I have been watching the crypto market for many years now and one thing I have learned is this simple rule real utility survives every cycle. $BNB is one of those rare coins that has managed to stay relevant through bull markets crashes regulations and nonstop noise.

The early days of $BNB

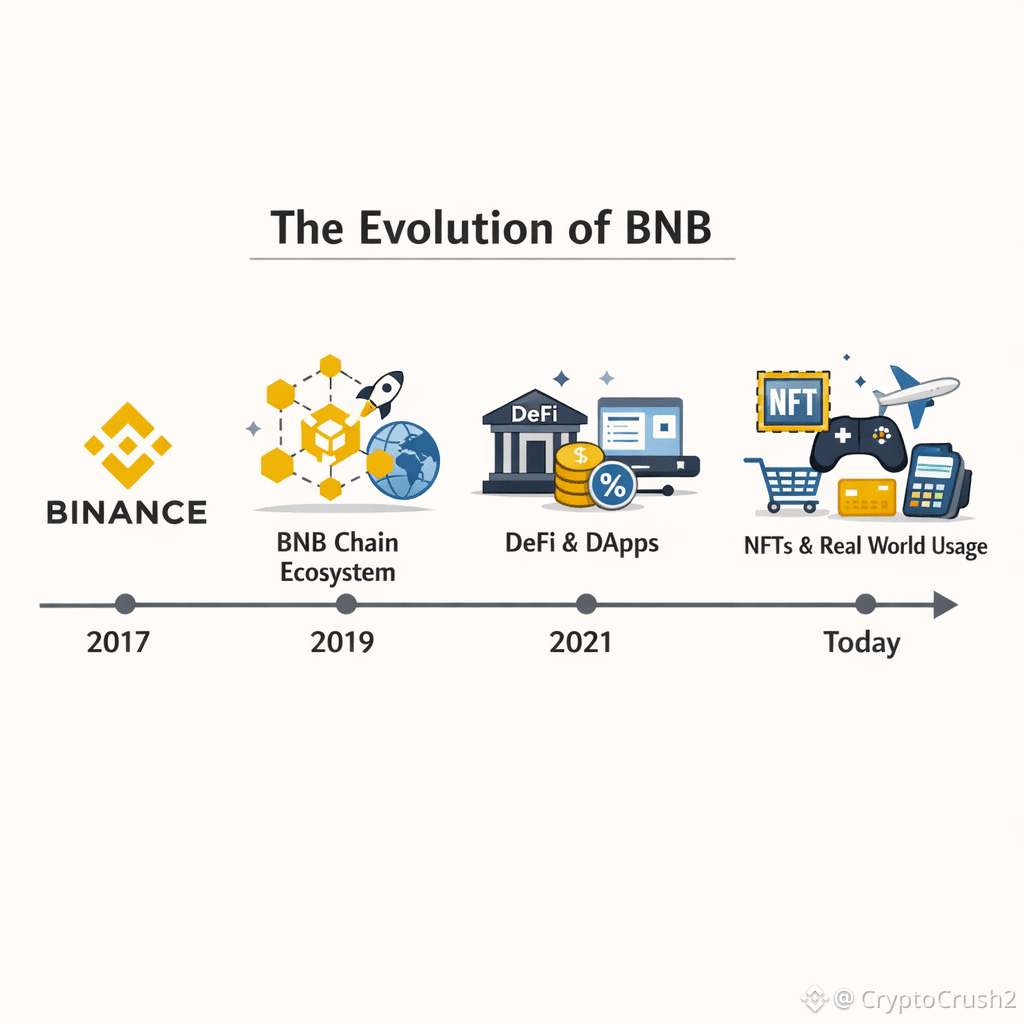

BNB started in 2017 as a utility token for Binance exchange. At that time it was mainly used to get trading fee discounts. Many people treated it like just another exchange coin and nothing more.

But over time Binance kept expanding and BNB kept getting more use cases. From trading fees it moved into payments launchpads staking governance and later became the fuel of an entire blockchain ecosystem.

How BNB became more than an exchange coin

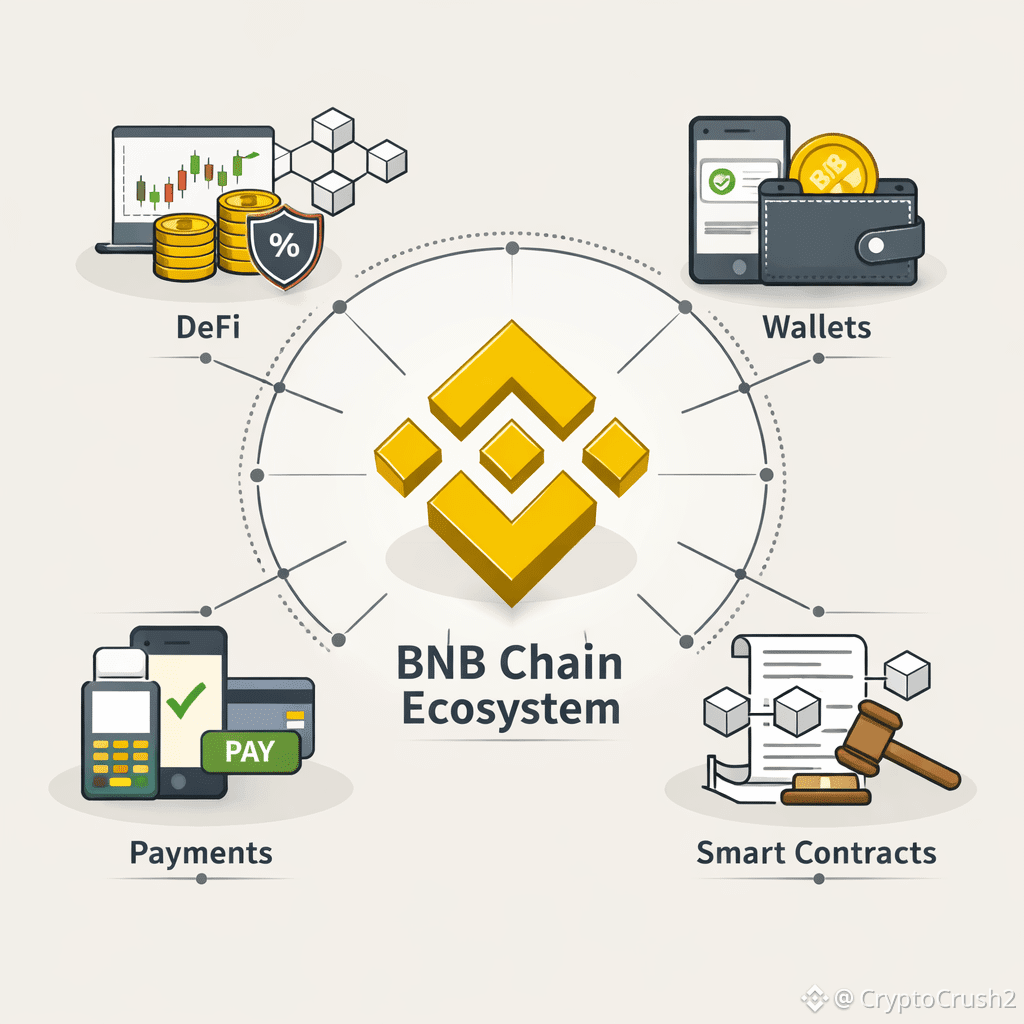

The real shift happened when Binance Smart Chain later renamed BNB Chain was launched. This changed everything. $BNB was no longer just linked to trading activity. It became the gas token for transactions smart contracts DeFi apps games NFTs and thousands of projects.

Low fees and fast transactions attracted developers and users. While many chains struggled with congestion BNB Chain focused on speed and affordability. That practical approach helped it grow fast.

Another important part is the quarterly burn. Binance uses profits to buy back and permanently destroy $BNB. This reduces supply over time and supports long term value. This is not marketing. This is coded into the ecosystem.

Why people still buy $BNB

From my experience people buy BNB for a few clear reasons.

First utility. BNB is actually used every day. Trading fees gas fees staking launchpad access and payments all depend on it.

Second ecosystem strength. Thousands of active applications run on BNB Chain. That means constant demand.

Third deflation. The burn mechanism slowly reduces supply which supports price over the long term if demand stays.

Fourth trust. Binance is still one of the largest crypto platforms in the world. Whether people like it or not that scale matters.

BNB in real market conditions

One thing I always observe is how a coin behaves during stress. BNB has shown resilience. It does not move only on hype. It moves with usage activity burns and ecosystem growth.

When markets cool down BNB often holds better than many altcoins because it is tied to real activity not just speculation. That does not mean it cannot drop. It means it usually has reasons to recover.

2026 perspective on $BNB

Going into 2026 the role of BNB looks even clearer. Regulation is tightening. Speculative projects are fading. Chains with real usage are becoming more important.

BNB fits that shift. It is already used for payments DeFi cross chain activity and exchange infrastructure. As crypto moves toward utility driven value models coins like $BNB naturally stay in focus.

I am not looking at BNB as a quick flip. I see it as infrastructure exposure. When the system grows the token benefits.

Final thoughts from experience

After years in this market I do not chase noise anymore. I look at what is being used what survives pressure and what keeps evolving.

BNB has proven it can adapt. It started small grew into an ecosystem token and continues to play a central role in crypto infrastructure.

That is why many long term traders still keep BNB on their watchlist and often in their portfolio. Not because of promises but because of what it already does.

#Binance #BinanceCoin #bnb #BinanceSquare #BNBChain

$BNB Price Chart 👇