Bitcoin Is Below Trend just Pinned by Structure

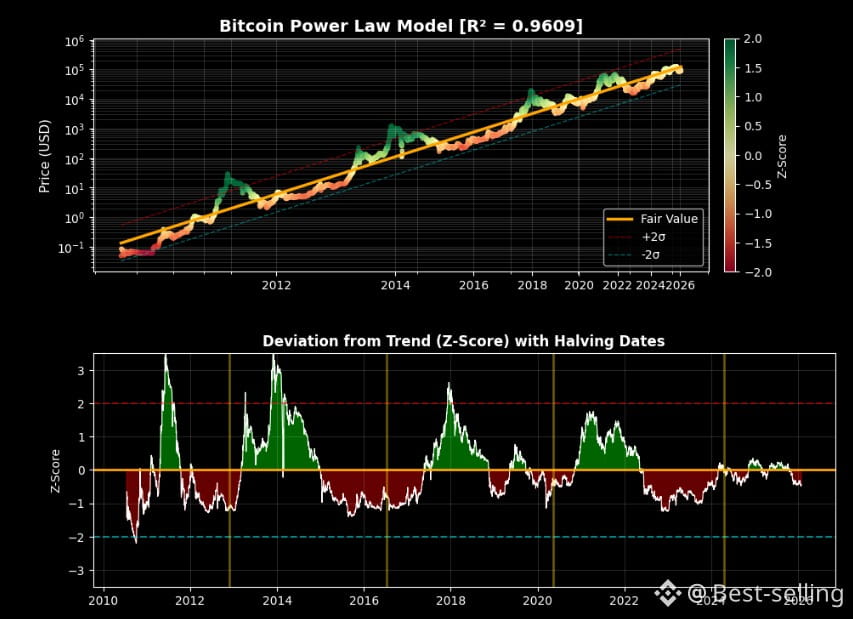

At ~21 months post-halving, Bitcoin is 26.7% below its long-term power-law value ($89.5k vs ~$122k).

In every prior cycle, this point was overheated.

This cycle is still below trend.

That’s the anomaly.

Leverage isn’t the issue:

• Funding ~1.5% APR

• Vol ~33%

No FOMO. No liquidation fuel.

Flows aren’t the driver:

• ETF outflows are small and slowing

• Price isn’t breaking because structure, not sentiment, is in control.

Here’s the constraint:

Options.

• Net gamma is positive → volatility suppressed

• Price pinned near ~$90k

• Support near ~$85k

• Upside supply clustered at $100k+

Now the key part most people miss:

~43% of total gamma expires around Jan 30.

That doesn’t predict direction.

It removes a mechanical restraint.

When the hedge comes off, price is allowed to move again even if the narrative doesn’t change.

Hash rate isn’t at ATH, but hash vs price is constructive.

The network isn’t breaking. The market is just compressed.

Bottom line:

This isn’t distribution.

It’s compression.

And compression doesn’t last forever. @Walrus 🦭/acc #walrus $WAL @Cellula Re-poster #dusk $DUSK