In many ways, Dusk’s design philosophy is conservative by necessity. Finance is an industry where mistakes are costly and trust is earned slowly. Innovation succeeds not by breaking assumptions, but by respecting them while improving efficiency. Determinism and privacy are not constraints to work around; they are the baseline.

As blockchain technology matures, the question is no longer whether institutions will use decentralized systems, but which systems are built with institutional realities in mind. Dusk’s answer is clear: scalable finance requires predictability and confidentiality at the protocol level, not bolted on later.

By aligning deterministic execution with privacy, Dusk creates infrastructure that doesn’t ask institutions to change how finance works. It meets finance where it already is and gives it a path forward that is secure, verifiable, and ready to scale.