If you’ve been in this market long enough, you learn a blunt truth. Institutional money isn’t short on interest, it’s short on a venue that’s “clean” enough to operate in without turning itself into a target. A lot of people think institutions enter crypto for profit and that’s it, but I see it differently. What they need first is a framework. Process, control, compliance, and just enough privacy so they don’t expose their hand. Dusk Network sits right at that intersection, privacy paired with compliance, not privacy to hide wrongdoing, but privacy to do serious work.

I’ve watched too many projects preach total transparency, and then that transparency becomes the blade that cuts their largest users. You place a big order and the market watches. You move capital and someone tracks it. You deploy a strategy and others copy it or front run it. In the end, institutions conclude that on chain can be fast and cheap, but information leakage is far more expensive. Have you ever wondered why some funds clearly want in, but keep hovering outside and only test with tiny size. It’s not that they fear the tech, they fear the exposed surface area.

Dusk approaches this problem in a way that catches my attention. They don’t sell privacy as an invisibility cloak, they try to turn privacy into something that can still be verified. Meaning you can prove you meet conditions without publicly revealing all sensitive data. That difference matters. Institutions don’t want to hide so they can break rules, they want to hide so they don’t get exploited, while still being able to prove they acted correctly when it matters. Don’t you think that balance is exactly what this market has been missing.

When people hear “compliance” in crypto, many instinctively recoil. But I’m used to how traditional finance actually runs. Compliance isn’t just paperwork, it’s the mechanism that lets large capital move without choking at audit, approval, and legal responsibility. If rules can be embedded into the logic of assets and contracts, who can buy, who can transfer, what limits apply, then you’re turning “law” into part of the infrastructure. Have you ever considered that the future of institutional DeFi isn’t about breaking fences, but about automating fences in a more efficient way.

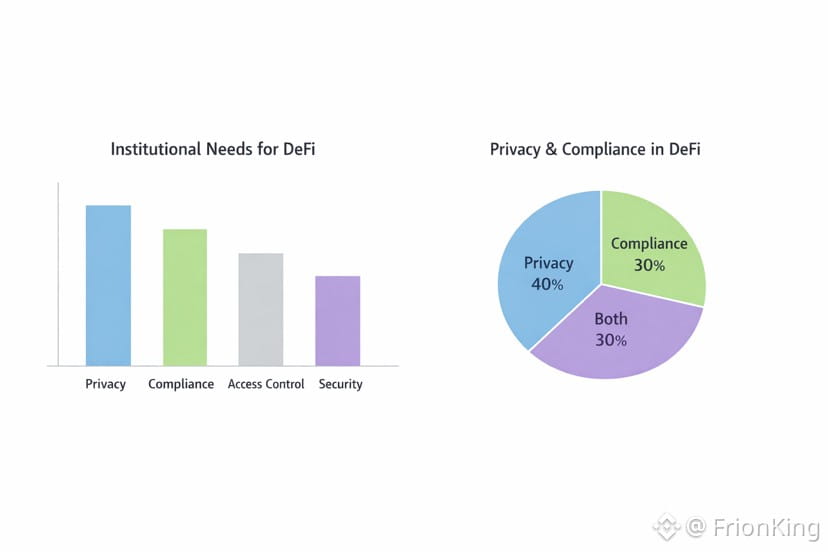

What I like about Dusk’s story is that it sticks to real needs. Institutions need access control, role based permissions, the ability to prove compliance, and privacy that protects strategy. When you assemble those pieces, you can finally talk about tokenized assets, security tokens, and on chain settlement without turning everything into a playground for predators. Dusk is aiming at a layer where “conditional assets” are the default, not the exception.

I’m not saying Dusk is the only answer. In this market, nothing is guaranteed. But if you ask me which direction makes sense for pulling institutional capital deeper on chain, then “privacy + compliance” is one of the few angles that already smells like real execution. And I’ll leave you with one question. If a network can protect transaction data while still allowing rules to be verified when needed, what’s still stopping institutional money from truly flowing in, technology, or trust.