Over the past weeks, rising geopolitical tensions between the United States and Iran have begun to leave clear footprints in global financial markets — including cryptocurrencies such as Bitcoin and major altcoins.

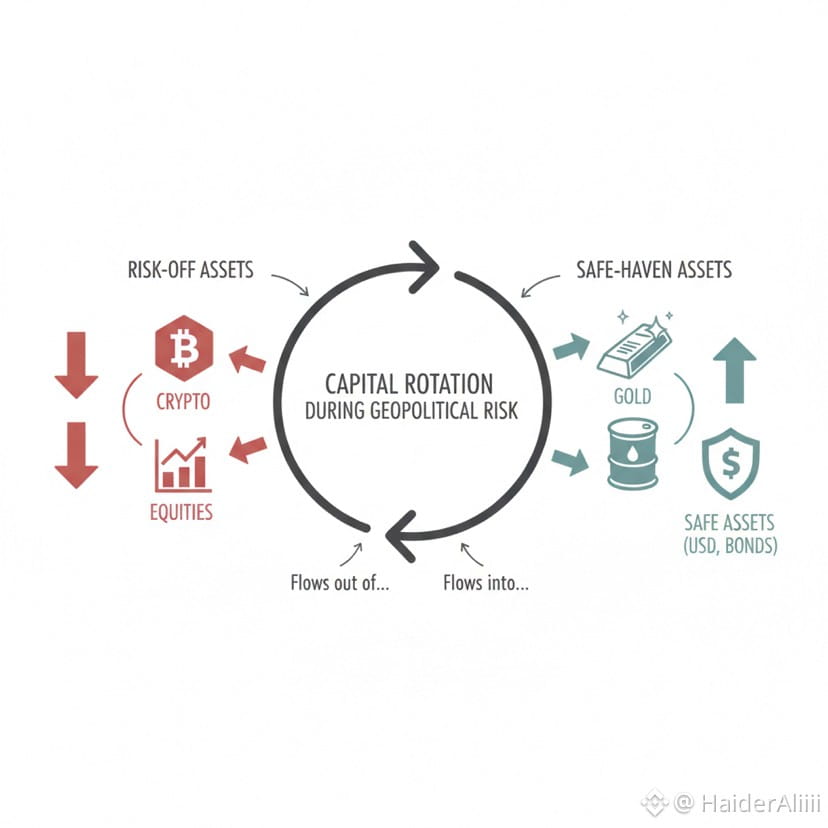

What we’re seeing now isn’t isolated price movement. It’s a structure of risk perception, capital rotation, and sentiment shifts that affects all asset classes, from oil and gold to crypto.

Geopolitical Risk Has Returned to Market Pricing

Escalations involving the U.S. and Iran — including saber-rattling rhetoric, military deployments, and sanctions — have pushed risk assets into “risk-off” mode. In these scenarios, investors typically reduce exposure to volatile instruments and rotate into what they perceive as safer stores of value or liquid positions.

This dynamic has two observable effects:

Safe-haven assets like gold and crude oil have surged, reflecting fears of supply disruptions and inflationary pressure from geopolitical instability.

Risk assets like equities and cryptocurrencies see increased selling pressure, especially during sharp headlines.

In other words, the market is pricing in uncertainty not optimism.

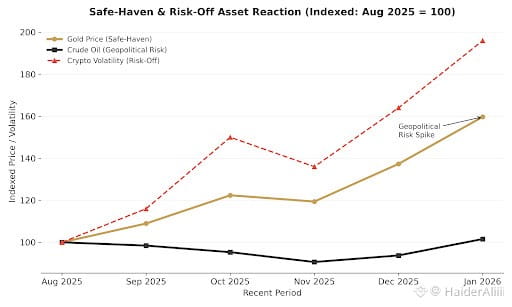

Oil & Gold Price Reaction Chart

Caption: Oil and gold rallies often accompany risk-off episodes.

This chart illustrates the recent performance of gold and crude oil alongside cryptocurrency market volatility. As geopolitical risks spiked in late 2025 and early 2026, gold surged to record highs above \$5,300 per ounce, acting as a primary safe-haven. Crude oil saw a corresponding uptick due to supply concerns in the Middle East, while crypto volatility spiked sharply, reflecting a rotation out of riskier digital assets into traditional stores of value.

Crypto’s Sensitivity to Geopolitical Events

Bitcoin and broader crypto markets aren’t immune. During past escalations related to Iran or broader Middle Eastern tensions:

Bitcoin and major altcoins experienced sharp sell-offs, liquidations, and increased volatility as traders fled to stable assets.

Risk-off sentiment caused capital to rotate into traditional safe havens, weakening crypto performance even if macro drivers remained intact.

This pattern shows crypto’s *continued classification as a risk asset in the short term — especially when uncertainty peaks.

Why Geopolitics Still Trumps “Digital Gold” Narrative

Crypto proponents often describe Bitcoin as digital gold. But in moments of acute geopolitical fear, Bitcoin has behaved more like a risk speculative asset than a haven. When markets price extreme uncertainty, institutional capital tends to de-risk portfolios first — even ahead of potential long-term hedges that could benefit from inflationary pressures later.

This doesn’t mean Bitcoin can’t serve as a hedge over longer cycles, but it does suggest that short-term reactions are dominated by risk-off behavior, not safe-haven flows.

What Peace and De-Escalation Could Mean for Crypto

Markets are forward-looking. When geopolitical risk starts to ease — whether through diplomacy, ceasefires, or strategic de-escalation — we usually see a return to risk appetite.

History shows that once the fear premium fades:

Capital rotates back into higher-beta assets

Volatility settles

Liquidity flows into growth-oriented markets

For crypto, this environment has often led to renewed momentum and inflows, as traders regain confidence and speculative appetite returns.

In contrast, prolonged conflict tends to keep risk assets subdued.

Final Thought

The U.S.–Iran standoff isn’t just a political story — it’s a market sentiment story. Crypto doesn’t move in isolation from global news. It moves with it.

Right now, the narrative is dominated by:

uncertainty,

risk aversion,

capital rotation into safer or more liquid positions.

If geopolitical volatility recedes and confidence begins to return, crypto could benefit significantly from the renewed inflow of risk capital.