Why Platforms Like @Dusk Trade Are Defining the Institutional On-Chain Future

The conversation around tokenization has matured. We are no longer in the phase where tokenized assets are viewed as experimental wrappers around traditional instruments. Today, tokenized securities are increasingly recognized as a structural upgrade to how ownership, settlement, compliance, and market access can function in a digital world.

But there is one truth that serious market participants already understand:

Tokenized securities do not succeed on technology alone they succeed on regulated infrastructure.

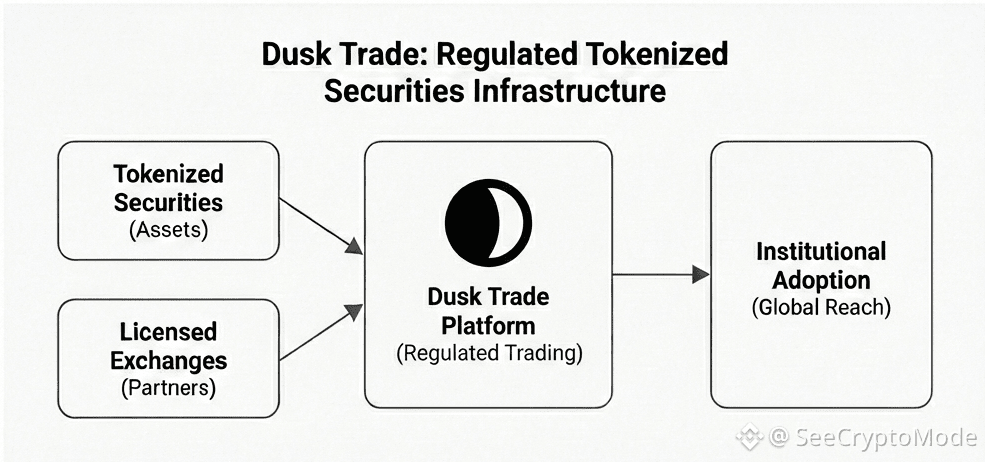

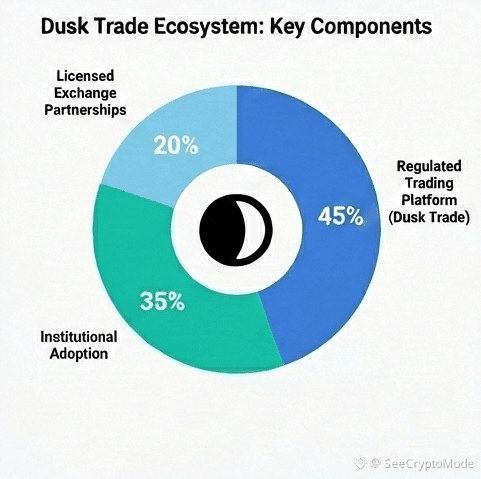

Without compliant trading venues, licensed exchange partnerships, audit-ready processes, and institutional grade execution layers, tokenization remains a concept not a market. This is exactly why platforms like Dusk Trade are drawing attention: they are not simply building token rails; they are building regulated trading infrastructure designed specifically for tokenized securities, in partnership with licensed exchanges.

This is the difference between experimentation and adoption. Between pilots and pipelines. Between retail curiosity and institutional participation.

Let’s unpack why regulated infrastructure is the real unlock for tokenized securities and why this layer will determine which projects actually scale.

Tokenization Is Not the Finish Line It’s the Starting Line

Over the past few years, “tokenization” has become one of the most frequently used terms in digital asset discussions. Real world assets, such as equities, bonds, funds, real estate, and commodities, are increasingly being represented as tokens on blockchain networks.

The benefits are widely understood:

Faster settlement

Programmable ownership

Fractional access

Automated compliance

Global distribution

Transparent audit trails

Reduced intermediaries

But tokenizing an asset is only step one.

A tokenized security without a regulated marketplace is like a stock certificate without an exchange. It exists but it cannot function efficiently in a capital market.

Institutional investors don’t just need tokenized assets. They need:

Regulated trading venues

Recognized counterparties

Compliance enforcement

Legal clarity

Custody frameworks

Settlement guarantees

This is where most tokenization narratives fall short and where regulated platforms like Dusk Trade step in.

Why Institutions Cannot Trade on Unregulated Rails

Institutional capital operates under constraints that retail participants often underestimate. Pension funds, asset managers, regulated brokers, and financial institutions cannot simply move into new markets because the technology looks promising.

They must answer critical questions:

Is the venue regulated?

Is trading supervised?

Are counterparties verified?

Are disclosures standardized?

Is compliance enforced automatically?

Is the reporting regulator-ready?

Are investor protections embedded?

If the answer is no, participation is blocked.

This is not hesitation. This is a fiduciary responsibility.

For tokenized securities to move beyond niche adoption, they must trade on platforms that mirror or improve the safeguards of traditional exchanges. That is the design philosophy behind regulated token trading platforms such as Dusk Trade, built in partnership with licensed exchanges rather than in isolation.

That partnership model matters. It bridges innovation with legality instead of trying to bypass it.

The Infrastructure Gap Most People Ignore

Much of crypto discussion focuses on asset creation and protocol innovation. Far less attention is given to market structure infrastructure yet that is where institutional adoption is won or lost.

Market structure includes:

Order matching systems

Market surveillance

Trade reporting

Compliance screening

Settlement finality

Dispute resolution

Audit trails

Access controls

Traditional exchanges invested decades building this. Token markets must do the same, but with modern architecture.

Without this layer:

Liquidity remains fragmented

Institutions stay sidelined

Regulators push back

Risk premiums stay high.

Regulated token trading platforms close this infrastructure gap. They make tokenized securities tradable in environments that institutions can legally access.

This is not cosmetic compliance; it is functional compliance.

Why Partnership With Licensed Exchanges Changes Everything

There is a massive difference between a platform that claims regulatory friendliness and a platform built with licensed exchange partners.

Licensed exchanges bring:

Regulatory approval pathways

Operational standards

Market surveillance expertise

Investor protection frameworks

Established reporting systems

Legal enforceability

When tokenized security platforms integrate with licensed exchange partners, they inherit structural credibility. They align with the existing financial system instead of fighting it.

This partnership approach accelerates:

Approval cycles

Institutional onboarding

Asset issuer confidence

Broker participation

Custodian integration

#dusk Trade’s positioning around regulated trading infrastructure built alongside licensed exchange frameworks signals exactly this kind of alignment-first strategy.

It’s not about replacing markets.

It’s about upgrading them.

Compliance by Design Not Compliance by Patch

One of the biggest mistakes early blockchain projects made was treating compliance as an add-on. A layer applied later. A filter bolted on after launch.

Institutional systems don’t work that way.

Compliance must be embedded at the architecture level:

Identity-aware trading

Rule-based transfer restrictions

Jurisdiction filters

Investor qualification checks

Automated reporting

Policy driven settlement

Tokenized securities require programmable compliance rules enforced at the transaction layer, not just at the user interface.

This is where specialized security token infrastructure differs from general-purpose chains. Regulated trading platforms are designed with compliance logic integrated into execution flows.

That dramatically reduces:

Operational risk

Legal ambiguity

Regulatory friction

Post-trade violations

Markets scale when rules are enforced by design, not by exception.

Liquidity Needs Legal Confidence

Liquidity is not just about buyers and sellers. It is about confidence.

Institutional liquidity providers ask:

Are trades enforceable?

Are the records admissible?

Are counterparties verified?

Are disputes resolvable?

Are the rules standardized?

If legal confidence is weak, spreads widen, and participation drops.

Tokenized securities often promise liquidity improvements but without regulated venues, liquidity providers hesitate. Regulated infrastructure creates the legal confidence layer required for serious market making.

This is how spreads tighten.

This is how volume grows.

This is how markets mature

Settlement Efficiency Is Only Valuable If It’s Recognized

One of the strongest advantages of tokenized securities is faster settlement potentially near instant finality compared to traditional T+2 cycles.

But faster settlement only matters if institutions can recognize and rely on it legally.

Regulated platforms make token settlement:

Legally recognized

Operationally integrated

Accounting compatible

Custody aligned

Without that, fast settlement is technically impressive but commercially underutilized.

Infrastructure turns speed into usable efficiency.

The Convergence of Traditional Finance and OnChain Markets

We are entering a convergence phase, not a replacement phase.

Traditional finance is not disappearing. It is digitizing. Tokenizing. Automating. Integrating.

The winning platforms will be those that connect:

On-chain efficiency

Offchain legality

Digital execution

Regulatory recognition

Regulated token trading platforms serve as convergence bridges.

They allow:

Traditional issuers to tokenize

Institutions for trade

Regulators to supervise

Investors to access

Markets to function

This is not disruption by destruction. It is disruption by integration.

Why This Model Attracts Serious Issuers

Asset issuer companies, funds, and structured product creators will not tokenize securities unless distribution and trading are credible.

They need:

Regulated distribution channels

Recognized trading venues

Compliant investor onboarding

Standardized disclosure frameworks

When infrastructure like $DUSK Trade provides a regulated marketplace environment, issuers gain confidence that tokenization will lead to real investor access, not stranded digital instruments.

Issuance follows infrastructure. Always.

Market Evolution Follows Infrastructure, Not Hype

Every financial innovation follows the same pattern:

Concept appears

Experiments launch

Failures occur

Infrastructure develops

Regulation integrates

Institutions adopt

Markets scale

We are moving from phase 3 to phase 4 in tokenized securities.

The conversation is shifting from:

“What can we tokenize?”

to

“Where can we trade this compliantly?”

That shift marks maturity.

Professional Capital Watches Infrastructure First

Retail markets often chase narratives. Professional capital studies infrastructure.

Infrastructure answers:

Can this scale?

Can this survive regulation?

Can this support volume?

Can this manage risk?

Can this be integrated legally?

Regulated token trading platforms check these boxes. That is why they attract institutional attention even when retail conversations are quiet.

Smart money follows rails, not noise.

Risk Reduction Is the Real Adoption Catalyst

Institutional adoption rarely comes from upside alone. It comes from downside control.

Regulated infrastructure reduces:

Counterparty risk

Compliance risk

Operational risk

Legal risk

Settlement risk

When risk drops below the threshold, participation begins.

This is the real unlock. $DUSK

Final Perspective: Regulated Infrastructure Is the True Engine of Tokenized Securities

Tokenized securities are not a technology trend they are a market structure upgrade. But upgrades only deploy when infrastructure supports them.

Regulated trading platforms are the support layer.

They transform tokenization from:

A technical possibility

intoA tradable reality

From:

A pilot

intoA marketplace

From:

A narrative

intoA system

Platforms like Dusk Trade, built with licensed exchange partnerships and compliance-first architecture, represent the kind of infrastructure that enables institutional participation rather than merely inviting it.

The future of tokenized securities will not be decided by who tokenizes the most assets. #dusk

It will be decided by who builds the most trusted markets for them to trade. @Dusk