When most people hear “blockchain,” they think of high-speed transactions, flashy benchmarks, or the latest Layer-1 network promising millions of TPS. But the reality of running a reliable payment system is far less glamorous and that’s where Plasma takes a different approach.

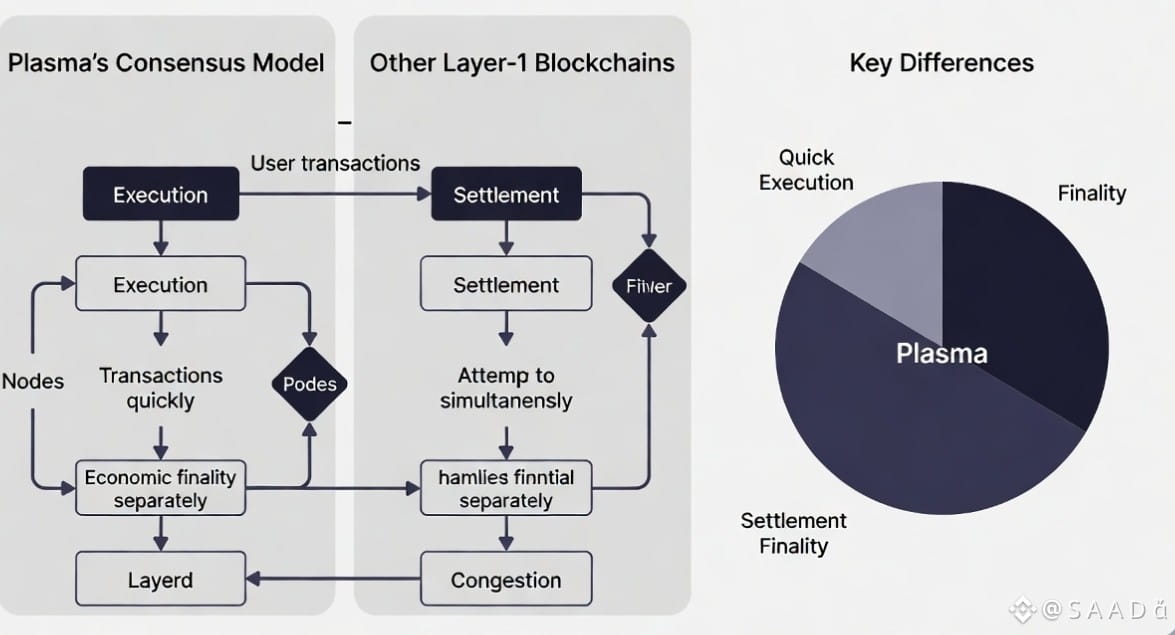

Unlike many Layer-1 blockchains that try to handle everything at once from execution to settlement to economic finality Plasma separates the concerns. Payments are processed quickly, without forcing every transaction to compete for immediate global consensus. This isn’t just a technical detail; it’s what makes real-world financial flows dependable, even under heavy load.

Other Layer-1s often optimize for peak numbers, showcasing “millions of transactions per second” on paper. But in practice, high-volume settlement isn’t about spikes; it’s about sustained performance when liquidity is moving fast and delays carry real consequences. Plasma’s model assumes that heavy traffic is the norm, not an exception.

The consensus mechanism itself is designed with this in mind. Instead of making every node constantly verify every action in real time, Plasma layers execution and settlement. This reduces congestion, keeps the chain responsive, and allows the network’s economic layer powered by $XPL to operate smoothly in the background.

The result is a payment chain that feels effortless to users. Transactions settle reliably, without hiccups, even when activity surges. Compared to other Layer-1s, Plasma isn’t chasing flashy metrics; it’s focused on what actually matters: consistent, predictable, and scalable financial operations.

Plasma shows that the best consensus model isn’t always the loudest or the fastest on paper it’s the one that quietly keeps payments flowing, every time.